Regulatory update: RBI and SEBI’s operational framework for reclassification of FPI into FDI

The Reserve Bank of India (“RBI”) vide Circular dated 11 November 2024 (“Circular”) released the operational framework for reclassification of Foreign Portfolio Investment (“FPI”) into Foreign Direct Investment (“FDI”).

The current operational framework encompasses of the Foreign Exchange Management (Non-Debt Instruments) Rules, 2019 (“Rules”), which establishes the prescribed limit for FPIs in India. This limit now stands at 10% of the total paid-up equity capital on a fully diluted basis for investments made by foreign portfolio investor along with its investor group (‘FP Investor’). When this prescribed limit is breached, a FPI has an option to either divest its holdings (so as to remain within the prescribed ambit of an FPI) or get reclassified as a FDI. The option chosen would have to comply with the Rules and the Securities Exchange Board of India (Foreign Portfolio Investors) Regulations, 2019 within 05 (five) trading days from the date when such limit is breached.

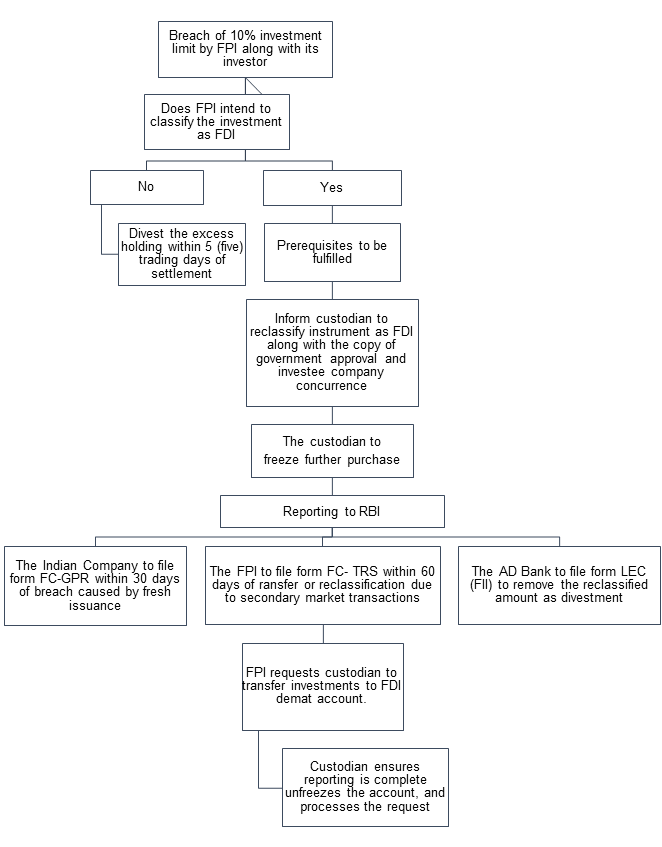

In the event that a FP Investor desires to reclassify its FPI as FDI, it would have to adhere to the operational framework outlined below (and as prescribed in the Circular):

- No reclassification permitted for prohibited sectors

The facility of reclassification shall not be permitted in any sector prohibited for FDI as outlined in para 5.1 of the Foreign Direct Investment Policy 20201 which deals with Prohibited Sectors.

- Approvals

FP Investors are required to obtain the necessary government approvals as per the regulatory framework, including approvals required for investments by land bordering countries with India, in light of Press Note 3 (2020) namely China, Nepal, Bhutan, Bangladesh, Myanmar, Pakistan and Afghanistan or where the beneficial owner of such investment is from these countries2. The acquisition beyond the prescribed limit would have to be made in accordance with the provisions applicable for FDI wherein the investment would have to adhere to the entry routes, sectoral caps, investment limits, pricing guidelines and other conditions as laid down in Schedule I of the Rules. Furthermore, where investment is permitted under the Government approval route, then FP Investors, would have to seek the prior approval from the Central Government before any reclassification takes place.

Further, before intending to acquire equity instruments beyond the prescribed limit, the concerned FP Investor would also have to obtain concurrence of the Indian investee company concerned for reclassification of the investment to FDI to enable such company to ensure compliance with conditions pertaining to sectors prohibited for FDI, sectoral caps and government approvals, wherever applicable, under the Rules.

- Declaration and Transaction Freezing

The FP Investor should declare their intention to reclassify holdings and submit all required documentation to their designated custodian. Upon such declaration, the custodian would then freeze further purchase transactions until the reclassification process is completed. In the event of the failure to obtain the required approvals, the FP Investor would be required to make a divestment of its excess holdings.

- Reporting and Transfer Procedure

The following are the notified reporting requirements for the transfer procedure :

| Reporting Entity | Form Used | Condition |

| Indian Company | FC-GPR | Investment beyond the 10% limit due to fresh issuance of equity instruments to FPI within 30 days. |

| FP Investor | FC-TRS | Investment beyond the 10% limit due to acquisition of equity instruments in the secondary market within 60 days. |

| AD Bank Concerned | LEC (FII) | Report the amount of reclassified foreign portfolio investment as divestment. |

- Post reclassification requirements

Upon completing the necessary reporting for reclassification, the FP Investor should request its custodian to transfer the equity instruments from its demat account for FPIs to one for FDI. The custodian would verify the completeness of the reporting, unfreeze the equity instruments, and process the transfer. The date of the investment breach would be the reclassification date. Post-reclassification, the entire investment would be treated as FDI, even if it later falls below 10%. The FP Investor would be considered a single entity for reclassification purposes.

Further, any reclassification or divestment of holdings should strictly adhere to the timeframes set forth in Schedule II of the Rules. Furthermore, upon reclassification of the FPI to FDI, such holdings shall automatically become subject to and be governed by the provisions of permitted sectors, entry route and sectoral caps for the total foreign investment as stipulated in Schedule I of the Rules.

For ease of reference and understanding, a summary in the form of a flowchart of the operational framework notified by RBI pursuant to the aforesaid Circular is outlined herein below:

The information contained in this document is not legal advice or legal opinion. The contents recorded in the said document are for informational purposes only and should not be used for commercial purposes. Acuity Law LLP disclaims all liability to any person for any loss or damage caused by errors or omissions, whether arising from negligence, accident, or any other cause.

- FDI Policy, 2020, can be accessed at: FDI-PolicyCircular-2020-29October2020_0.pdf ↩︎

- DPIIT, Press Note 3 (2020), can be accessed at: https://dpiit.gov.in/sites/default/files/pn3_2020.pdf ↩︎