Corporate Yearly Rewind 2024

The year 2024 witnessed high-stakes mergers and acquisitions, sector-shaping regulatory developments and precedent-setting judgments, which have left an indelible mark on how businesses will operate and strategize in India, going forward.

At Acuity Law, we’ve curated a comprehensive roundup of the most significant M&A deals, corporate transactions, and landmark case laws that defined 2024. This annual rewind aims to provide business leaders, investors, and legal professionals with a sharp lens on the developments that shaped the market and will likely influence decisions in the years ahead. You can also download a PDF via this button –

Let’s take a closer look at the corporate milestones that mattered.

KEY M&A DEALS IN INDIA IN 2024

AIR INDIA-VISTARA MERGER: RESHAPING INDIA’S AVIATION LANDSCAPE

INTRODUCTION

On 11 November 2024, Vistara officially ceased its independent operations as its final flight took to the skies. This marked the brand’s formal integration into Air India Limited (“Air India”), signalling the end of an era and resulting in the rise of another in India’s aviation industry. The integration of Vistara with Air India was executed through a composite scheme of arrangement amongst Talace (defined hereinafter), Tata SIA (defined hereinafter) and Air India by the Chandigarh Bench of the National Company Law Tribunal.

This integration was a hybrid transaction involving equity and cash components and marks a significant milestone in the Indian aviation sector.1

To fully understand the significance of this merger, one would have to discern the foundational vision that was laid down by J.R.D. Tata in 1932 with the creation of Tata Airlines (renamed as Air India) symbolized a pioneering step in Indian aviation. Air India’s nationalization in 1953 and eventual return to the Tata Group in 2022 marked a momentous “homecoming” for the airline pursuant to the settlement with the Government of India of a total debt of INR 615.62 billion as of 31 August 2021, with the Government of India. After Air India’s acquisition, Tata Group began discussions on consolidating other airlines including Vistara and AirAsia India (which was then a joint venture between Tata Group and AirAsia Berhad). In November 2022, Tata Group completely acquired AirAsia Berhad’s stake in AirAsia India and subsequently rebranded it as AIX Connect. On 01 October 2024, Air India announced the completion of the operational integration and legal merger of Air India Express Ltd and AIX Connect Pvt Ltd (formerly AirAsia India), forming a single, largest low-cost carrier under the Air India Group. The formation of the merged entity, now operates under the ‘Air India Express’ name and a unified airline code IX.2

BACKGROUND OF THE PARTIES

- Acquisition of Air India

When the Government of India announced the privatisation of Air India, the Tata Group swiftly stepped forward, driven by a mission to reclaim the airline that J.R.D. Tata had originally founded. To facilitate the acquisition, Tata Sons Private Limited (“TSPL”) established a special-purpose vehicle, Talace Private Limited (“Talace”). This entity was specifically created to participate in and win the bid for Air India.

Following a successful bid, Talace acquired Air India, gaining ~100% of its equity ownership, which also included the acquisition of (i) 100% stake in Air India Express Limited (“AIXL”); and (ii) 50% stake in Air India SATS Airport Services Pvt. Ltd. (“AISATS”) with Talace functioning solely as a holding entity, enabling streamlined ownership and management of Air India’s assets and subsidiaries.

- Vistara

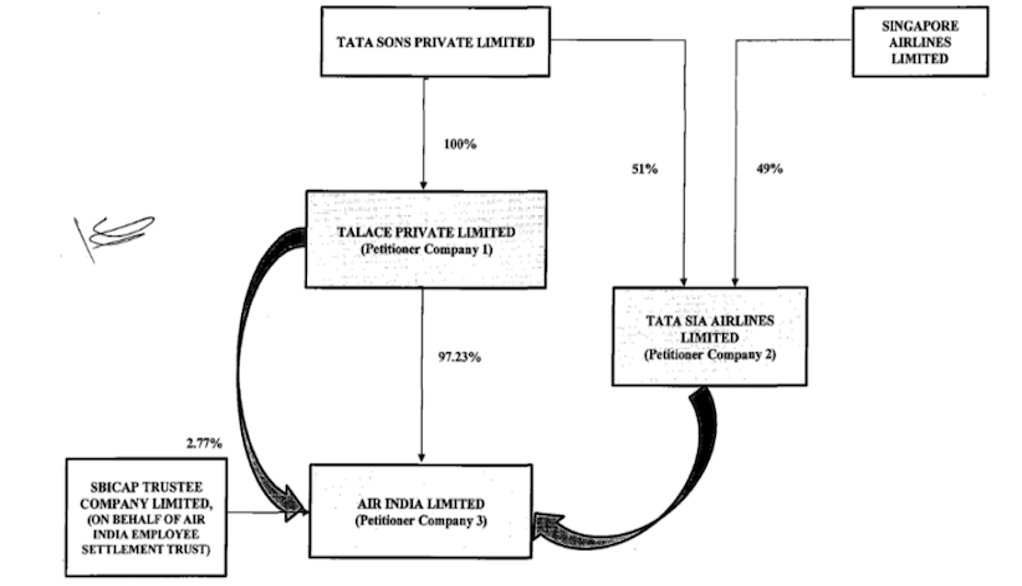

Vistara was a premium airline operated by the entity Tata SIA Airlines Limited (“Tata SIA”), a joint venture incorporated between TSPL and SIA, wherein, TSPL held 51% and SIA held the remaining 49% stake (please refer to the below mentioned pre-integration structure). Since its inception, Vistara was recognized for its strong brand positioning, high service standards, and its contribution in enhancing India’s premium domestic and international travel segment.

- Singapore Airlines Limited (“SIA”)

SIA (the parent company of the Singapore Airlines Group) is a publicly listed entity in Singapore, which is globally recognised for its passenger and cargo air transportation services.

STRUCTURE OF THE DEAL

The diagrammatical structure of the deal before the integration:-

Image credits3

The integration of Air-India and Vistara involved a four -step process as follows:

| Steps | Description |

| Capital restructuring of Air India | Air India’s share capital was restructured by reducing its equity share value from INR 10 to INR 4 per share. |

| Merger of Talace into Air India | Talace (a wholly owned subsidiary of TSPL and the holding company of Air India) was merged into Air India, eliminating Talace as a separate legal entity and making Air India, the surviving company. |

| Merger of Vistara into Air India | Vistara (operated by SIA) merged into Air India as follows: Certain fully paid-up equity shares of Air India, having a face value INR 4 each were issued for every 1 equity share and 1 preference share of Vistara, having a face value INR 10 each, to TSPL for its holdings in Vistara; and Certain equity shares were issued to SIA in a swap ratio of 2.5487 shares of Air India for every 1 share of Vistara held by SIA. |

| Preferential Allotment to SIA | Air India additionally issued certain number of fully paid-up equity shares to SIA at INR 5.56 per share, raising a total of INR 20.58 billion, whereby SIA held 25.1% of the total issued and paid-up equity share capital of Air India. |

