Decoding Budget 2025 – Tax and Legal Insights

The Hon’ble Finance Minister has announced the proposals for the Union Budget 2025-26 on 01 February 2025.

The theme for the Union Budget 2025-26 in the words of the Hon’ble Finance Minister is “Sabka Vikas” stimulating balanced growth of all regions. The government has demonstrated its commitment to inclusive economic development by prioritizing private investment, increasing funding for the agriculture sector, and enhancing people’s spending power.

On the direct tax proposals, increase in personal tax rebate limit is one of the significant development with no tax levied on incomes up to INR 12 Lakhs. Further, there are reforms in TDS and TCS collection regime, amendment to streamline business taxation provisions, amendment to transfer pricing provisions and other such amendments are proposed to ensure clarity in the implementation of direct tax laws. The introduction of new Tax bill in the near future will bring tax certainty and reduce litigation. It is expected that this bill will address ongoing issues, enhance ease of doing business, reduce compliance burdens, and minimize tax disputes.

On the indirect tax front, a well-rounded approach is adopted by the Government to to rationalize customs tariffs, promote economic growth, and facilitate trade. The proposals focus on streamlining the tariff structure and addressing duty inversion, which are crucial steps to support manufacturing in India and promote exports. By simplifying basic customs duty rates and applying a single cess or surcharge, the government aims to enhance clarity and ease of doing business.

A notable feature of this budget is the introduction of a voluntary compliance scheme for post-clearance processes. This trade-friendly and practical initiative encourages businesses to comply voluntarily, leading to smoother operations and fewer disputes. Such measures are expected to significantly boost domestic manufacturing, enhance export competitiveness, and make trade processes more efficient.

All in all, a good budget and the proposals are positive and forward looking.

We at Acuity Law have analyzed a few significant tax proposals in the ensuing paragraphs.

DIRECT TAX

A. Personal Income Tax Rates (PITR)

- The tax rates have been reduced and the tax slabs have been increased leading to much lower tax burden for individuals.

- Income up to INR 1,200,000 (approx. USD 14,000) would be exempt from tax in hands of individuals.

B. Rationalization of threshold on withholding of tax (w.e.f. 1 April 2025)

- Thresholds and rates have been relaxed for withholding taxes across various categories of transactions, notably, interest on securities, professional/technical services, dividends, rent, commissions, securitisation trusts, etc.

- In order to reduce compliance burden on the taxpayers, w.e.f 1 April 2025, it is proposed to remove certain provisions which required collection of taxes @ 0.1% of the sale consideration exceeding INR 5 million in any financial year towards sale of any goods (including unlisted shares).

- Currently, there is a requirement on banks to collect tax @ 0.5% on amounts in excess of INR 700,000 in a FY where such amount is procured as an education loan from financial institution and remitted under liberalised remittance scheme (LRS) overseas towards pursuing education. It is now proposed to do away with this requirement. Accordingly, w.e.f 1 April 2025, there is no requirement by banks to collect TCS on remittance by individuals under LRS scheme towards education loan procured from financial institutions for pursuing education overseas.

- Presently, in case a person does not file a tax return in India (‘non-filer’) then any payment to such non-filer would be subject to a much higher withholding rate by the payer/deductor. Similarly, any payment received from such non-filer would be subject to tax collection at source by such non-filer at much higher rates. To reduce compliance burden for such deductors/collectors and allied working capital burden, there would henceforth be no requirement to withhold or collect tax at higher rate qua non-filers.

C. Updated Tax Return

- Section 139(8A) of the Act allows taxpayers to file an updated return (ITR-U) in case they have omitted or misreported income in their original return. An updated return can be filed within 24 months from the end of the relevant assessment year (AY).

- To enhance voluntary tax compliance, the time limit to file the updated return for any assessment year has been revised from 24 months to 48 months from the end of the relevant AY. (w.e.f FY April 1, 2025 onwards)

D. Taxation of Investment Fund and Business Trusts (such as REITs/INVITs/AIFs)

- Securities held by Investment Fund treated as “capital asset”

- Presently, there is no clarity whether income from securities held by an Investment Fund is “business income” or “capital gains”

- It is now proposed

- to treat such securities held by Investment Fund, as per SEBI regulations, as “capital assets”

- any gains from selling them will be considered as “capital gains”

- the same would be taxed directly in the hands of the unit holders, while the Investment Fund itself remains exempt qua such “capital gains”

- Rationalisation of tax on transfer of capital assets by Business Trusts (REITs/InvITs/AIFs)

- Previously, a special taxation regime for Business Trust i.e. Real Estate Investment Trust (REIT) and Infrastructure Investment Trust (InvIT), was introduced under Section 115UA of the Act in order to address the challenges of financing and investment in infrastructure.

