REITs and INVITs – India Update

While Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs) are a common investment vehicle globally, they are a relatively new product in the Indian landscape. They seem to have gained popularity amongst Indian investors (institutional as well as retail) in a very short span of time. Briefly put, REITs and InvITs (a) allow investors to invest in these assets without owning them, and (b) enable developers to monetize their revenue-generating real estate/infrastructure assets and release capital for funding new real estate/ infrastructure projects. In India, from a traditional investor perspective, ownership of real estate is essentially a private domain and ownership is in real property terms; owning securitized real estate assets is largely unknown. REITs democratize such ownership by adopting a mutual fund like model where investor could own the units representing/represented by underlying real estate property without any direct ownership therein. Basically, REITs are securities (units) with physical real estate as the underlying asset and such securities can be traded on the stock exchange after their listing. While REITs deal with commercial/residential real estate, InvITs deal with dedicated infrastructure projects such as commercial properties, ports, roads, dams, etc. REITs regulations were introduced in 2014 by India’s securities market regulator Securities and Exchange Board of India (SEBI) and subsequently amended and operationalized in 2017/18. The first REIT was launched in 2019. So far, we have seen five InvITs (two publicly listed and three private) and two REITs in India.

| Particulars | InvITs | REITs |

| Publicly Listed | IRB InvIT Fund and India Grid Trust | Embassy Office Parks REIT (2019)

In the Offing – Mindspace Business Parks REIT |

| Private | IndInfravit Trust, India Infrastructure Trust, Oriental Infra Trust |

To encourage retail participation from investors, SEBI has reduced the minimum investment size to INR 50,000 for REITs and INR 100,000 for InvITs. However, in order to have a much wider market reach, it may need to make them more affordable and attractive akin to stocks; say, the minimum investment size could be reduced further to say, INR 5,000 or INR 10,000.

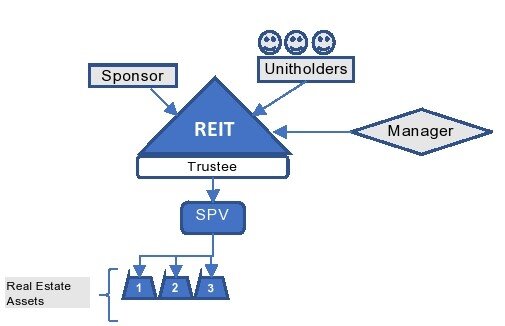

Typical REIT Structure:

Taxation

At unitholder level: Tax on capital gains on sale of units depending on (a) residential status of unitholder (resident/non-resident), (b) period of holding (short term/long term), (c) nature of unit (listed/unlisted). Dividend, interest or rental income (generated and passed on from SPV) would be taxable in hands of unitholder.

At Trust level: Interest income, dividend income, rental income derived from underlying real estate assets from SPV would be exempt from tax in hands of Trust. However, when distributing to unitholder, there would be an appropriate withholding at Trust level considering (a) residential status of unitholder (resident/non-resident), (b) whether SPV has availed concessional tax rate or paid maximum marginal tax rate.

At SPV level: Taxes to be paid at applicable corporate tax rates on the net income computed (comprising chiefly, rental income and capital gains derived from underlying real estate assets).

Foreign REITs/InvITs

In line with the global practice of international financial centers, India also has its International Financial Services Centre (IFSC) located in GIFT City, Gujarat – a notified Special Economic Zone (SEZ). The IFSC is partially operational. Recently, SEBI issued a circular permitting listing of foreign InvITs and REITs on recognized stock exchanges in India’s IFSC. This seems to be a step to incentivize global REITs and InVITs to list in Indian IFSC, provided:

-

Such InVITs and REITs are

o incorporated in permissible jurisdictions (US, UK, Japan, Canada, S Korea, France, Germany)

o regulated by securities market regulators in those jurisdictions

o listed on stock exchanges in those jurisdictions

Further, any stock exchange of a foreign jurisdiction may form a subsidiary to provide the services of stock exchange in IFSC where at least fifty one per cent of paid up equity share capital is held by such foreign stock exchange and remaining shares may be offered to any other recognized stock exchange, whether Indian or of foreign jurisdiction.

While this is a welcome step to attract foreign REITs/InvITs to India, it is noteworthy that as of today, apart from the two nationally recognized Indian bourses, NSE and BSE, no foreign stock exchange has made a foray in India’s IFSC. To that extent the aforementioned SEBI circular is yet to see fruition.

The information contained in this article is not legal advice or legal opinion. The contents recorded in the said document are for informational purposes only and should not be used for commercial purposes. Acuity Law LLP disclaims all liability to any person for any loss or damage caused by errors or omissions, whether arising from negligence, accident, or any other cause.