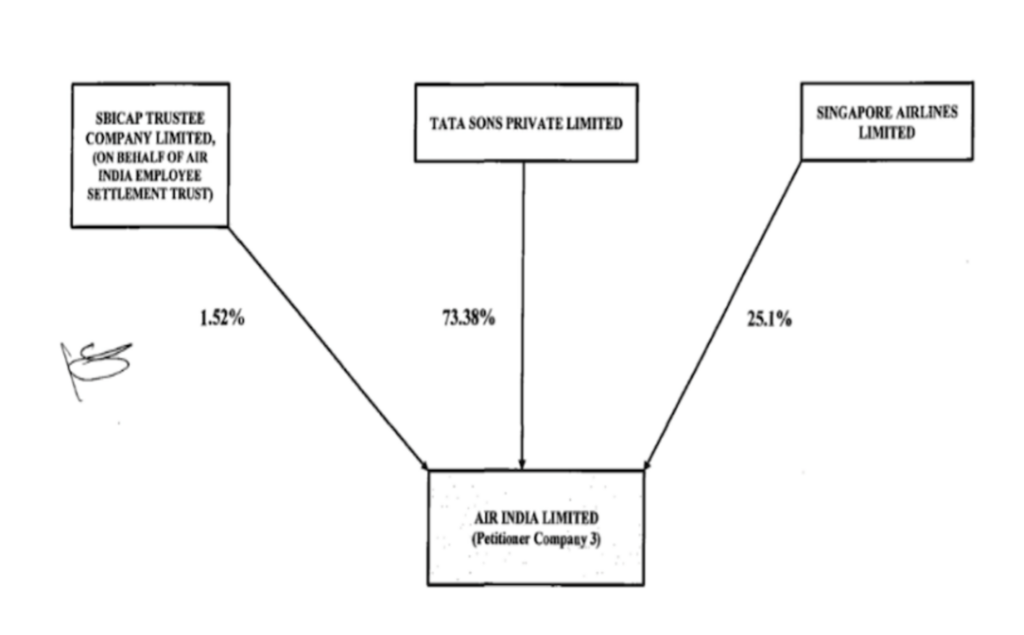

The diagrammatical structure of the deal after the integration:

Image credits4

KEY LEGAL ASPECTS

The Air India & Vistara integration is a great example to ascertain how a merger procedure is governed in India, the legal implications entailed thereof. A broad outline that has to be adhered to for effecting a merger is encapsulated below:

- The procedure for a merger begins with a thorough review of memorandum of association of the companies involved to ensure that it contains the provisions for merger, if not, then the same has to be amended. The first board meeting is then held to approve the merger ‘in-principle’, appoint professionals for National Company Law Tribunal (“NCLT”) representation, and designate a valuer to obtain a valuation report and determine the share exchange ratio.

- A petition is then filed with NCLT to seek approval for convening necessary meeting(s). Upon such application the NCLT shall give orders in relation to the following: (1) calling of meetings with the members, creditors or classes of the same to whom the notice shall be sent, (2) fix the day, date, time and venue of the meeting, (3) elect chairperson of the meeting and, (4) mode of voting in these meetings. After receiving the order, compliance with the given directions is required by the company, followed by the submission of an affidavit by the chairperson to the NCLT confirming that all instructions have been fulfilled.

- After complying with these directions, a meeting of members is held to approve the scheme of amalgamation and valuation report, and grant authority to the directors to proceed. The chairperson shall give the report of this meeting to NCLT. A 2nd petition is then filed for approval of the compromise/ arrangement scheme to NCLT. The NCLT sets a hearing date, which is (i) published in newspapers in which advertisement was made and; (ii) communicated to regulators who have raised objections.

- NCLT, after being satisfied that the procedure for compromise/ arrangements has been complied with, then it may order in favour of the compromise/ arrangements or may pass an order in accordance with Section 232(3) Companies Act, 2013 (“CA, 2013”).

- The final order must then be filed with the relevant Registrar of Companies (“RoC”).

Implementation: The final stage involved transferring assets, liabilities, and business operations to the merged entity. In the instant case, Vistara integrated into Air India, forming a single consolidated airline under the Tata Group.

Foreign Direct Investment

As per the FDI provisions applicable to the civil aviation sector in India, in case a foreign airline invests in the share capital of Indian companies, operating scheduled and non-scheduled air transport services, it is required to follow the government approval route. Accordingly, SIA received government approval for its foreign direct investment (“FDI”)5 in Air India. We note that SIA’s post-merger shareholding in Air India is limited to 25.1%.

Further, the FDI provisions specifically provide for the following restrictions with respect to foreign investment in Air India:

- Foreign investment in such civil aviation services cannot exceed 49% (directly or indirectly), except for Non-Resident Indians, where up to 100% investment is allowed under the automatic route; and

- Substantial ownership and effective control of Air India must remain with Indian nationals.

Additionally, foreign nationals likely to be associated with the Indian air transport services due to a foreign Investment must obtain security clearance before deployment. Subsequently, any technical equipment imported as a result of these investments must also receive clearance from the Ministry of Civil Aviation.

Competition Challenges

The Air India-Vistara merger raised significant competition concerns, particularly regarding its potential to cause Appreciable Adverse Effects on Competition (“AAEC”) in India’s aviation sector. The Competition Commission of India (“CCI”) identified that the merger would consolidate two major players, creating a “near monopoly” on flights between India and Singapore, reducing competition, and leading to higher fares, limited consumer choice, and potential anti-competitive practices such as collusive pricing, market allocation, and unilateral price hikes. The elimination of Vistara as an independent competitor was a primary concern, as it would reduce the number of available flights on certain routes, affecting pricing dynamics. Additionally, barriers to entry, including high capital requirements and regulatory complexities, would limit the emergence of new competitors, making it easier for the merged entity to exert market power alongside Indigo, the only other major airline in India.

To address these concerns, TSPL and SIA proposed voluntary commitments, including maintaining minimum flight capacities on specific domestic and international routes to ensure availability and competition. They also committed to appointing an independent auditor to monitor compliance, ensuring the merger does not lead to a significant reduction in service levels. Moreover, in Singapore, the Competition and Consumer Commission of Singapore (“CCCS”) approved the merger with conditions, requiring the merged entity to maintain pre-COVID-19 capacity levels on key routes such as Singapore-Mumbai and Singapore-Delhi, with regular compliance reporting.

However, doubts remain regarding the practical feasibility of these commitments, especially given the volatile nature of the aviation industry, which makes maintaining fixed capacity levels challenging. Furthermore, while these commitments aim to prevent AAEC, the CCI had clarified in its order that “its ex-ante approval does not provide any immunity to the parties qua their ex-post conduct that may contravene the provisions of the Act” 6 and warned that non-compliance could lead to competition proceedings as the same would be deemed to have caused AAEC on competition in India.

Other Approvals

In the case of a change in ownership or management, fresh security clearances are required, which must be obtained from the Bureau of Civil Aviation Security. Moreover, any change in ownership must be reported to the Directorate General of Civil Aviation (“DGCA”), and until the DGCA grants approval or issues a new Aircraft Registration, it is unlawful to operate or assist in the operation of the aircraft without written permission from the DGCA.

Taxation Aspects

- Capital reduction by way of reducing face value: Section 2(22)(d) of the Income Tax Act, 1961 (“ITA”) provides for taxation of dividend income which includes “any distribution to its shareholders by a company on the reduction of its capital” to be deemed as dividend income and thereby attracting dividend taxation. It is also imperative to point out that w.e.f. 01 April 2020, Dividend Distribution Tax was abolished for companies, and dividends are now taxable under the head ‘Income from Other Sources’ in the hands of shareholders. The applicable tax rate depends on the shareholder’s category i.e., individual, domestic company, foreign company, etc.

In this context, Section 66 of the CA, 2013 governs the procedure for the reduction of share capital. This provision allows a company to reduce its share capital by either cancelling paid-up capital that is lost or not represented by assets, or by paying off excess paid-up capital that exceeds the company’s requirements.

The taxation of dividend income would apply only if the excess paid-up capital has been paid out. However, there are limited resources available to definitively assess whether this situation applies in the current case, making it uncertain whether the aforesaid tax implications would be applicable here. Prima facie, based on review of publicly available information, it appears to be a case of cancellation of paid-up share capital not represented by assets. Accordingly, there may be no dividend tax implications as there is potentially no paying-off of excess capital involved qua shareholders.