- It provides a pass-through status to Business Trusts in respect of interest income, dividend income and rental income received by such Business Trust from underlying special purpose vehicles (SPV)[1]. Such income is taxable directly in the hands of the unit holders of Business Trust.

- Any other income (i.e. other than interest, dividend and rental income) accruing to Business Trust shall be taxed at maximum marginal rate (MMR) in hands of Business Trust, excluding income taxed at special rates such as capital gains (short term capital gains (STCG) from listed securities and long-term capital gains (LTCG) from other assets).

- Such capital gains, would not be subject to tax at MMR but instead at prescribed special rates in hands of Business Trust

- It is now specifically clarified that even LTCG from transfer of listed securities would be excluded from such “other income” as it would be subject to tax at special rate of 12.5% in hands of Business Trust

- Effective from FY April 1, 2025 onwards (i.e. AY April 1, 2026 onwards).

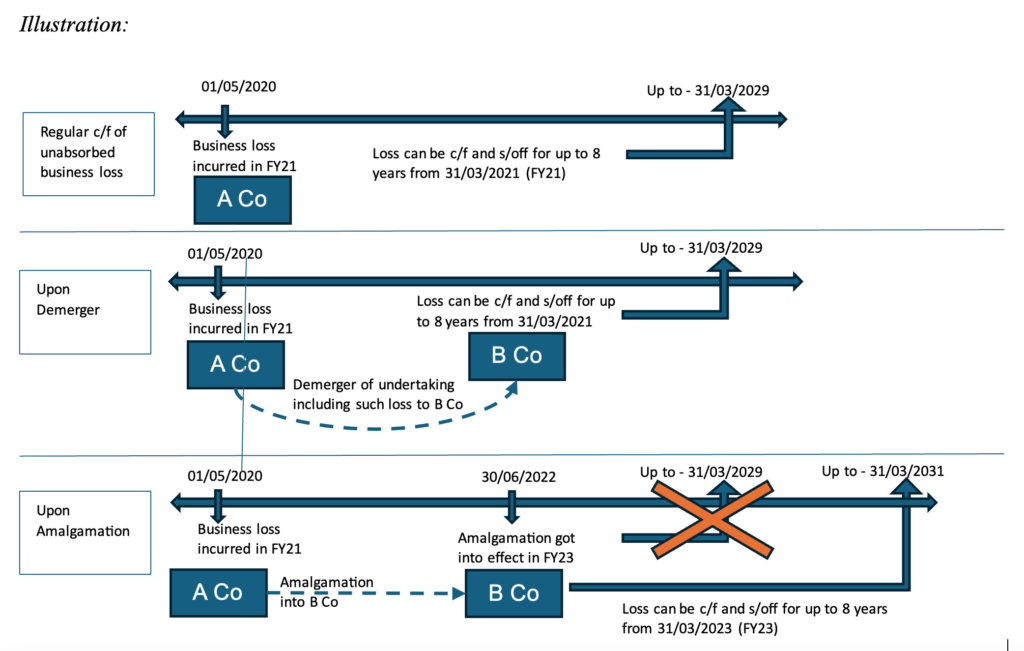

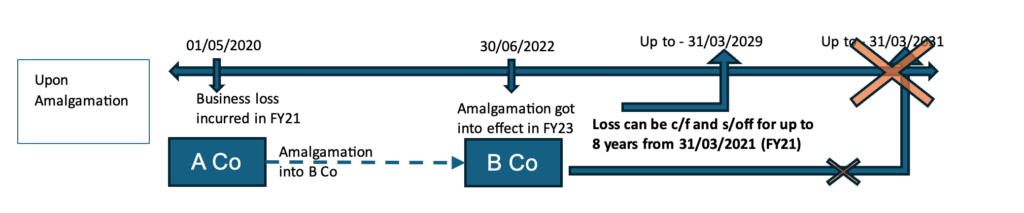

E. Restriction on period of c/f of unabsorbed business losses upon amalgamation

- Business losses, if generated and unabsorbed in a given year, can be c/f for up to 8 years from year in which generated, and set off accordingly against business income of subsequent years.

