Non-Banking Financial Companies – NBFC

Non-Banking Financial Companies (NBFCs) are key to the India’s economy and play an important role in promoting inclusive growth in the country. NBFCs play a critical role in the core development of several sectors especially in the micro, small and medium enterprises and have been making significant contribution to wealth creation and financial support for small businesses and organizations.

This primer aims at providing a brief overview of the laws and regulations governing NBFCs in India.

- What is an NBFC?

An NBFC is a financial institution which is primarily engaged in the financial activities of receiving deposits or lending, as a principal business.

NBFCs are entities which are engaged in the business of (i) receipt of deposits, (ii) financing by way of loans and advances, (iii) acquisition of shares, stocks, bonds, debentures or securities issued by the Government / local authority or marketable securities of a like nature, (iv) hire-purchase, (v) insurance, (vi) chit business, (vii) collecting monies in lump sum under any scheme, arrangement by way of subscribing to / sale of units.

- What is the concept of ‘principal business’?

The concept of ‘principal business’ was laid down by India’s central bank, the Reserve Bank of India (RBI), to determine which companies / entities will be considered as an NBFC. A company will be treated as an NBFC if its financial assets are more than 50% of its total assets (netted off by intangible assets), and income from financial assets is more than 50% of the gross income.

- What is the governing authority regulating establishment and operations of NBFC in India?

The RBI is the governing authority regulating the establishment and operations of NBFCs in India. The RBI has the power to register, make policies, inspect, issue directions to NBFCs in India.

- What are the regulations governing the establishment and operations of NBFCs in India?

In India, operations of NBFCs are regulated by RBI in accordance with the provisions of Reserve Bank of India Act, 1934 (RBI Act) and master directions and master circulars issued by the RBI, from time to time. The RBI has issued certain master directions to govern the operations of NBFCs in India. Following master directions have been issued by RBI with respect to different categories of NBFCs:

(a) Master Direction on Mortgage Guarantee Companies, 2016;

(b) Master Direction for Non Systemically Important Non-Deposit taking NBFCs, 2016;

(c) Master Direction for Systemically Important Non-Deposit Taking NBFCs, 2016;

(d) Master Direction for Residuary Non-Banking Companies, 2016;

(e) Master Direction for Miscellaneous Non-Banking Companies, 2016;

(f) Master Direction for Core Investment Companies, 2016; and

(g) Master Direction on NBFCs Acceptance of Public Deposits, 2016.

- Which categories of NBFCs are exempted from registration with RBI?

As per RBI Master Direction on Exemptions from provisions of Reserve Bank of India Act, 1934 (Master Direction), following NBFCs are exempted from obtaining a registration from RBI:

(a) NBFC engaged in micro financing activity, having license under Section 25 of Companies Act, 1956 or Section 8 of Companies Act, 2013 (that is, companies established for promoting commerce, arts, science, religion, charity or any other business) and not accepting public deposit;

(b) NBFC which is securitization company or a reconstruction company registered under the SARFAESI Act, 2002;

(c) An NBFC notified as Nidhi company under the Companies Act, 1956;

(d) An NBFC which is a mutual benefit company;

(e) An NBFC doing business of chit as defined under Chit Funds Act, 1982;

(f) Mortgage guarantee company notified as NBFC;

(g) An NBFC registered with the Securities and Exchange Board of India (SEBI) as merchant banking company;

(h) An NBFC doing the business of insurance, registered with Insurance Regulatory and Development Authority in India and not holding or accepting any public deposit;

(i) An NBFC which is a stock exchange recognized under the Securities Contract (Regulation) Act, 1956;

(j) An NBFC which is an Alternate Investment Fund or doing business of stock broker or sub-broker registered with SEBI and subject to the conditions of the Master Direction;

(k) NBFC which is a housing finance institute defined under the National Housing Bank Act, 1987; and

(l) An NBFC which is a core investment company covered under Core Investment Companies (Reserve Bank) Directions, 2016.

- What are the various categories of NBFCs?