- During preferential allotment of shares: There was no tax incidence on Air India and SIA because issuance of shares was by way of a preferential allotment at the fair market value.

TRANSFORMING ASSETS: FLEET INTEGRATION, LIVERY UPDATES, AND REGISTRATION CHANGES POST-MERGER7

After merging with Vistara, Air India Group now operates a fleet of 300 aircraft. This includes the full integration of Vistara’s 70 aircraft8, including leased ones, into Air India’s operations. The group now has over 30,000 employees and aims to improve operations and customer service through this integration.

More than 6,000 Vistara employees have been inducted into the new organization structure. Over 140 IT systems have been aligned, 4,000 vendor contracts consolidated, and 270,000 customer bookings migrated. Additionally, 4.5 million Club Vistara frequent flyer accounts have been moved to Air India’s Maharaja Club program.

Following the integration, the airline operates under two service categories. Air India, as a full-service carrier, now has a fleet of 208 aircraft operating 5,600 weekly flights, covering more than 90 domestic and international destinations. Air India Express, the low-cost arm, has 90 aircraft operating 2,700 weekly flights, focusing on 45 domestic and international routes. This restructuring helps streamline operations, optimize routes, and improve overall passenger experience.

From November 12, 2024, Vistara’s renowned service standards will remain integral to the new Air India experience. Customers can identify Vistara-operated aircraft through a special four-digit Air India code beginning with “2” For instance, Vistara’s UK 955 is now AI 29559. However, full rebranding, including changes to aircraft livery and seat branding, is a gradual process. Initially, Vistara’s seat colors and branding will remain to ensure a seamless experience for customers. The priority is to refurbish Air India’s fleet by mid-2025, after which modifications to Vistara’s aircraft will be implemented in phases. This approach minimizes disruption and ensures continuity in service quality.

As part of the integration, Vistara’s existing codeshare agreements were discontinued. Instead, passengers now have access to Air India’s expanded network, which includes 24 Star Alliance partners and over 75 global codeshare and interline partners. While this change may require some adjustments for former Vistara passengers, the broader network is designed to offer better international connectivity and a more seamless travel experience.

With these changes, the Air India-Vistara merger marks a significant step in strengthening the airline’s operations, expanding its global reach, and enhancing customer service across all travel segments.

OUR THOUGHTS

The merger of Air India and Vistara marked a pivotal moment in Indian aviation, uniting the strengths of both carriers under the Tata Group’s vision for a world-class airline. This strategic integration combined Air India’s extensive global network, Vistara’s premium brand image, and Singapore Airlines’ expertise to drive operational excellence, enhance customer experience, and ensure sustainable growth.

However, maintaining Vistara’s high service standards within Air India’s broader operations poses a significant challenge. Ensuring consistency in product quality, cabin experience, and customer service would require seamless integration of operational processes, training, and cultural alignment. Balancing Air India’s legacy systems with Vistara’s premium offerings will test the group’s ability to uphold excellence while scaling operations.

Beyond operational challenges, the merger also raised significant competition concerns. The Competition Commission of India highlighted potential risks of reduced consumer choice, fare increases, and anti-competitive practices, particularly on international routes like India-Singapore, where the merged entity could create a near-monopoly. To mitigate these risks, Tata Sons and Singapore Airlines committed to maintaining minimum flight capacities on key routes and appointing an independent auditor to monitor compliance. Similarly, Singapore’s competition authority-imposed conditions to ensure competitive market dynamics.

Despite these commitments, concerns remained over their long-term feasibility, given the volatile nature of the aviation industry. Regulatory scrutiny continued post-merger, with authorities reserving the right to intervene if anti-competitive behaviour emerged. Ultimately, while the merger presented a transformative opportunity, its success depended on the Tata Group’s ability to navigate operational challenges, sustain Vistara’s premium standards, and adhere to regulatory commitments, ensuring that the integration benefited both the airline industry and Indian consumers.

ZOMATO’S STRATEGIC MOVE: ACQUIRING PAYTM INSIDER & TICKETNEW TO DOMINATE TICKETING BUSINESS

INTRODUCTION

Zomato Limited (“Zomato”), founded in 2008, is a prominent food technology company that is spread across more than 800 cities in India, the Middle East and Southeast Asia.

One97 Communications Limited, which launched Paytm (“Paytm”), on the other hand, is a leading digital payments and financial services company offering a wide range of services, including mobile payments and e-commerce. Paytm Insider and TicketNew, the online entertainment ticket booking platforms of Paytm, offer a wide range of online ticket booking services for movies, live events, etc. Since Paytm desired to focus more on its core business of financial services, it was resolved that its business of entertainment ticketing would be divested.

Furthering Zomato’s growth strategy of targeted acquisitions, it acquired Paytm Insider and TicketNew for INR 20.48 billion, thereby expanding its portfolio beyond the food delivery vertical. Many analysts have, however, questioned whether the deal size was overvalued with the valuation being overpriced by 60%.10 This acquisition by Zomato garnered a lot of attention particularly after its acquisition of the Indian quick- commerce service provider, Blinkit in 2022. It signals Zomato’s entry into the entertainment ticketing sector and diversifies Zomato’s business model to a wider unified “Going-Out” platform to include dining, entertainment, and leisure activities under its ambit.

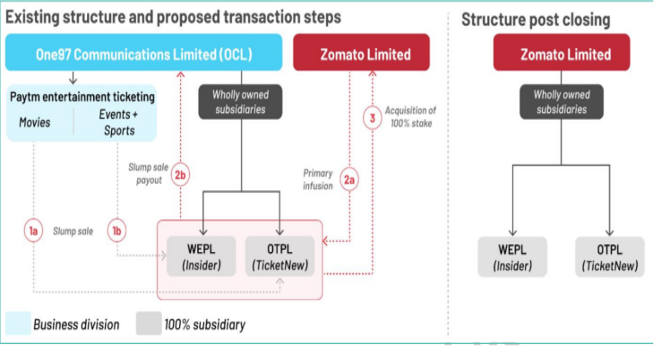

STRUCTURE OF THE DEAL

The deal was approved by Paytm’s Board on 21 August 2024.11 As part of the transaction, Paytm transferred its events business i.e. Paytm Insider to Wasteland Entertainment Private Limited (“WEPL”) and its movie ticketing business i.e. TicketNew to Orbgen Technologies Private Limited (“OTPL”), both of which are wholly owned subsidiaries of Paytm, by way of a Slump Sale. Zomato thereafter acquired a 100% stake in these Paytm subsidiaries through a Share Purchase and Share Subscription Agreement executed with One97 Communications Limited, WEPL and OTPL for an aggregate of INR 20.48 billion (INR 12.64 billion for OTPL and INR 7.83 billion for WEPL), making them wholly owned subsidiaries of Zomato. This infusion by Zomato was utilized by WEPL and OTPL for the Slump Sale payout to Paytm.

A diagrammatical representation of the deal structure is given below12:

The transaction also included a Transitional Services Agreement between Paytm and Zomato wherein the ticketing business would continue to be operated by Paytm for a period of up to 12 months. Pursuant to the 12 months period elapsing, the acquired entertainment ticketing business of Paytm Insider and TicketNew, along with the existing application of Zomato, has now been moved to a new application namely, ‘District’. Moreover, as a part of the transaction, approximately 280 existing employees of Paytm have been transferred to Zomato.13

KEY LEGAL ASPECTS

Competition Law Challenges

The Competition (Amendment) Act, 2023 introduced the concept of ‘deal value threshold’ that requires prior notification to the CCI where the ‘value of the transaction’ exceeds INR 20 billion and where the target entity has ‘substantial business operations’ in India. However, since this amendment is not retrospective and is applicable for transactions consummated after 10 September 2024, the current deal was not required to be notified to CCI, although the deal size was INR 20.48 billion.