- Section 72A of the Income Tax Act, 1961, plays a crucial role in facilitating mergers and acquisitions by allowing the carry-forward and set-off of accumulated business losses and unabsorbed depreciation of an amalgamating company for the amalgamated company. This provision is aimed at promoting corporate restructuring, ensuring business continuity, and supporting financially stressed companies.

- Currently, accumulated business loss of the amalgamating entity or predecessor entity is deemed to be the loss of the amalgamated entity or the successor entity for the financial year in which amalgamation or business reorganization is given effect to and c/f provisions shall be construed accordingly. This effectively meant that such loss acquired a fresh lease of life of 8 years from year of such amalgamation.

- However, on the other hand, a demerger did not have any such benefit and any such loss forming part of demerged undertaking transferred from demerged company to resulting company, would be allowed to be c/f for set off in hands of resulting company only for the unexpired period remaining in hands of demerged company had such demerger not taken place.

- Union Budget 2025 has addressed this inconsistency and has provided that even upon amalgamations such loss shall be available for c/f and set off in hands of amalgamated company/succeeding company only for unexpired period of such loss in hands of original entity which incurred such loss.

- This effectively means that going forward unabsorbed losses can be c/f for only balance period available for c/f in hands of original entity. There is no fresh lease of life of 8 years for c/f as was previously available in case of amalgamations.

- Effective from FY April 1, 2025 onwards (i.e. AY April 1, 2026 onwards)

F. Rationalisation of rate of capital gains tax on transfer of capital assets by certain non-residents

- Presently, for residents as well as non-residents, the rate of long-term capital gains (LTCG) tax is 12.5% in case of prescribed securities i.e. listed equity shares or units of equity oriented mutual funds

- For Category-I FPIs[2] and Category-III AIFs[3], LTCG tax for “other categories” (i.e. other than aforementioned prescribed securities) was at 10%

- To bring parity, it is now proposed to tax the above LTCG w.r.t other categories, arising in hands of Category-I FPIs and Category-III AIFs, also at 12.5% instead of 10%

G. Introduction of presumptive taxation for specified non-residents

- Proposed to insert a new provision to cover non-residents engaged in business of providing services or technology to Indian resident company which is establishing or operating electronics manufacturing facility or a connected facility for manufacturing or producing electronic goods, article or thing in India under a scheme notified by the Central Government, subject to fulfilment of certain conditions.

- On a presumptive basis, 25% of gross receipts received by the non-resident or on behalf of non-resident on account of providing services or technology will be deemed as profits and gains from this business in India.

H. Rationalization of definition of ‘dividend’ for treasury centres in International Financial Services Centres (IFSC)

- Under Indian tax law, loans to shareholders or to companies owned by common shareholders are deemed as ‘dividends’ in the hands of shareholders.

- It is intended to exclude advances or loans provided by corporate treasury centres in IFSC from the application of such presumed dividend norms.

- The aforementioned amendment will take effect on April 1, 2025. Advances or loans made between group entities that have a parent company listed on a foreign stock exchange and one of the entities is an IFSC unit serving as a global or regional treasury centre will not be presumed as ‘dividends’.

I. Rationalization of transfer pricing provisions for carrying out multi-year arm’s length price determination

- Transfer Pricing rules require arm’s length price (ALP) determination for international transactions amongst related parties. The process involves repetitive determinations and tax assessments for similar transactions over multiple years, leading to high compliance costs for taxpayers and administrative burden on tax authorities.

- An amendment now provides that once the ALP is determined for a particular year for an international transaction or class thereof, it will automatically apply to similar transactions for the two consecutive years immediately following such year. Taxpayer can opt for this scheme within a prescribed timeframe, subject to approval by the concerned authority to ensure consistency.

- Once opted, no fresh ALP references will be required for these transactions for 3 consecutive years.

- Effective from FY April 1, 2025 onwards (i.e. AY April 1, 2026 onwards).

J. Harmonization of ‘Significant Economic Presence’ (SEP) applicability with ‘Business Connection’

- Presently, if a non-resident is only purchasing goods from India for export and has no other business activities, such income is not deemed to accrue or arise in India.

- However, if such non-resident carries on any transaction in respect of any goods with any person in India which exceeds applicable threshold amount[4], it shall constitute SEP and thus, a ‘Business Connection’[5] in India.

- To provide clarity, it is proposed that non-residents who only purchase goods from India for export will not be considered as having a SEP in India thereby aligning with the existing exemption for such non-residents.