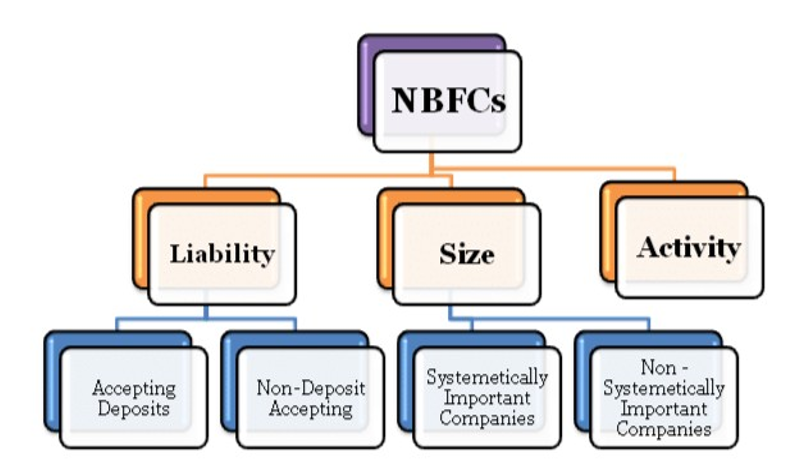

(a) Broadly, NBFCs can be categorized as ‘deposit accepting’ and ‘non-deposit accepting’ based on the type of liability. Non-deposit accepting NBFCs are further categorized based on their asset size as:

(i) Systemically Important, that is, those NBFCs having total asset of INR 5 billion and above; and

(ii) Non Systemically Important, that is, those NBFCs whose total asset is less than INR 5 billion.

(b) NBFCs are also be categorized into following types based on the kind of activity they are engaged in:

(i) Asset Finance Companies;

(ii) Investment Company;

(iii) Loan Company;

(iv) Infrastructure Finance Company;

(v) Core Investment Company;

(vi) Infrastructure Debt Fund;

(vii) Micro Finance Institution;

(viii) NBFC Factors;

(ix) Mortgage Guarantee Companies; and

(x) Non-Operative Financial Holding Company.

- Can an NBFC be a partner in a partnership firms?

No, an NBFC cannot become a partner of a partnership firm.

- What is the difference between Banks and NBFCs?

Unlike banks:

(a) NBFC cannot accept demand deposits;

(b) NBFCs do not form part of the payment and settlement system;

(c) NBFCs cannot issue cheques drawn on itself; and

(d) depositors of NBFCs cannot access the deposit insurance facility of Deposit Insurance and Credit Guarantee Corporation.

- Which entities are eligible to become NBFC?

As per the provisions of RBI Act, an entity which is:(a) a company incorporated under the Indian Companies Act, and (b) which has its principal business the receiving of deposits under any scheme or arrangement or any other manner, or lending in any manner, is eligible to become an NBFC.

Further, the entity is required to have a minimum net owned fund of INR 10 million. The minimum net owned fund requirement is different for the following categories of NBFCs:

(a) NBFC which is an infrastructure finance company is required to have a minimum net owned fund of INR 3 billion.

(b) NBFC which is a mortgage guarantee company is required to have a minimum net owned fund of INR 1 billion.

(c) NBFC Factors are required to have a minimum net owned fund of INR 50 million.

(d) Core Investment Companies are required to have a minimum net owned fund of INR

1billion.

(e) A micro financing institution which is an NBFC is required to have a minimum net owned fund of INR 50 million.

- When does a financial company require registration as an NBFC?

A financial company after being duly registered under the Indian Companies Act and satisfying the minimum net owned fund requirement as per RBI can apply for a certificate of registration before the RBI to carry on the business of NBFC.

- What are the permissible activities of an NBFC?

As per the RBI Act, an NBFC can carry on the following activities as its business or part of its business:

(a) Financial activities, that is, extending loans and advances;

(b) Investment in Government securities and marketable securities;

(c) Letting or delivering of any goods to a hirer under a hire purchase agreement as defined under Hire Purchase Act, 1972;

(d) Insurance business;

(e) Manage, conduct or supervise, as foreman, agent or in any other capacity, chits or kuries as defined under the State laws; and

(f) Collect, for any purpose or under any scheme or arrangement, monies in lump sum or otherwise, by way of subscriptions or by sale of units or other instruments or in any other manner and awarding prizes or gifts to persons from whom monies are collected or to any other person.

The RBI Act does not specifically prohibit an NBFC from being involved in other activities. However, the RBI Act indicates that the following activities should not be the principal business of an NBFC:

(a) Agricultural operations;

(b) Industrial activity;

(c) Purchase or sale of any goods other than securities or providing any services; and

(d) Purchase, construction or sale of immovable property.

- What are the various compliance requirements for an NBFC in India?