Further, the Competition Act, 2002 prohibits acquisitions that have an adverse effect on competition in India. However, since Zomato, Paytm Insider and TicketNew operate in separate and exclusive fields, the deal does not fall under the ambit of having an “adverse effect on competition”.

Taxation Aspects

The sale of Paytm Insider to WEPL and OTPL was completed through a Slump Sale wherein the entire undertaking was transferred as a “going concern” for a lump sum consideration without values being assigned to individual assets and liabilities. In this regard, it is pertinent to note that capital gains arising out of transfer of an undertaking is treated as a long-term or short-term capital gain, depending on whether the undertaking is ‘owned and held’ for less or more than 36 (thirty-six) months. In this case, since Paytm Insider and TicketNew were owned and held by Paytm for more than 36 (thirty-six) months, the profits or gains, arising from the slump sale would be deemed to be treated as long term capital gains from the transfer of its assets.

It is also noteworthy that Slump Sales are exempt from the applicability of Goods and Services Tax (GST) and deduction of Tax deduction at source (TDS) under the ITA as slump sale transactions do not involve sale of any specific individual assets and only an agreed upon lump sum consideration is payable to the Seller for all assets and liabilities.

Securities Exchange Board of India

Both Zomato and Paytm being listed entities, were required to make disclosures with respect to the acquisition to the stock exchanges within the prescribed timelines and disclose the same on its website as required under the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 (‘LODR Regulations” or “LODR”).

Having regard to the said requirements under LODR Regulations, Zomato and Paytm have made regular disclosures to the stock exchanges regarding approval received for the acquisition from their board of directors on 21 August 2024, the binding agreements entered by them in relation to the proposed transaction, transcript of teleconference with the investors, and the media releases in relation to the same. These disclosures are further displayed on the websites of Zomato and Paytm.

OUR THOUGHTS

Zomato’s acquisition of Paytm Insider could potentially change India’s approach towards the entertainment and ticketing industry. The acquisition has come at a time where the Indian market is experiencing a surge in demand for live events and entertainment. However, the coming years will significantly determine the profitability of Zomato’s diversification strategy and whether their ticketing vertical can grow alongside their core operations of food and dining.

A lot will also depend on Zomato’s execution strategy and investment appetite as it looks to take on Reliance-backed BookMyShow in the live events and movie ticketing space. BookMyShow, a cash-rich company with nearly 20 years of experience has notably, also been in the news for a potential $300 Mn infusion by KKR14, a leading global investment firm.

INDIA’S MEGA ENTERTAINMENT MERGER: RELIANCE AND DISNEY

INTRODUCTION

The media and entertainment industry are undergoing a transformative shift with strategic mergers driving digital and technological innovation. A prime example is the merger of Viacom 18 Media Private Limited (“Viacom 18” or the “Transferor”), a subsidiary of Reliance Industries Limited (“RIL”) with Star India Private Limited (“SIPL” or the “Resultant Company”), a subsidiary of The Walt Disney Company (“Disney”), through Digital18 Media Limited (“Viacom18 WOS” of the “Transferee”) a wholly owned subsidiary of Viacom 18. After completion of proposed structure of the deal SIPL is a joint venture between Viacom 18, RIL and Disney (hereinafter referred as “Merger”). The said merger is being touted as the biggest entertainment merger India has ever seen.

BACKGROUND OF THE PARTIES

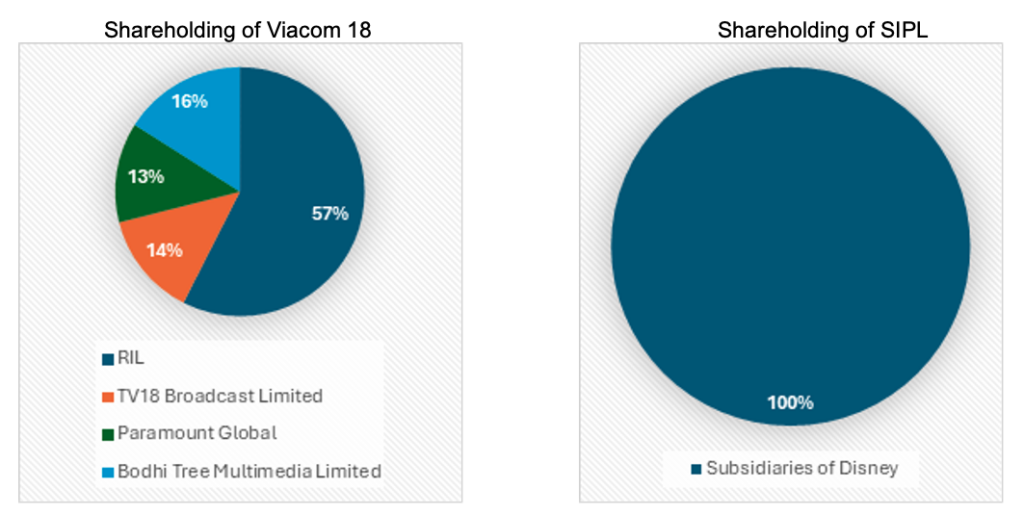

Shareholding prior to the Merger 15

- Based upon the aforementioned shareholding structure, it can be noted that RIL has a significant shareholding in Viacom 18. In addition to the 57% held by RIL, it also holds indirect shareholding of 14% through TV18 Broadcast Limited.

- As mentioned above Transferee is a wholly owned subsidiary of Viacom 18.

STRUCTURE OF THE DEAL16

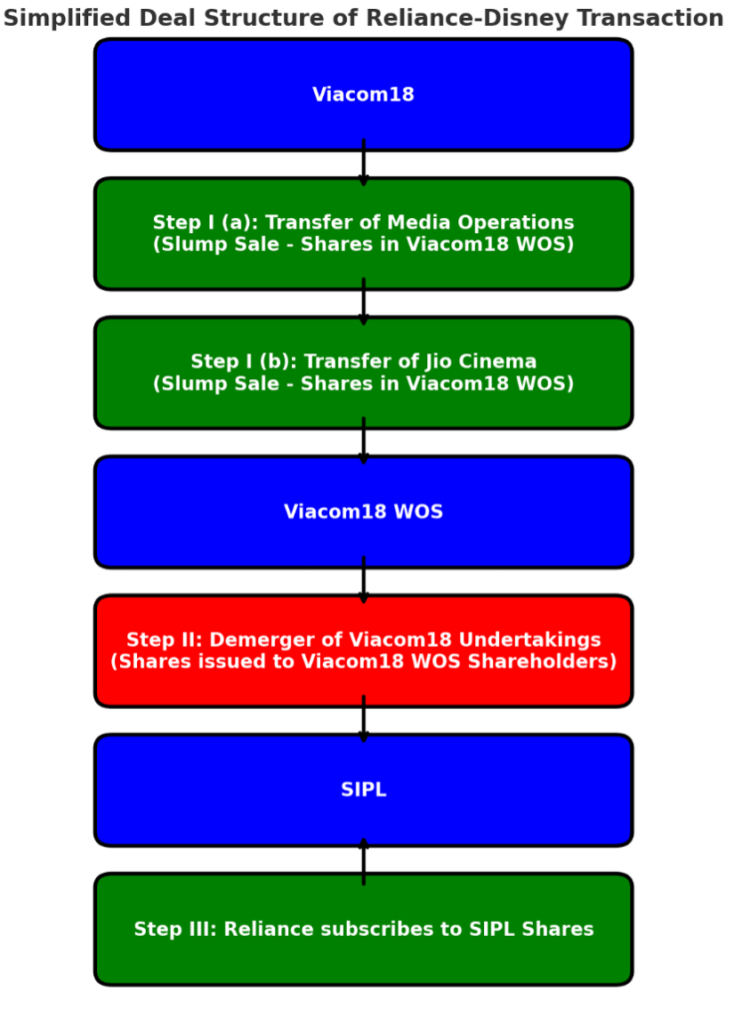

The composite scheme of arrangement inter alia provides for the following steps, involved in the deal:

