Government of Haryana – Amnesty Scheme for Outstanding Dues as on 30 June 2017

Government of Haryana – Amnesty Scheme for Outstanding Dues as on 30 June 2017

The Excise and Taxation Department, Haryana Government has notified “Haryana One-Time Settlement Amnesty Scheme for Recovery of Outstanding Dues, 2023” (‘Amnesty Scheme’). The Amnesty Scheme will be operational from 01 January 2024, and will continue for a period of 90 (ninety) days unless extended further.

Salient features of the Amnesty Scheme are:

A. Applicable Laws: Acts for which benefits under the Amnesty Scheme can be availed are:

- Haryana Value Added Tax Act, 2003

- Central Sales Tax Act, 1956

- Haryana Local Area Development Tax Act, 2000

- Haryana Tax on Entry of Goods into Local Areas Act, 2008

- Haryana Tax on Luxuries Act, 2007

- Punjab Entertainment Duty Act, 1955

- Haryana General Sales Tax Act, 1973

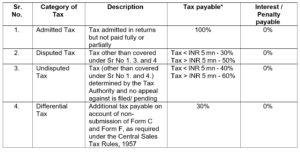

B. Benefits extended: Under the Amnesty Scheme, the following benefits have been extended for settlement of outstanding tax, interest and penalty:

* The Amnesty Scheme also provides a mechanism to deposit the tax in installment.

C. Ineligible Applicant: The following category of applicants are not permitted to avail benefits under the Amnesty Scheme:

- Against whom criminal proceedings have been initiated under the Applicable Laws; and

- Where the outstanding dues pertain to a on account of an erroneous refund

D. Procedure: Eligible applicants are required to electronically apply by filing Form OTS-1 along with proof of payment of the settlement amount or the first instalment, whichever is opted. Form OTS-1 is required to be filed within 90 days commencing from 01 January 2024.

E. Appeal: A final settlement order under the Amnesty Scheme will be binding and cannot be challenged through an appeal. However, such order can be rectified (for any errors) within a period of 30 (thirty) days from the date of issuance of such order.

Comments: Since introduction of Goods and Services Tax in 2017, amnesty/ settlement schemes have found favour with the State Governments to reduce the burden on courts/ adjudicating authorities as well as to augment tax collections. Taxpayers should avail of this Amnesty Scheme to avoid protracted litigation as well as reduce the exposure to interest and penalty.

To read the official notification of the Amnesty Scheme, click here.

The information contained in this document is not legal advice or legal opinion. The contents recorded in the said document are for informational purposes only and should not be used for commercial purposes. Acuity Law LLP disclaims all liability to any person for any loss or damage caused by errors or omissions, whether arising from negligence, accident, or any other cause.