(a) A deposit taking NBFC is required to submit the following:

(i) Quarterly returns on deposits in form NBS-1 within 15 (Fifteen) days from the end of quarter;

(ii) Quarterly returns on Prudential Norms in form NBS-2 within 15 (Fifteen) days from the end of quarter;

(iii) Quarterly return on liquid asset in form NBS-3 within 15 (Fifteen) days from the end of quarter;

(iv) Annual return of critical parameters by a company holding public deposits whose application for certificate of registration has been rejected in form NBS-4 by 1 May of every year;

(v) Deposit taking NBFCs with asset size of INR 1 billion or more are required to submit monthly return on exposure to capital market in form NBS-6 within 7 (Seven) days from the end of the month;

(vi) Audited balance sheet and auditor’s report; and

(vii) Branch information return

(b) A Non-Deposit taking Systemically Important NBFC is required to submit the following:

(i) A quarterly statement of capital funds, risk weighted assets, risk asset ratio etc., in form NBS-7 within 15 (Fifteen) days from the end of quarter;

(ii) Monthly return on important financial parameters within 7 (Seven) days from the end of the month;

(iii) Monthly statement of short term dynamic liquidity in form NBS-ALM1 within 10 (Ten) days from the end of the month;

(iv) Half yearly statement of structural liquidity in form NBS-ALM2 within 30 (Thirty) days from the end of the term;

(v) Half yearly statement of interest rate sensitivity in form NBS-ALM3 within 30 (Thirty) days from the end of the term; and

(vi) Branch information return.

(c) A non-deposit taking NBFC having asset size between INR 500millionand INR 1 billion is required to submit basic information like name of the company, address, net owned fund, profit/ loss during the last 3 (Three)years to RBI in every quarter. The information is required to be submitted with 15 (Fifteen) days of the end of the quarter. In addition, such NBFCs are required to submit quarterly returns within 30 (Thirty) days of the end of the quarter.

(d) All NBFCs are required to submit a certificate duly certified by statutory auditors that the company is engaged in the business of Non-Banking Financial Institution and hence is required to hold the certificate of registration at end of March every year. The certificate should also mention the asset/ income pattern of the NBFC for making it eligible for classification as investment and credit company.

(e) An NBFC with foreign direct investment (FDI) is required to submit a certificate indicating that it has complied with the minimum capitalization norm and its activities are restricted to the activities prescribed under FEMA. The certificate is required to be submitted half yearly.

(f) An NBFC having overseas investment is required to submit quarterly returns to the regional office of Department of Non-Banking Supervision and Department of Statistics and Information Management. The returns should be submitted within 30 (Thirty) days of the end of the quarter.

- What are various annual filings required to be made by an NBFC in India?

An NBFC, being a company, is required to submit its annual returns in form MGT-7, financial statements in form AOC-4, interest of directors in form MBP-1 with the concerned Registrar of Companies (RoC).

Apart from RoC compliances, all NBFCs are required to submit a certificate by statutory auditor relating to its business at end of March every year. A company holding public deposits, whose application for certificate of registration has been rejected, is required to submit critical parameters in form NBS-4 by 1 May of each year.

- In what circumstances or events will an NBFC require prior approval / permission from RBI?

An NBFC is required to take prior approval of RBI, in any of the following circumstances:

(a) Any takeover or acquisition of control of an NBFC irrespective of change in management as a result of such takeover or acquisition;

(b) Any change in shareholding of an NBFC which result in acquisition/transfer of shareholding of 26% or more of the paid-up equity capital of an NBFC;

(c) Any change in management of the NBFC which would result in change in more than 30% of the directors, excluding the independent directors.

- What is the procedure for an application for registration of NBFC and what are the steps involved?

The applicant is required to apply online, on the platform at https://cosmos.rbi.org.in and submit a physical copy of the application along with necessary documents to the regional office of RBI.

Any company which satisfies the requirement of application, may follow the following steps to apply for registration:

(a) Visit RBI platform at the website link mentioned above;

(b) Fill the necessary application form;

(c) Submit all the necessary documents along with application form;

(d) Send the hard copy of the application to RBI; and

(e) After the application is checked and verified, license will be given to the applicant company.

- What are the documents required for the registration of an NBFC?

Following are some of the important documents that are required for registration of an NBFC:

(a) Certified copy of certificate of incorporation and certificate of commencement of business in case of a public limited company;

(b) Certified copy of only the main object clause of the memorandum of association;

(c) Board resolution stating that:

(i) The company is not carrying on/has stopped and will not carry on/ commence NBFC activity before getting registration from RBI;

(ii) The unincorporated body in the group, in which the director holds substantial interest, has not accepted any public deposit till date and will not accept the same in future;

(iii) The company has formulated a ‘Fair Practice Code’ as prescribed by RBI;

(iv) The company has not accepted public funds in the past and does not hold public funds as on date. Further that, the company will not accept public funds without the prior approval of RBI; and

(v) The company does not have customer interface and will not have any in future without the prior approval of RBI;

(vi) Copy of fixed deposit receipt;

(vii) Bankers certificate of non-lien with respect to net owned fund;

(viii) Audited balance sheet and profit & loss account for companies which are already in existence. Such documents should be furnished for the lesser of the entire period of existence of the company or for the last 3

(Three) years; and

(ix) Banker’s report in respect of the applicant company, dealings of its group/subsidiary/associate/holding company/related parties and directors of the applicant company having substantial interest in other companies.