- Transfer and vesting of two of undertakings viz (i) media operations and (ii) Jio Cinema (“Viacom 18 Undertakings”) from Viacom 18/ Transferor to I wholly-owned subsidiary, Viacom18 WOS/ Transferee on a Slump Sale basis; and

- Demerger, transfer and vesting of Viacom 18 Undertakings from Viacom18 WOS to Star India Private Limited (“Star India”) on a going concern basis. Upon such demerger the shareholders of Viacom18 WOS (i.e., Viacom 18) had received shares of SIPL.

- Pursuant thereto, it has been acknowledged in the scheme that SIPL and RIL had executed a share subscription agreement, wherein RIL has subscribed to the shares of SIPL.

The commercial rationale (as per the scheme) for structuring this Merger in the aforementioned manner is that this deal structure aims at enhancing operational efficiencies and facilitating future growth, diversification, and strategic investments in key business areas such as sports, general entertainment, and digital content streaming. Viacom18 remained the holding company of RIL’s media operations, with the Viacom18 Undertaking being transferred to Viacom18 WOS.

SIPL, an indirect subsidiary of Disney, was interested in participating in the V18 Undertaking. Both Viacom18 WOS and SIPL operated in similar markets, including broadcasting television channels and OTT platforms, which were already competitive. The Merger involved integrating the V18 Undertaking with SIPL’s business, resulting in synergies that reduced costs and created value for shareholders.

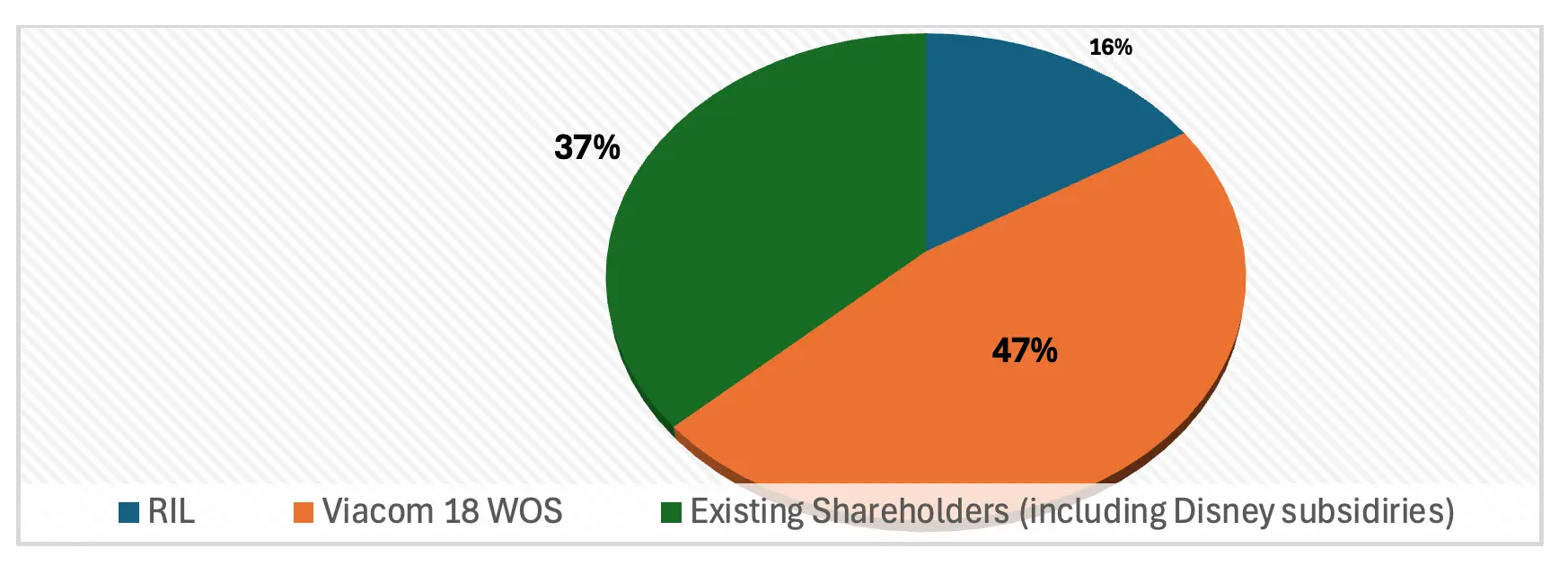

SHAREHOLDING OF SIPL POST MERGER

KEY LEGAL ASPECTS

Approval from Stock Exchanges

As RIL, a listed entity was involved in the Merger, all compliances required as per the LODR, were made whereby the draft scheme of arrangement was filed with the stock exchanges and a no- objection letter was obtained before filing it before the tribunal. Additionally, all disclosures regarding deal structure, transaction documents, financial implications, strategic rationale, and expected timelines were made to the stock exchanges as per LODR.

Competition Challenges

As per the Competition Act, 2002, any merger or acquisition that exceeds the asset or turnover threshold of INR 4,500,000,000 (Indian Rupees Four Billion Five Hundred Thousand) and INR 12,500,000,000 (Indian Rupees Twelve Billion and Five Hundred Thousand), respectively, must be notified to the CCI.17This notification ensures that the transaction does not adversely affect market practices, balance, or competition. As the Merger crossed these thresholds, it was duly notified to the CCI, which was subsequently approved by the CCI with certain modifications.18

The Merger raised several competition law concerns that the CCI carefully analyzed. One of the key issues was competition in sports broadcasting. Both RIL and SIPL hold significant broadcasting rights for major live cricketing events—SIPL has rights for the International Cricket Championship until 2027, while RIL holds the Indian Premier League rights until 2028. The CCI examined whether this could negatively impact competition in the sports broadcasting market. In response, the merging entities argued that the expiration of these rights would create future opportunities for other competitors, preventing a permanent monopoly over cricket broadcasting. Additionally, they offered voluntary commitments, including (i) not increasing the prices of their platforms due to the aggregation of broadcasting rights, (ii) not unreasonably increasing advertisement rates, and (iii) not bundling incremental sports rights.

Another major concern was the impact on the TV channels market. The Resultant Entity would hold a significant market share in various narrow segments (TV channels categorized by genre) and sub-segments (TV channels categorized by language). This market dominance could give the Resultant Entity the ability to increase prices for consumers, advertisers, and other stakeholders in the value chain. To address this concern, the merging entities voluntarily committed to divesting certain TV channels and assigning rights to another entity.

In light of these voluntary modifications and commitments, the CCI approved the Merger, ensuring that no appreciable adverse effect on competition would arise in the relevant market.

