Insolvency And Bankruptcy Code, 2016

The Insolvency and Bankruptcy Code, 2016 (Code) was enacted to revamp the insolvency and bankruptcy laws and resolve problems being faced by creditors due to non-repayment of outstanding dues by corporate borrowers.

This primer deals with the fundamental principles of corporate insolvency, its related procedure and relevant law in India.

- What are the circumstances under which the provisions of the Code can be invoked?

The provisions of the Code are applicable in cases of insolvency, liquidation, voluntary liquidation or bankruptcy of a company, limited liability partnership, partnership firms, corporate persons or individuals.

- What is the object of the Code?

The object of the Code is reorganisation and insolvency resolution of an entity which is under financial distress. The provisions of the Code cannot be invoked for recovery of dues to a creditor.

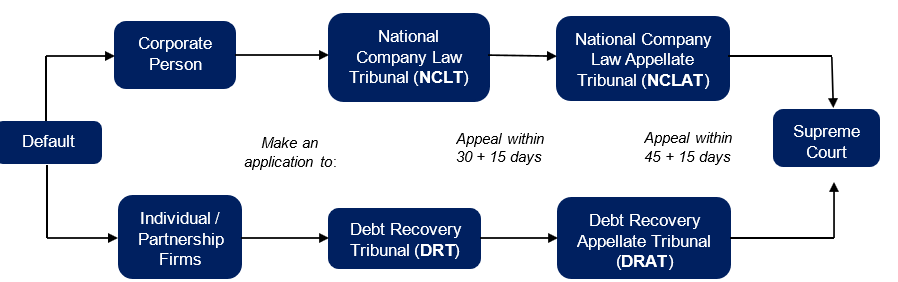

- What is the institutional framework provided under the Code?

The framework is as follows:

(i) Insolvency and Bankruptcy Board of India (IBBI) – It is the apex regulatory and supervisory authority with the responsibility of effectively implementing the Code. It also has the power to make regulations and guidelines on matters relating to the Code.

(ii) Insolvency Professional Agencies (IPA) – These are specialised agencies entrusted with the registration and monitoring of insolvency professionals

(iii) Insolvency Professionals – They are registered with the IBBI and enrolled with an IPA. They perform multiple roles under the Code like functioning as a resolution professional, liquidator, bankruptcy trustee, etc.

(iv) Information Utilities – These are comprehensive databases which store financial information provided by financial and operational creditors on various entities. Stakeholders may access the information provided in these databases to gain a comprehensive picture of the financial condition of the entity.

- What is the legal structure?

CORPORATE INSOLVENCY RESOLUTION PROCESS (CIRP)

- Who can initiate CIRP?

CIRP can be initiated by a financial creditor, operational creditor or the corporate debtor itself (or a member or partner of the corporate debtor authorized to make such application or an individual in charge of managing the operations or has control over the financial affairs of the corporate debtor).

- Who is a corporate debtor?

A corporate debtor means a company or a limited liability partnership firm which owes a debt to any person. However, it does not include a financial service provider such as bank. Separate rules are prescribed for the insolvency and liquidation of a financial service provider.

- Who are financial creditors?

Financial creditors are those whose relationship with the corporate debtor is a pure financial contract, such as a loan or debt security. A creditor that provides a financial debt which generates value over time will be considered a financial creditor.

- Who are operational creditors?

Operational creditors are those whose relationship with the corporate debtor arises out of the business operations of the corporate debtor. Such operations may relate to provision of goods or services to the corporate debtor, among other things.

- Who is a resolution professional (RP)?

An RP is a professional who conducts the CIRP of a corporate debtor and manages the affairs of the corporate debtor during the CIRP. Collection of information relating to the assets, finances and operations of the corporate debtor, receipt and collation of claims, constitution of the Committee of Creditors (CoC) are some of the duties of the RP.

- Who is an interim resolution professional (IRP)?

An IRP is a professional appointed by the NCLT (based on the suggestion of the applicant) till the constitution of CoC. Once the CoC is constituted, the CoC may confirm the IRP as the resolution professional of the corporate debtor or appoint a new resolution professional after terminating the mandate of the IRP.

- What is the CoC? Who constitutes it?

CoC is the decision-making committee in the CIRP. It is constituted of the financial creditors of the corporate debtor. The interim resolution professional, after the collation of all the claims, constitutes the CoC.

- What is the role of CoC in CIRP?

The CoC is responsible for the decisions made during the CIRP of the corporate debtor such as raising of interim finance, creation of security interest over the assets of the corporate debtor, etc. They assess and decide the viability of the resolution plan including the manner of distribution of funds to the various classes of creditors. They may also suggest modifications of the commercial proposals made by the resolution applicant.

