About

Souvik is the Founder and Managing Partner of Acuity Law. With a practice of more than 22 years, Souvik specialises and advises all participants in mergers and acquisitions; private equity and venture funding; on matters relating to corporate governance, corporate policy, and strategy. He has represented numerous public, private and government businesses, and their boards in domestic and cross border transactions. His practice also includes employment and labour laws, insolvency law and commercial and trading arrangements. Prior to founding Acuity Law, Souvik was a partner at BMR Legal and also worked at AZB & Partners, a leading law firm in India and Trowers & Hamlins, a reputed international law firm in the Middle East. Souvik was called to the Bar in the year 2001 and qualified as a solicitor of England and Wales in the year 2005. Some of Souvik’s significant publicly disclosed representations include:

- Nippon Steel Corporation in ~$ 5.9bn rescue of Essar Steel.

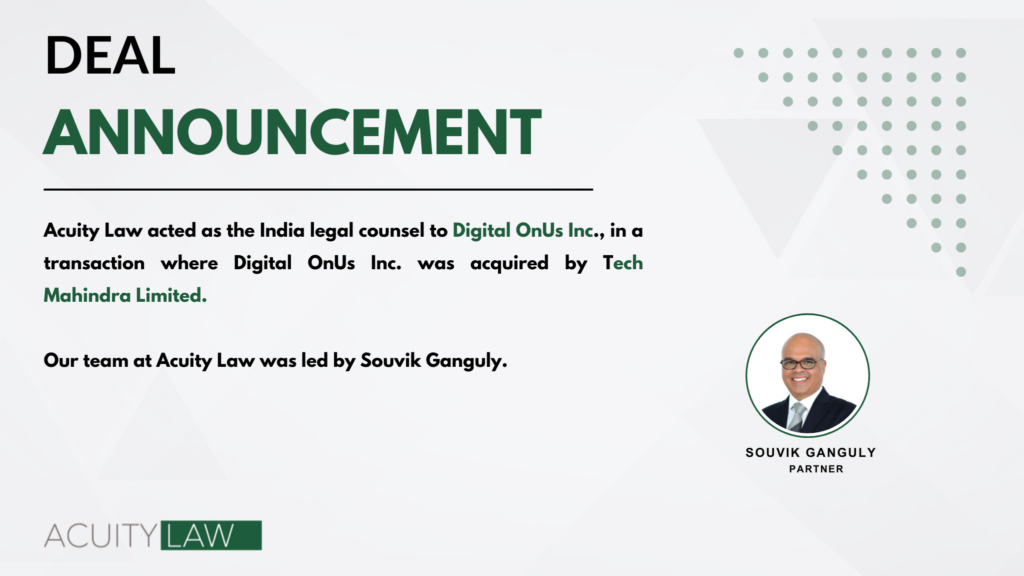

- DigitalOnUs it is $ 120mn acquisition by Tech Mahindra.

- NABVENTURES Limited, a wholly owned subsidiary of the National Bank for Agriculture and Rural Development, in various investments in the agri-tech sector and its exit from Fraazo.

- Rebright Partners III Investment Partnership and Avaana Capital Growth Fund I in their investment in Eggoz.

- DAIKO Inc., Japan on acquisition of From Here On Communications.

- Incofin Investment Management in its investment in Unnati agri, an agritech start-up.

- Vincotte International in acquisition of controlling stake in Mumbai-based non-destructive testing (NDT) services provider Geecy Industrial Services Private Limited.

- Kawasaki Rikosu Transport, Japan on entry strategy in the agri-logistic sector and acquisition of a logistics company.

- Tata Realty and Infrastructure Limited on its acquisition of various road assets and establishment of ropeways in Northern India.

- Invoice Bazaar in its acquisition by Triterras Fintech Pte. Limited, a NASDAQ listed company.