NCLT Approval

Under Sections 230 to 232 of the CA, 2013, any scheme of arrangement—whether a merger, demerger, or amalgamation—requires the prior approval from the National Company Law Tribunal (“NCLT”). The Merger involved a series of matters submitted for NCLT’s approval, including the demerger of Viacom18’s media undertaking and Jio Cinema, followed by their transfer to SIPL. The scheme was sanctioned by NCLT Mumbai.19

Approval from the Ministry of Information and Broadcasting of India (“MIB”)

As per paragraph 32 of the MIB Guidelines, the approval of MIB is required to transfer TV channels from Digital18 to SIPL. MIB has approved transfer of non-news and current affair channels from Viacom 18 to SIPL.20

Tax Considerations

The tax consideration for the Deal will be different for each step of the deal structure:

- Slump sale of Viacom18 Undertakings to Viacom18 WOS:

The transfer of the Viacom18 Undertakings from Viacom18 to Viacom18 WOS qualifies as a slump sale under the ITA. Now this sale would be exempted from any taxation considering the wholly owned subsidiary relationship under the provisions of Section 47(iv) (Exemption from capital gains tax in case of any transfer of a capital asset by a company to its subsidiary company) subject to satisfaction of prescribed conditions under Section 47A (Withdrawal of exemption in certain cases) of the ITA.

- Demerger of Viacom 18’s Undertaking from Digital 18 then transfer to SIPL:

Additionally, the demerger of Viacom 18 undertakings from Viacom18 WOS then transfer of these undertakings to SIPL shall be considered as demerger under Section 2(19AA) of the ITA. Further, the consideration upon demerger that Viacom18 (as sole shareholder of Viacom18 WOS) would receive in the form of shares in SIPL would be exempt from tax under Section 47(vid) of the ITA.

We observe that the aforesaid two step hiving off achieves an objective of making Viacom 18 the sole shareholder in the Resulting Company i.e., SIPL. It is to be noted, had the carve out of business happened directly from Viacom 18 to SIPL in a form of tax neutral demerger, the same would have resulted in multiple shareholders of Viacom 18 (demerged company) becoming shareholders in Resulting Company. This may have possibly distorted the shareholding of SIPL.

THE DISNEY-RELIANCE MERGER: RATIONALE, SYNERGY, AND TRANSFORMATION OF INDIA’S ENTERTAINMENT LANDSCAPE

The Disney-Reliance merger represents a strategic shift for Disney in India, addressing its financial challenges and enabling a stronger foothold in the entertainment landscape. With the high costs of sports streaming rights and the loss of IPL digital rights, Disney faced declining subscribers and mounting financial strain. By joining forces with Reliance, Disney reduces its exposure, shares risks, and shifts focus from linear TV to digital—a critical move as India’s advertising market increasingly pivots to online platforms. Globally, this helps Disney save resources and recover financially while staying in the market.

For Reliance, the merger serves advantages through the creation of a powerful joint venture. The integration of Disney’s extensive 30,000+ content assets with Viacom18’s channels like Colors and Star India’s network ensures a robust content library catering to diverse audiences. Exclusive rights to distribute Disney content in India further elevate its premium appeal, while the combined resources position the joint venture as a dominant force across TV and streaming platforms.

The merger’s impact on India’s entertainment industry is transformative. The combined entity will dominate the sports broadcasting market, controlling 75-80% of major sports tournaments, driving up ad rates. With 120 TV channels and two leading streaming platforms, it gains significant leverage over advertising pricing and subscription fees, potentially raising costs for advertisers and consumers. Smaller broadcasters like Zee and Sony may struggle to compete, while OTT platforms like Netflix and Amazon Prime face intensified competition, compelling them to invest heavily in content. This integration reshapes the industry’s competitive dynamics, setting a new benchmark.

OUR THOUGHTS

The Merger has led to formation of a new OTT platform ‘JioHotstar’ which is set to create a significant structural shift in India’s media and entertainment industry. The Resultant Entity will emerge as the dominant media player, with a vast portfolio spanning entertainment and sports. The deal was structured to provide mutual benefits to all parties involved.

The Merger will enable the Resultant Entity to offer a comprehensive range of content, including web series, movies, sports, original programming, and a wide global catalogue.21 Disney+ Hotstar currently leads the Indian OTT market with a 24% market share, while JioCinema holds 6%. Together, the ‘JioHotstar’ will control 30% of the OTT market, surpassing the market shares of Netflix at 22% and Prime Video at 13%.22

ADANI’S ACQUISITION SPREE IN THE CEMENT SECTOR: AMBUJA CEMENTS ACQUIRES PENNA CEMENT

INTRODUCTION

In 2024, India’s cement sector has seen significant developments, including major acquisitions led by Ambuja Cements Limited (“Ambuja Cements”), a subsidiary of Adani Cements Limited (“Adani Cements”), and Aditya Birla Group-backed UltraTech Cement Limited.23 The Adani group, since its entry in the cement sector in 2022, has focused on expansion of market presence by acquiring stakes in multiple entities.24

In a defining move, Ambuja Cements acquired 100% stake in Hyderabad-based Penna Cement Industries Limited (“Penna Cements”) on 16 August 2024, at an enterprise value of INR 104.42 billion (“Enterprise Value”).25 This acquisition lay the path for expansion of the presence of Ambuja Cements in the Indian markets and specifically strengthen its position in South Indian markets. We have discussed the structure of the deal in brief below.

STRUCTURE OF THE DEAL

Penna Cements, promoted by P Pratap Reddy and family, boasted of an annual production capacity of 14 million tons with several factories in Andhra Pradesh, Telangana and Rajasthan. The acquisition by Ambuja Cements was completed through the purchase of Penna Cement’s shares from its promoter group and was financed entirely through internal accruals. According to the filings made by Ambuja Cements with the National Stock Exchange of India Limited, Bombay Stock Exchange Limited and Luxembourg Stock Exchange, the transaction includes acquisition of 14 (fourteen) million tonnes per annum (“MTPA”) cement capacity of Penna Cements.26

Out of the 14 MTPA cement capacity of Penna Cements, 10 MTPA was operational at the time of acquisition, and the remaining 4 million tons was under construction, which is expected to be added to the operational capacity within 12 months from the acquisition.27 The significance of this deal is that it boosts Adani Cement’s operational capacity to 89 MTPA.

Ambuja Cements will retain approximately INR 30 billion from the Enterprise Value as milestone payments for the completion of a 2 million tonne (“MT”) cement capacity and a 3 MT clinker facility at Penna’s Rajasthan plant.28 This would aid in the goal of Ambuja Cements to increase their cement capacity to 140 MTPA by the year 2028.29 It is noteworthy that the Enterprise Value for this acquisition was not on a debt-free basis. As part of the deal-structure, Penna Cements’ debt of ~INR 35 billion was to be fully paid by Ambuja Cements upon closing of the acquisition deal.30This move is expected to upgrade Penna Cement’s credit rating too AAA from BBB- (minus) and reduce its borrowing costs. Accordingly, Ambuja Cements closed the deal by acquiring ~99.94% stake of Penna Cements from its existing promoter group, for a consideration of ~INR 42.99 billion, pursuant to the terms of the share purchase agreement dated 01 July 2024. Ambuja Cements had also agreed to acquire the residual stake of ~0.06% from its other shareholders.

This deal is strategically significant for Adani-group controlled Ambuja Cements, since as a result of this deal, the market presence of Ambuja Cements in South India would improve by ~8-15% while pan India market share is stated to improve by ~2%. Further, Ambuja Cements will also gain entry to the Sri Lankan markets,31 along with replenishing access to the eastern and southern parts of peninsular India. Thereby, providing it competitive edge by strengthening its cost leadership and productivity due to the presence of significant sea logistics and railway siding at most plants.