K. Section 285BAA – Obligation to Furnish information on transaction of crypto-asset

- Effective 1 April 2025, a new annual reporting requirement for crypto-assets will be implemented, with specific rules to define the reporting entities, information scope, reporting method and due diligence procedures. It lays out an enhanced disclosure format qua crypto-assets.

- From FY 2025-26, the definition of virtual digital asset (under new provision Section 2(47A)(d)) is broadened to encompass any crypto asset that uses cryptographic, distributed ledger technology for transaction validation and security.

L. Extension of sunset period for commencement of operations to 31 March 2030 with respect to

- income arising on transfer of aircraft or ship that was leased by an IFSC Unit;

- income attributable to investment division of Offshore Banking Unit;

- royalty or interest income of non-resident on account of lease of aircraft or to an IFSC Unit; and

- capital gains in the hands non-resident or IFSC Unit engaged in leasing of aircrafts or ships, on sale of IFSC company engaged in leasing of aircrafts/ ships.

M. Amendment of Section 10 related to Exempt Income of Non-Residents

With effect from FY26, it is proposed to amend existing provision [Section 10(4E) of the Act] to exempt income earned by non-residents on transfers of non-deliverable forward contracts, offshore derivatives, and related instruments when such transactions involve foreign portfolio investors (FPIs) acting as IFSC units (beyond transactions with offshore banking units).

N. Extension of sunset clause for investments by sovereign wealth fund (SWF)/pension fund (PF)

At present, Section 10(23FE) exempts designated people, such as SWFs and PFs, from paying taxes on dividends, interest, and long-term capital gains from investments in India, especially in infrastructure. This provision is proposed to be changed to prolong the sunset clause for making investments from 31 March 2025 to 31 March 2030. Furthermore, it is stated that long-term capital gains would remain tax-exempt for SWFs and PFs, even if reclassified as short-term profits under Section 50AA.

INDIRECT TAX

A. Goods and Services Tax (“GST”)

- Definitions inserted for the terms – “Local Fund” and Municipal Fund”: Section 2(69) of the Central Goods and Services Tax Act, 2017 (“CGST Act”) defines the term “local authority”, which inter alia includes a “municipal and local fund”. It is proposed to define the terms – “Local Fund” and “Municipal Fund” to bring clarity for claiming exemptions and applying other provisions of the CGST Act.

- Input Service Distributor (“ISD”): It is proposed to expand the scope of distribution of input tax credit (“ITC”) by an ISD. Section 2(61) and Section 20 of the CGST Act are being amended to allow distribution of ITC for inter-state supplies on which tax is paid under the reverse charge mechanism.

- GST on supply of Vouchers: The Central Board of Indirect Taxes and Customs (“CBIC”) had videCircular dated 31 December 2024 clarified non-applicability of GST on vouchers. Accordingly, it is proposed to omit Section 12(4) and Section 13(4) which deal with Time of Supply of Vouchers, as these provisions are now redundant given the non-applicability of GST.

- Restriction on availing ITC on construction of immovable property: It is proposed to amend the phrase used in Section 17(5)(d) – “plant OR machinery” and replace the same with the phrase – “plant AND machinery”. This proposed amendment seeks to override the Supreme Court judgment in the case of Safari Retreats, which allowed availment of ITC by differentiating both the words, “plant” and “machinery”. The amendment is being inserted retrospectively from 01 July 2017 and thus denying taxpayers the favorable interpretation in the Safari Retreats case. This proposal is pursuant to the recommendations of GST Council in its 55th meeting held on 21 December 2024.

- Condition for claiming deduction on issuance of credit notes: It is proposed to amend Section 34(2) of the CGST Act, to insert a condition to allow supplier of goods or services to claim deduction of GST liability on issuance of credit notes to a registered recipient. The amendment now requires a supplier to confirm that ITC (as mentioned in the credit note) has been appropriately reversed by the registered recipient, before claiming a deduction in the tax liability in the GST returns. This is an additional and unreasonable obligation for the supplier, as a supplier will have limited control over the recipients’ actions. This proposal is pursuant to the recommendations of GST Council in its 55th meeting held on 21 December 2024.

- Pre-deposit for filing appeals against demand of penalty (not involving any tax demand): It is proposed to amend Section 107 and Section 112 to require a taxpayer to pre-deposit an amount equal to 10% of the penalty demanded, prior to filing an appeal before the 1st Appellate Authority and Appellate Tribunal, respectively. Earlier, the pre-deposit requirement was restricted only to tax demands and penalty demands (involving only detention, seizure and release of goods and conveyances in transit). With this proposed amendment, a pre-deposit requirement is mandatory for all appeals involving tax demands, penalty demands or both tax and penalty demands.

