Maharashtra Government Announces Stamp Duty Amnesty Scheme-2023

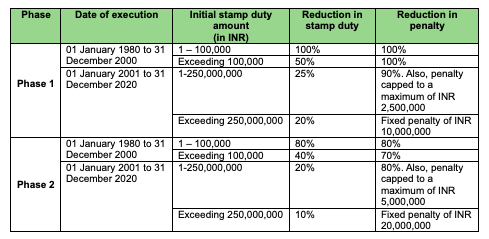

On 07 December 2023, the Maharashtra government introduced the Maharashtra Stamp Duty Amnesty Scheme 2023 (Scheme). This initiative aims to remit or reduce stamp duty and penalties on specified instruments. The Scheme will be implemented in two phases: Phase 1 from 01 December 2023 to 31 January 2024, and Phase 2 from 01 February 2024 to 31 March 2024. Key points of the scheme are as follows:

-

The scheme is applicable to instruments executed between 01 January 1980 and 31 December 2020.

-

Eligible instruments must be executed on government-approved stamped paper, and those on plain paper without stamp duty are not covered within the ambit of the Scheme.

-

Applicants are required to submit an online application, including the original instrument and supporting documents.

-

No refund is provided if stamp duty or penalty on the deficient portion has already been paid before the Scheme’s introduction.

-

The deficient portion must be paid within seven days of receiving the demand notice from the Collector of Stamps.

-

The reduction or waiver of stamp duty and penalties is contingent upon the initial stamp duty amount and the execution date of the instrument. Notably, Phase 1 offers relatively higher reductions in stamp duty and penalties compared to Phase 2, as provided below:

To read the official notification of the Scheme, click here.

The information contained in this document is not legal advice or legal opinion. The contents recorded in the said document are for informational purposes only and should not be used for commercial purposes. Acuity Law LLP disclaims all liability to any person for any loss or damage caused by errors or omissions, whether arising from negligence, accident, or any other cause.