KEY LEGAL CONSIDERATIONS

The acquisition of Penna Cements, a public unlisted company by Ambuja Cements, a public listed company requires specific regulatory compliances under Indian laws:

CA, 2013

Section 186(2) of the CA, 2013 imposes certain limits on loan and investment transactions with other body corporates. An Indian company as an acquirer, can acquire securities of another company through methods like subscription, purchase, or other means, subject to certain thresholds prescribed under the law. The acquisition limit is capped at either (i) 60% of the acquirer’s paid-up share capital, along with its free reserves and securities premium; or (ii) 100% of its free reserves and securities premium; whichever is higher. However, the acquirer can exceed these limits if it receives an approval from its shareholders through a special resolution in a general meeting.

For the purposes of this deal, 100% of the shares of Penna Cements were acquired by way of entering into a binding agreement. The approval for the same was provided by Board meeting held on June 13, 2024.32

Securities Exchange Board of India

Regulation 30 of the LODR requires a listed company to disclose any such events or information which, in the opinion of the board of directors of the listed company, is material. Part A of Schedule III of LODR lays down a list of events which are deemed to be material, which includes acquisitions or agreement to acquire shares or voting rights in a company. The listed entities are required to make the disclosure to the stock exchanges within the prescribed timelines and disclose the same on its website. Further developments regarding the material events referred to in Regulation 30 should be disclosed by the listed entity till the event is resolved or closed.

In compliance with the above mentioned provisions and Securities and Exchange Board of India (“SEBI”) Circular No. SEBI/HO/CFD/CFD-PoD-1/P/CIR/2023/123 dated July 13, 2023, Ambuja Cements made regular disclosures to the stock exchanges regarding approval received for the acquisition from its board on 13 June 2024, the binding agreement entered by it for acquisition of 100% shares in Penna Cements, transcript of teleconference with the investors, completion of the acquisition of shares in Penna Cements, and the media releases in relation to the same. These disclosures are further displayed on the website of Ambuja Cements.

Taxation Aspects

In the acquisition of Penna Cements by Ambuja Cements, the seller is liable to pay income tax on the gains arising from the transaction, which are classified as capital gains. Under the Indian Income-tax Act, 1961, the tax treatment depends on the residency status of the seller and the holding period of the shares: (i) Long-term capital gains (“LTCG”) tax applies if the unlisted shares have been held for more than 24 months. While calculating LTCG, the acquisition cost can be indexed for inflation; and (ii) Short-term capital gains (“STCG”) tax applies if the unlisted shares have been held for less than 24 months, and such gains are taxed at the applicable rates.

Competition Challenges

The Competition Act, 2002 regulates combinations under Section 5 and 6, and the CCI is to be notified if certain thresholds as prescribed are met in a transaction. In case of an acquisition, it constitutes a ‘combination’ if, the value of the assets of the acquirer and the enterprise being acquired, jointly, exceeds INR 25 billion, or their combined turnover exceeds INR 75 billion. If either of these thresholds are met, then CCI must be notified prior to the consummation of the acquisition. However, the ‘de-minimis’ exemption provides that if any one of the following conditions are fulfilled, such acquisition is exempted from constituting a combination under the Act: (i) either the value of assets of the enterprise being acquired is less than INR 4.5 billion; or (ii) the turnover of the enterprise being acquired is less than INR 12.5 billion.

Since the turnover of Penna Cements (enterprise being acquired) was ~INR 12.19 billion for FY 2023-24,33 its acquisition by Ambuja Cements qualifies for the ‘de-minimis’ exemption and is not considered to be a combination under the Competition Act, 2002. Therefore, there was no requirement to notify CCI.

OUR THOUGHTS

The acquisition of Penna Cements by Ambuja Cements marks a significant step in strengthening the latter’s market position and expanding its production capacity. This strategic move aligns with Ambuja’s growth and leadership objectives, enhancing its footprint in key regions and improving operational efficiencies. The deal is expected to drive synergies, bolster supply chains, and create long-term value for stakeholders, reinforcing Ambuja Cement’s position as a leading player in the Indian cement industry.

With enhancement of business potential and stakeholder value as the focus, Ambuja Cements has recently on 17 December 2024, announced the merger of Penna Cements with itself. The draft scheme has been approved by the board of Ambuja Cements and is subject to requisite approvals from relevant stakeholders and authorities.34

NOTABLE JUDGEMENTS AND ORDERS IN 2024

MINISTRY OF CORPORATE AFFAIRS’ ORDER DATED 22 MAY 2024 AGAINST LINKEDIN INDIA UNDER SECTION 90 OF COMPANIES ACT, 2013

INTRODUCTION

The CA, 2013 provides obligations regarding Significant Beneficial Owners (“SBOs“) to identify individuals who hold ultimate control or beneficial interest in a company as legal ownership does not always reveal true control. This requirement is aligned with the Financial Action Task Force’s 2012 recommendations which lay down the essential measures to be set in place by countries to combat the misuse of corporate structures for money laundering and tax evasion.

Since legal ownership of a company may not reveal true control in view of indirect control being held therein, the Companies (Amendment) Act, 2017 was introduced prescribing mandatory tracking and disclosure of beneficial ownership thereby promoting transparency, strengthens governance, and safeguards financial integrity.

BRIEF FACTS

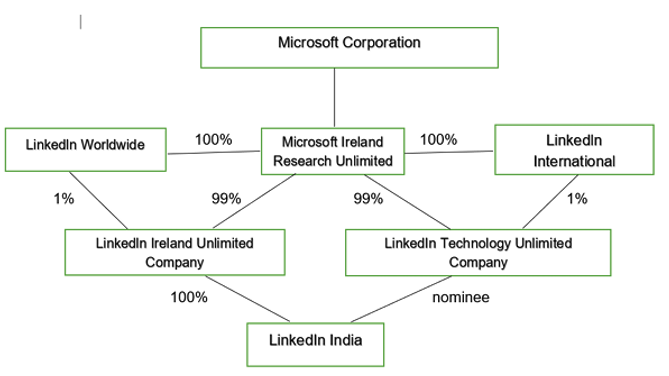

- LinkedIn India filed Form MGT-6 on 29 January 2024, incorrectly stating the creation of beneficial interest as on 11 January 2024. This conflicted with their earlier filings, particularly their financial statements for FY 2022-2023, which indicated that LinkedIn Technology Unlimited Company (“LinkedIn Technology”), a company registered in Ireland held shares as a nominee for LinkedIn Ireland Unlimited Company (“LinkedIn Ireland”).

- Since, LinkedIn India failed to declare its SBO under Section 90 of CA, 2013, a Show Cause Notice (“SCN”) was issued on 15 February 2024, to determine the compliance with Sections 89 and 90 of CA, 2013.

- LinkedIn India clarified that LinkedIn Ireland had always been the beneficial owner since 2014, a fact acknowledged by them during its amalgamation with Uzanto Consulting India Private Limited in 2014. The incorrect date was attributed to a cautious filing approach to address ambiguities in Section 89 of CA, 2013. Despite LinkedIn India’s request to withdraw Form MGT-6, the RoC held that the explanation furnished by LinkedIn India was unsatisfactory and that further clarifications were required.

- However, in its response, LinkedIn India reiterated that beneficial ownership rested with LinkedIn Ireland, while the 11 January 2024, date stemmed from procedural formalities.