- Track and Trace mechanism for certain commodities: It is proposed to insert a new Section 148, to allow the Government to notify certain goods and persons/ class of persons who may be in possession or dealing in such notified goods, for the purpose of implementing the Track and Trace mechanism. Under this mechanism, a Unique Identification Marking (“UIM”) will be required to be affixed on goods/ packages that may be dealt with by the notified persons/ class of persons. UIM is proposed to be defined by inserting Section 116A to include a digital stamp, digital mark or any other similar marking which is unique, secure and non-removable. In addition, the notified persons/ class of persons will be required to furnish information/ details (as may be prescribed), maintain records/ documents (as may be prescribed) and also furnish information of machinery installed for the notified goods, including its capacity, identification, and such other details as may be prescribed. For non-compliance with this requirement, a penalty is proposed of INR 0.1 mn or 10% of the tax payable on such notified goods, whichever is higher.

- Retrospective amendment to Schedule III of CGST Act: Schedule III lists certain activities/ transactions which shall neither be treated as supply of goods nor supply of services. It is proposed to expand this list (retrospectively from 01 July 2017) to include – “supply of goods warehoused in a Special Economic Zone or in a Free Trade Warehousing Zone to any person before clearance for exports or to the Domestic Tarif Area”. This is a welcome amendment, seeking to promote ease of doing business and should put to rest any on-going litigation pending before various appellate forums.

B. Customs Duty

- Timelines prescribed for finalization of provisional assessments: It is proposed to amend Section 18 of the Customs Act, 1962 (“Customs Act”) to provide a timeline of two years for finalization of provisional assessments. For pending provisional assessments, timeline of two years will commence from the date this proposal received the Presidents assent. This timeline of two years is extendable by one year by the Principal Commissioner or Commissioner of Customs, but after showing sufficient cause and recording the reasons in writing. Certain exceptions have been carved out for which this timeline will remain suspended. This is a welcome amendment, as the industry has been grappling with the issue of non-finalization of provisional assessments, leading to uncertainty of legal interpretations, duty and interest demands, and burden to furnish bonds/ bank guarantee.

- Voluntary revision of bill of entry/ shipping bill post clearance of goods: It is proposed to insert Section 18A to the Customs Act, to allow importers and exporters to voluntarily revise the import/ export entries, even after the corresponding goods have been cleared. This revision will be on a self-assessment basis and the proper officer may verify/ re-assess such revised entries selected on the basis of risk evaluation. If the revision results in short payment of duty, the importer/ exporter can deposit the differential duty along with interest. If the revision results in a refund, the same will automatically be considered as a refund claim and thus eliminating the need to file a separate refund claim. Voluntary revision is not permitted if any search, seizure or summons proceedings have been initiated, any reassessment has already been done or any other cases as may be notified. Corresponding amendments have also been made to timelines relating to refund claims/ demand notices arising on account of such revision in import/ export entries. This is an important amendment which will help improve compliances, disclosures and significantly mitigate litigation as importers/ exporters can now voluntarily rectify any errors, rather than approaching the customs authorities.

C. Miscellaneous Proposals

- Relaxation under Customs (Import of Goods at Concessional Rate of Duty or for Specified End Use) Rules, 2022: The following timelines have been extended:

- The requirement to file statements for imports, consumption, etc have been changed from monthly to quarterly

- Goods can now be sent for job-work for a maximum duration of one year; currently, the maximum duration prescribed is six months

- Unused or defective goods can now be re-exported or cleared for home consumption within a period of one year; currently, the timeline prescribed is six months

- Abolition of Customs, Central Excise and Service Tax Settlement Commission (“CCESC”): It is proposed to abolish CCESC effective 01 April 2025, and to establish an Interim Board to dispose of the pending applications. The term “pending applications” will include applications which have been filed and allowed by CCESC, and a final order has not been passed on or before 31 March 2025.

- Service Tax – exemption to insurance companies: It is proposed to extend exemption from service tax to insurance companies for services rendered by way of reinsurance under the Weather Based Crop Insurance Scheme and the Modified national Agricultural Insurance Scheme. This exemption will apply for the period from 01 April 2011 to 30 June 2017. Companies will also be entitled to a refund if service tax was collected and deposited on such services, subject to filing a refund claim within six months of this proposal receiving the President’s assent.