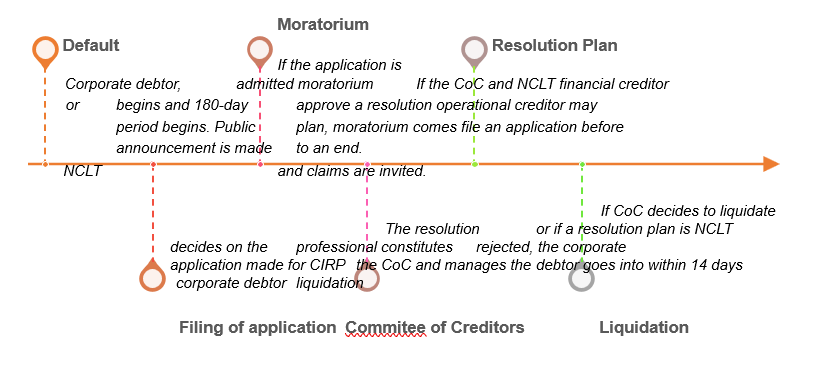

- What is CIRP?

CIRP is the procedure provided under the Code for insolvency resolution of a corporate debtor. Once a corporate debtor is placed under CIRP, the existing management ceases to have control over its affairs and the management of the corporate debtor is vested in the IRP. The IRP / RP along with the CoC, work towards finding a resolution applicant who will take over the affairs of the company after settling the outstanding debts of the corporate debtor.

- When can CIRP be initiated?

It can be initiated on non-payment of debt, whether the whole amount or a part of it, by the corporate debtor.

- Is there a minimum amount of default that is required to initiate CIRP?

Yes, the minimum amount of default required to initiate CIRP is INR 100,000 .

- What is the timeline for the completion of CIRP?

The CIRP must conclude within 330 days which can be extended for sufficient cause.

- What is moratorium?

Moratorium is a period during CIRP wherein no judicial proceedings for recovery, enforcement of security interest, sale or transfer of assets, or termination of essential contracts can be instituted or continued against the corporate debtor.

- What is information memorandum?

It is the document prepared by the resolution professional which aids a prospective resolution applicant in formulating a viable resolution plan for the corporate debtor. The resolution professional shall provide to the resolution applicant access to all relevant information such as the assets and liabilities of the corporate debtor, latest annual financial statements and other information which gives a clear picture of the financial position of the corporate debtor.

- Who is a resolution applicant?

A resolution applicant is a person, who individually or jointly with any other person, submits a resolution plan to the resolution professional. However, some persons are ineligible to be a resolution applicant such as an undischarged insolvent, wilful defaulter, etc.

- What is a resolution plan?

A resolution plan is a commercial proposal by a resolution applicant for the insolvency resolution of the corporate debtor. All resolution plans are placed before the CoC for its consideration and CoC may approve or reject the plan. For a resolution plan to be approved, it will have to be approved by the CoC by vote of not less than 66% of voting share. Post such approval, it will be submitted for approval before the NCLT.

- What happens if all the resolution plans are rejected by the CoC?

If all the resolution plans placed before the CoC are rejected and the prescribed time expires, the corporate debtors goes into liquidation.

- What is the extent of liability of the corporate debtor post the approval of the resolution plan by the NCLT?

If the resolution plan results in change in the management or control of the corporate debtor, the incoming management is provided immunity against offences committed in the name of the corporate debtor prior to the commencement of CIRP.

- What is the remedy under the Code in case of preferential transactions?

If the resolution professional is of the opinion that the corporate debtor has at a relevant time given a preference in such transactions, an application will be made by the resolution professional to the NCLT. The NCLT may pass an order requiring a person to pay sums received as benefit to the resolution professional or release or discharge the security interest created by the corporate debtor or vesting of property transferred by means of such preferential transaction to be vested with the corporate debtor among others.

LIQUIDATION - When can liquidation of a corporate debtor be initiated?

Liquidation process may be initiated –

(i) if a resolution plan is not submitted to the NCLT before the expiry of the maximum period of time permitted for completion of CIRP;

(ii) if the NCLT rejects a resolution plan submitted to it by the resolution professional;

(iii) if approved by at least 66% of the voting share of the CoC prior to the confirmation of the resolution plan;

(iv) if the corporate debtor contravenes the resolution plan.

- Does the moratorium continue during liquidation?

The moratorium ceases to have effect from the date of liquidation order passed by the NCLT. But no legal proceeding can be instituted by or against the corporate debtor. However, a legal process may be instituted by the liquidator on behalf of the corporate debtor with the permission of the NCLT.

- What is the status of the officers, employees and workmen of the corporate debtor if a liquidation order is passed by the NCLT?

If a liquidation order is passed by the NCLT, it shall be deemed to be a notice of discharge to the officers, employees and workmen of the corporate debtor, except when the business of the corporate debtor is continued during the liquidation process by the liquidator.