- Can a registration of an NBFC be revoked?

The certificate of registration granted to an NBFC may be revoked by RBI on any of the following grounds:

(a) If the entity ceases to carry on the business of non-banking financial institution in India;

(b) If the entity has failed to comply with the conditions upon which the certificate of registration was granted;

(c) If the entity is not in a position to pay its depositors in full;

(d) If the affairs of the entity are in a manner detrimental to the interest of its depositors;

(e) If the character of the management of the of entity is prejudicial to the public interest or interest of its depositors;

(f) If the entity fails to have adequate capital structure and earning prospects;

(g) If the grant of certificate of registration is prejudicial to the operation and consolidation of the financial sector;

(h) If the entity fails to comply with any direction issued by the RBI;

(i) If the entity fails to maintain accounts in accordance with the requirements of any law or any direction or order issued by RBI;

(j) If the entity fails to submit or offer for inspection of its books of account and other relevant documents on demand; or

(k) If the entity has been prohibited from accepting deposit by an order made by RBI and such order has been in force for a period of at least 3 (Three) months.

- Is FDI permissible in NBFCs?

As per Foreign Exchange Management (Non-Debt Instrument) Rules, 2019, FDI in NBFCs is permitted up to 100% under the automatic route.

- Describe in brief, the Fair Practices Code applicable to all NBFCs.

(a) Loan application and processing:

(i) All communications to the borrower shall be in vernacular language / language understood by the borrower.

(ii) Application forms shall include necessary information affecting the interests of the borrower to enable a meaningful comparison with the terms offered by other NBFCs.

(iii) The application form shall specify documents to be submitted along with the form.

(iv) NBFCs are required to devise systems for giving acknowledgements as regards loan applications received and prescribe a time frame within which the loan applications shall be disposed off.

(b) Loan appraisal and terms / conditions:

(i) NBFCs shall convey the amount of loan sanctioned, terms and conditions, rate of interest by way of sanction letter. The acceptance of these terms and conditions by the borrower shall be maintained by the NBFCs.

(ii) Penal interest charged for late repayment shall be mentioned in bold in the loan agreement.

(iii) NBFCs shall furnish a copy of the loan agreement along with annexures to all the borrowers at the time of sanction / disbursement of loan.

(c) Disbursement of loans including changes in terms and conditions:

(i) Notice of change in terms and conditions including disbursement schedule, interest rates, service / prepayment charges shall be given to the borrower.

(ii) Changes in interest rate and charges should be effected only prospectively.

(iii) NBFC’s shall release all securities on repayment of dues / on realization of outstanding amounts. If an NBFC exercises right of set-off, the borrower shall be given notice with full particulars about outstanding claims.

(d) General:

(i) The NBFC’s shall refrain from interfering in the affairs of the borrower, unless information not earlier disclosed by the borrower is noticed.

(ii) In case of receipt of transfer request from the borrower, consent / no objection shall be provided within 21 (Twenty-one) days from the date of receipt of request.

(iii) The NBFC’s shall not resort to harassment for recovery of loans. NBFCs shall ensure that the staffs are adequately trained to deal with customers.

(iv) NBFCs shall not charge foreclosure charges / pre-payment penalties on floating rate term loans sanctioned to individual borrowers for purposes other than business.

(v) NBFC’s shall display information such as name, contact details of the grievance redressal officer at their branches / places of business.

(vi) The board of directors shall adopt an interest rate model which shall take into account relevant factors such as cost of funds, margin and risk premium and determine the rate of interest to be charged for loans and advances.

(vii) The rate of interest, the approach for gradations of risk, and rationale for charging

different rate of interest to different categories of borrowers shall be disclosed to the borrower or customer in the application form and communicated explicitly in the sanction letter, or made available on the website / published in newspapers

- Where can one access the list of all NBFCs?

A list of registered NBFCs is available on the RBI website at www.rbi.org.in – Sitemap – NBFC List

Disclaimer: The information contained in this document is not legal advice or legal opinion. The contents recorded in the said document are for informational purposes only and should not be used for commercial purposes. Acuity Law disclaims all liability to any person for any loss or damages caused by errors or omissions, whether arising from negligence, accident or any other cause.