D. Customs Tariff/ Rate Changes

A. Increase in tariff rates (effective 02 February 2025)

| Sr No | HSN Code | Description of goods | Duty | |

| From | To | |||

| 1 | 6004 10 00 6004 90 00 6006 22 00 6006 31 00 6006 32 00 6006 33 00 6006 34 00 6006 42 00 6006 90 00 |

Knitted Fabrics | 20%/10% | 20% or Rs.115/kg, whichever is higher |

| 2 | 8528 59 00 | Interactive Flat Panel Displays | 10% | 20% |

B. Decrease in tariff rates (effective 01 May 2025)

* Rate reduction effective 02 February 2025 vide Notification No 04/2025-Cus dated 01 February 2025

| Sr No | HSN Code | Description of goods | Duty | |

| From | To | |||

| 1 | 2515 1100 2515 12 |

Marble and travertine, crude or roughly trimmed, merely cut into blocks, slabs and others | 40% | 20% |

| 2 | 3302 10 | All goods other than goods covered under Sr No. 239 of the table appended to notification No. 50/ 2017 Customs dated 30 June 2017 | 100% | 20% |

| 3 | 3406 | Candles, tapers and the like | 25% | 20% |

| 4 | 3920 | Other, plates, sheets, films, foils and strips, of plastics, non-cellular and not reinforced, laminated, supported or similarly combined with other materials | 25% | 20% |

| 5 | 6401 | Waterproof footwear with outer soles and uppers of rubber or of plastics, the uppers of which are neither fixed to the sole nor assembled by stitching, riveting, nailing, screwing, plugging or similar processes | 35% | 20% |

| 6 | 6402 | Other footwear with outer soles and uppers of rubbers or plastics | 35% | 20% |

| 7 | 6403 | Footwear with outer soles of rubber, plastics, leather or composition leather and uppers of leather | 35% | 20% |

| 8 | 6404 | Footwear with outer soles of rubber, plastics, leather or composition leather and uppers of textile materials | 35% | 20% |

| 9 | 6405 | Other Footwear | 35% | 20% |

| 10 | 7404 00 12 7404 00 19 7404 00 22 |

Copper Waste and Scrap | 2.5% | Nil |

| 11 | 8541 42 00 | Solar Cells | 25% | 20% |

| 12 | 8541 43 00 8541 49 00 |

Solar Module and Semiconductor devices and photovoltaic | 40% | 20% |

| 13 | 8702 | Motor vehicles for transport of 10 or more persons (All goods except goods covered under S. No. 524 and S. No. 525of the Table appended to notificationNo. 50/2017-Customs, dated the 30 June 2017) | 40% | 20% |

| 14 | 8703 | Motor cars and other motor vehicles principally designed for the transport of persons (other than those of heading8702) (All goods except goods covered under S. No. 526 and S. No. 526A of theTable appended to notification No.50/2017-Customs, dated the 30 June 2017) | 125% | 70% |

| 15 | 8704 | Motor vehicles for transport of goods(All goods except goods covered underS. No. 524 and S. No. 525 of the Table appended to notification No. 50/2017-Customs, dated the 30 June 2017) | 40% | 20% |

| 16 | 8711 | Motorcycles and cycles fitted with an auxiliary motor with or without sidecar(All goods except goods covered underS. No. 531 and S. No. 531A of the Table appended to notification No. 50/2017-Customs, dated the 30 June 2017) | 100% | 70% |

| 17 | 8903 | Yachts and other vessels for pleasure orsports; rowing boats and canoes | 25% | 20% |

| 18 | 9401 | Seats (other than those of headingsHSN 9402), whether or not convertible into beds, and parts thereof | 25% | 20% |

| 19 | 9503 00 91 | Parts of electronic toys | 70% | 20% |

| 20 | 9803 00 00 | All dutiable articles, imported by a passenger or a member of a crew in his baggage other than goods covered under notification No. 26/2016-Customs, dated the 3 March 2016 | 100% | 70% |

| 21 | 9804 00 00 | All dutiable goods imported for personal use other than those S. No. 608 of theTable appended to notification No.50/2017-Customs, dated the 30 June2017 | 35% | 20% |

C. Decrease in tariff rates (effective 01 May 2025)

* Effective rate remains unchanged

| Sr No | HSN Code | Description of goods | Duty | |

| From | To | |||

| 1 | 1520 00 00 | Glycerol Crude, glycerol waters, glycerol lye | 30% | 20% |

| 2 | 2711 19 10 | LPG (for non-automotive purpose) | 15% | 5% |

| 3 | 2711 19 20 | LPG (for automotive purpose) | 15% | 5% |

| 4 | 2711 19 90 | Other liquified petroleum gas | 15% | 5% |

| 5 | 3824 99 00 | Other – Prepared Binders, chemical products and preparations of chemical or allied industries | 17.5% | 7.5% |