- What happens to the power of the board and key managerial personnel (KMP) of the corporate debtor?

The powers of the board of directors, KMP and partners of the corporate debtor will be vested with the liquidator.

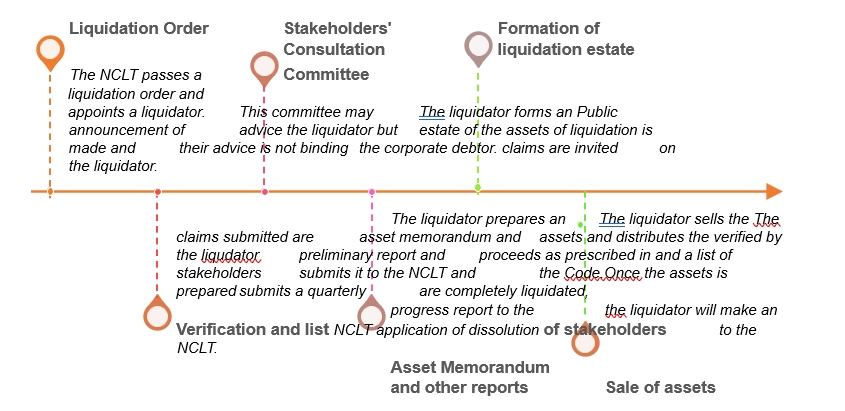

- Who is a liquidator?

Liquidator is the officer appointed by the NCLT when a liquidation order is passed. Usually, the resolution professional who manages the corporate debtor is appointed as the liquidator unless replaced by the NCLT. While appointing the liquidator, the NCLT will consider whether the proposed liquidator or the partner / director of the insolvency professional agency associated with the proposed liquidator is related to the corporate debtor.

- What are the powers and duties of a liquidator?

The liquidator can verify claims of the creditors, take into custody the assets, property, etc. of the corporate debtor, protect, preserve and sell the assets and properties of the corporate debtor, carry on the business of the corporate debtor for its beneficial liquidation, obtain professional assistance in discharge of his responsibilities, invite and settle claims, institute and defend any legal proceeding and other functions as specified by IBBI.

- Can a creditor challenge the decision of the liquidator regarding admission or rejection of its claim?

Yes, a creditor may appeal to the NCLT against the decision of the liquidator accepting or rejecting the claims within 14 days of the receipt of such decision.

- What is the liquidation process?

- How is the valuation of the corporate debtor determined?

The liquidator may use the average of the value arrived during CIRP to determine the valuation of the corporate debtor. If no such valuation exercise was undertaken during CIRP or if the liquidator opines that a fresh valuation is required, he will appoint two registered valuers to determine the valuation of the corporate debtor.

- How are the assets of the corporate debtor sold?

The liquidator may sell the assets on a standalone basis, in a slump sale, set of assets collectively or in parcels. The liquidator may also sell the corporate debtor or the business of the corporate debtor as a going concern i.e. as it would have been functioning prior to initiation of CIRP, other than the restrictions put by the Code.

- How are the secured creditors of the corporate debtor treated under the liquidation process?

A secured creditor has the option to realise its debt through the liquidation process or may enforce, realise, compromise, or deal with the secured assets under other applicable laws. If the amount realised through the secured assets is not adequate to repay debts owed to the secured creditor, the unpaid debts of the secured creditor will be paid as per the order of priority provided in the Code.

- Who gets priority in the distribution of proceeds from the sale of assets of the corporate debtor?

The proceeds from the sale of assets of the corporate debtor are distributed in the following order of priority –

(i) costs incurred during the CIRP and liquidation process;

(ii) workman dues (preceding 24 months) and secured creditor (which opted to realize its debt through the liquidation process);

(iii) other employee dues (preceding 12 months);

(iv) financial debt to unsecured creditors;

(v) government dues (preceding 24 months) and remaining debt of the secured creditors (which opted to realize the debt under other applicable laws)

(vi) any remaining debts or dues;

(vii) preference shareholders;

(viii) equity shareholders or partners

Recipients which occur in the same order of priority will rank equally between them.

- What is the time within which the liquidation process is to be completed?

The liquidator is required to liquidate the corporate debtor within one year from the date of passing of the liquidation order by the NCLT. If the liquidation of the corporate debtor is not complete within one year, the liquidator will have to make an application to the NCLT explaining the delay and the additional time required.

- What is the remedy if there is irregularity on part of the liquidator or the RP?

Any person aggrieved by the functioning of an insolvency professional agency or insolvency professional or liquidator (as the case may be) may file a complaint to the IBBI.

Disclaimer: The information contained in this document is not legal advice or legal opinion. The contents recorded in the said document are for informational purposes only and should not be used for commercial purposes. Acuity Law disclaims all liability to any person for any loss or damages caused by errors or omissions, whether arising from negligence, accident or any other cause.