D. Changes in effective customs duty (effective 02 February 2025)

| Sr No | HSN Code | Description of goods | Duty | |

| From | To | |||

| 1 | 4104 11 00 4104 19 00 4105 10 00 4106 21 00 4106 31 00 4106 91 00 |

Wet blue leather (hides and skins) | 10% | Nil |

| 2 | 8549 13 008549 14 008549 19 00 | Waste and scrap of lithium-lon Battery | 5% | Nil |

| 3 | 8517 | Ethernet switches carrier grade | 20% | 10% |

| 4 | 85248529 | Open cell for Interactive Flat Panel Display Module with or without touch, Touch Glass Sheet and Touch Sensor PCB for the manufacture of the Interactive Flat Panel Display Module | 15%/10% | 5% |

| 5 | 8529 | Inputs and Parts of the Open Cells for use in the manufacture of Television Panels of LED/LCD TV | 2.5% | Nil |

| 6 | Any Chapter | Inputs or Parts/sub-parts for use in themanufacture of the Printed Circuit BoardAssembly, Camera module and connectors of cellular mobile phones and inputs and raw materials for use in the manufacture of specified parts of cellular mobile phones i.e., on Wired Headset, Microphone and Receiver, USB Cable and Fingerprint reader/Scanner of Cellular Mobile Phone | 2.5% | Nil |

| 7 | Any Chapter | 35 additional capital goods included for use in manufacture of lithium-ion battery of EVs and 28 additional capital goods included for use in manufacture of lithium-ion battery of mobile phones in the list of exempted capital goods | As applicable | Nil |

| 8 | 8702 | Motor vehicles for transport of 10 or more persons | 25%/40% | 20% |

| 9 | 8703 | Motor cars and other motor vehicles with CIF value more than US $40,000 or with engine capacity more than 3000cc for petrol run vehicles and more than 2500cc for diesel run vehicles or with both | 100% | 70% |

| 10 | 8704 | Motor vehicles for transport of goods | 25%/40% | 20% |

| 11 | 8711 | Motorcycles with engine capacity not exceeding 1600cc in CBU form | 50% | 40% |

| 12 | 8711 | Motorcycles with engine capacity not exceeding 1600cc in SKD form | 25% | 20% |

| 13 | 8711 | Motorcycles with engine capacity not exceeding 1600cc in CKD form | 15% | 10% |

| 14 | 8711 | Motorcycles with engine capacity of 1600cc and above in CBU form | 50% | 30% |

| 15 | 8711 | Motorcycles with engine capacity of 1600cc and above in SKD form | 25% | 20% |

| 16 | 8711 | Motorcycles with engine capacity of 1600cc and above in CKD form | 15% | 10% |

| 17 | 9503 00 91 | Parts of electronic toys for manufacture of electronic toys | 25% | 20% |

E. Changes to Agriculture Infrastructure and Development Cess (effective 02 February 2025)

| Sr No | HSN Code | Description of goods | Rate | |

| From | To | |||

| 1 | 3406 | Candles, Tapers and the like | Nil | 7.5% |

| 2 | 3920 or 3921 | PVC Flex Films, PVC Flex Sheets, PVC Flex Banners | Nil | 7.5% |

| 3 | 8541 42 00 | Solar cells | Nil | 7.5% |

| 4 | 8541 43 008541 49 00 | Solar Module and other semiconductor devices and photovoltaic cells | Nil | 20% |

| 5 | 8702 | Motor vehicles for transport of 10 or more person | Nil | 20% |

| 6 | 8703 | Used Motor Vehicles | Nil | 67.5% |

| 7 | 8703 | Motor cars and other Motor vehicles principally designed for the transport of people in other than completely knocked down and semi knocked down form with CIF value exceeding USD 40,000 | Nil | 40% |

| 8 | 8704 | Motor vehicles for transport of goods | Nil | 20% |

| 9 | 8711 | Used motorcycles and cycles fitted withan auxiliary motor with or without sidecar | Nil | 40% |

| 10 | 8903 | Yachts and other vessels for pleasure ofSports | Nil | 7.5% |

| 11 | 9401 | Seats (other than those of headings 9402), whether or not convertible into beds, and parts thereof | Nil | 5% |

| 12 | 9503 00 91 | Parts of Electronic toys | Nil | 20% |

| 13 | 9503 00 91 | Parts of electronic toys for manufacture of electronic toys (S. No. 591 of notification No. 50/2017-Customs dated 30.06.2017) | Nil | 7.5% |

F. Exemption from levy of Social Welfare Surcharge (effective 02 February 2025)

| Sr No | HSN Code | Description of goods |

| 1 | 3406 | Candles, Tapers and the like |

| 2 | 8541 | Solar cells |

| 3 | 8903 | Yachts and other vessels for pleasure of sports |

| 4 | 9401 | Seats (other than those of headings 9402), whether or not convertible into beds, and parts thereof |

| 5 | 9503 00 91 | Parts of electronic toys |

| 6 | 9804 | All dutiable goods imported for personal use and not exempted under any prohibition in respect of imports thereof under theForeign Trade (Development and Regulations) (FTDR) Act, 1992 |

| 7 | 8541 | Solar Module and Other semiconductor devices and photovoltaic Cells |

| 8 | 8702 | Motor vehicles for transport of 10 or more persons |

| 9 | 8704 | Motor vehicles for transport of goods |

| 10 | 8703 | Motor cars and other motor vehicles principally designed for the transport of persons |

| 11 | 8703 | Motor cars and other motor vehicles which have been registered abroad before import into India i.e. used vehicles |

| 12 | 9803 | Dutiable articles imported by passenger or member of crew in his baggage classified under heading 9803 |

G. Changes to end date for certain exemptions under Notification No. 50/2017-Cus

| Sr. No. | Sr No in Notification No 50/2017-Cus | Description of goods | Extended up to |

| 1 | 345B | Seeds for use in manufacturing of rough Lab-Grown Diamonds | 31 March 2026 |

| 2 | 405 | Parts of wind operated electricity generators, for the manufacture or the maintenance of wind operated electricity generators | |

| 3 | 406 | Permanent magnets for manufacture of PM synchronous generators above 500KW for use in wind operated electricity generators | |

| 4 | 81A | Crude Glycerin for use in manufacture of Epichlorohydrin | 31 March 2027 |

| 5 | 104B | Denatured ethyl alcohol for use in manufacture of industrial chemicals | |

| 6 | 104C | Fish meal for use in manufacture of aquatic feed | |

| 7 | 168, 341, 341A | Goods for the manufacture of telecommunication grade optical fibres or optical fibre cables | |

| 8 | 460, 460A, 460B, 460C, 460D | Textile machinery (with addition of two new machinery) | |

| 9 | 460E | Parts and components for use in manufacturing of textile machineries | |

| 10 | 515B | Goods for use in the manufacture of open cell of LCD and LED TV panel | |

| 11 | 166 | Bulk drugs for manufacture of drugs or medicines. A separate entry is being created for drugs, medicines and diagnostic kits specified in List 3 | 31 March 2029 |

| 12 | 166A | Bulk drugs used in the manufacture of polio vaccine and mono-component insulins | |

| 13 | 167 | Bulk drugs used in the manufacture of life saving drugs or medicines. A separate entry is being created for drugs, medicines and diagnostic kits specified in List 4 | |

| 14 | 167A/ 607B | Drugs, Medicines or Food for Special Medical Purposes (FSMP) used for treatment of rare disease | |

| 15 | 532A | Good specified in List 36 imported by testing agencies specified in List 37, for the purpose of testing and/ or certification | |

| 16 | 555A | Ships and vessel for breaking up | 31 March 2035 |

| 17 | 559 | Raw materials, components, consumables or parts, for use in the manufacture of ships/vessels | |

| 18 | 489AA | Heat Coil for use in the manufacture of Electric Kitchen Chimneys falling under tariff item84146000 | To lapse effective 01 April 2025 |

The information contained in this document is not legal advice or legal opinion. The contents recorded in the said document are for informational purposes only and should not be used for commercial purposes. Acuity Law LLP disclaims all liability to any person for any loss or damage caused by errors or omissions, whether arising from negligence, accident, or any other cause.

[1] A Business Trust would garner income through investments in various real estate or infrastructure projects through the medium of SPVs

[2] Foreign Portfolio Investors

[3] Alternative Investment Funds

[4] INR 20 million (c. USD 235,000)

[5] ‘Business Connection’ defines the requisite level of nexus to support taxation of income at source i.e. in India. This principle attempts to charge to income tax any income derived by virtue of the activities carried on by a person in India and based on the nature of the presence.