- Non-Compliance with Section 89: Section 89 details the declaration to be provided in case of beneficial interest in any share. This declaration is made by the person who holds or acquires a beneficial interest in the share of a company. The RoC while analysing compliance under Section 89 concluded that since the reply of LinkedIn India admitted that LinkedIn Ireland was always the beneficial owner of the one share held by LinkedIn Technology, the duty of to make registrations arose in 2009 when the company was incorporated. The filings were to be made by the beneficial owner and registered owner in accordance with Section 187C of the Companies Act, 1956 (the applicable law at that time). The date of 11 January 2024, declared in Form MGT-4 and Form MGT-5, was acknowledged as incorrect. Further, the withdrawal of e-form was not permitted as it is a statutory requirement and the said filing does not abide by the requirements of Section 89(1) and (2) of CA, 2013.

- Non-Compliance with Section 90: Section 90 of CA, 2013 creates an obligation on companies to maintain a register of SBOs and further every company is required to take necessary steps to identify SBOs. Rule 02 of Companies (Significant Beneficial Owners) Rules read with Section 90 provides for the filing of Form BEN-02 with RoC.LinkedIn India did not file Form BEN-2, citing that Microsoft Corporation, its ultimate holding company, had diffused shareholding with no significant beneficial owner meeting the 10% threshold. LinkedIn India also failed to issue BEN-4 notices, required under SBO rules.

LinkedIn India’s claims that no SBO existed due to Microsoft’s professional board structure and wholly owned subsidiaries were deemed insufficient.

On the basis of the replies of LinkedIn India, the RoC has cited its holding structure as below:

Image credits35

ANALYSIS BY THE ROC

RoC analysed the liability of LinkedIn India under Section 90 of CA, 2013 and questioned the indirect role of Mr. Roslansky, who is the CEO of LinkedIn Corporation (the holding company of LinkedIn India). In this regard it is pertinent to note that LinkedIn Corporation itself is owned and controlled by Microsoft Corporation. Mr. Rolansky serves as an employee pursuant to an agreement and his role is supervised by the Board of LinkedIn Corporation and Microsoft Corporation.

The RoC rejected the need for a written agreement to signify the link between Mr. Roslansky and LinkedIn India as there are multiple tests to identify the SBO such as indirect holdings and the right to exercise or actual exercise of control or significant influence through direct holdings. Following three tests (as detailed below) were applied by the RoC in this regard to determine the significant beneficial ownership:

- Beneficial Ownership through holding subsidiary relationship: The analysis of the holding structure revealed that LinkedIn Corporation, though has been reported as the “holding company” in financial statements, does not have any holding through shares in LinkedIn India. Hence, the only way it could be regarded as a holding company is on account of its ability to control the Board of Directors of the subsidiary company as per Section 2(87)(i) of CA, 2013. The bylaws of LinkedIn Corporation available on public domain and the website of LinkedIn Corporation was referred to by the RoC to determine the role of Mr. Ryan Roslansky. Mr. Ryan Roslansky was determined to be an SBO owing to his ability to exercise control on the Board of Directors of LinkedIn India.

- Beneficial Ownership through the reporting channel test: While this was analysis on the basis of holding subsidiary relationship, the RoC also applied the “reporting channel test” to determine beneficial ownership. It was observed that Mr. Henry Fong, the director of LinkedIn India reports to the Mr. Blake Lawit, the secretary of LinkedIn Corporation who further reports to Mr. Ryan Roslansky. Referring to the relevant Sections of the bylaws of Microsoft Corporation, the CEO Mr. Satya Nadella has general charge and supervision of business. The RoC held that there is no requirement of proof of actual exercise of control or significant influence and the “right to exercise” significant influence or control is sufficient for determining liability.

- Beneficial Ownership through the test of financial control: The Board meetings of LinkedIn India corporation held on November 30, 2016 and May 2, 2022 was referred to by the RoC. These board meetings reflected financial control exercised by Microsoft Corporation reflecting pervasive control on LinkedIn India.

On the basis of the aforesaid, LinkedIn Technology Unlimited Company, the registered owner and LinkedIn Ireland, the beneficial owner were held liable for a penalty as provided under Section 89(5) of the Act for not filing declarations according to the requirements of Section 89(1) and (2). The RoC declared Mr. Satya Nadella and Mr. Ryan Roslansky as SBOs of LinkedIn India and further were held liable to a penalty under Section 90(10) of CA, 2013 for failure to report. Further, LinkedIn India and its officers were held liable under Section 90(11) for failing to take necessary steps as per Section 90(4A) to identify SBO in relation to the company. The cumulative penalty levied upon LinkedIn India and its directors along with Mr. Ryan Rolansky and Mr. Satya Nadella amounted upto INR 27 lakhs.

OUR THOUGHTS

The RoC order against LinkedIn India underscores significant compliance lapses, particularly in beneficial ownership disclosures. The expansive understanding adopted by the RoC increases the scope of SBOs to include CEOs who function as employees of the company. This could have a negative impact in group companies where CEOs of holding companies could be held liable for subsidiary companies. The intent behind the provisions on SBOs is to identify instances when the benefit flowing from the shares is beyond the registered shareholders. The extension of the scope of Significant beneficial owners to employees like CEOs deriving salaries for their functions is against the intent. This interpretation further increases the compliances to be followed in cases of foreign holding companies of Indian subsidiaries. The fallout of such increased compliances could negatively impact the ease of doing business in the country.

Further, this matter serves as a reminder for multinational corporations to ensure robust compliance frameworks, regular audits, and clear governance protocols which can be achieved by aligning their practices with Indian laws so as to avoid regulatory scrutiny and maintaining corporate integrity in complex structures.

PRADEEP MEHTA & ANR. V. UNION OF INDIA & ORS.

INTRODUCTION

On 26 August 2024, the division bench of the Bombay High Court in the case of Dr. Pradeep Mehta & Anr. v. Union of India and Ors.ruled on a writ petition filed by Dr. Pradeep Mehta and Neil Mehta (collectively “Petitioners”) challenging an order of the SEBI leading to their demat accounts being frozen for alleged non-compliances with the LODR. The High Court, while granting relief to the Petitioners and setting aside the writ petition, found SEBI’s actions to be unjust, illegal, and beyond its statutory authority thereby imposing a fine of INR 80,00,000 on SEBI and the stock exchanges.

The matter was subsequently remanded by the Supreme Court for fresh consideration by the High Court.

BRIEF FACTS

The Petitioners, who were the promoter shareholders and initial subscribers of Shernuj & Company Limited (“Shernuj”) during its incorporation in 1989, had no active involvement in the management or day-to-day affairs after its incorporation. In 2016, Shernuj defaulted in filing financial statements as per the LODR requirements. SEBI responded by penalizing Shernuj and freezing demat accounts of its promoters and promoter group, including the Petitioners, based on their historical designation as promoters. The Petitioners became aware of the freezing of the demat account only in 2017, when their demat accounts holding shares in other companies were also affected.

The Petitioners appealed to the Securities Appellate Tribunal (“SAT”), directing the stock exchanges to address the matter. However, the stock exchanges upheld SEBI’s decision, leading the Petitioners to file a writ petition before the Bombay High Court.

FINDINGS OF THE HIGH COURT

The High Court ruled in favor of the Petitioners, holding that:

- The Petitioners could not be classified as “promoters” under the LODR due to their lack of involvement in Shernuj’s management, particularly at the time of non-compliance.

- The freezing of demat accounts holding shares in other companies was unrelated to the violation and was beyond the scope of SEBI’s authority.

- SEBI and the exchanges violated the principles of natural justice by freezing the accounts without providing prior notice or an opportunity to be heard.

- The freezing of the Petitioners’ demat accounts was arbitrary, excessive, and not supported by the SEBI Act, 1992, or any subsequent regulations. Accordingly, SEBI and the stock exchanges were directed to defreeze the accounts and compensate the Petitioners for the losses incurred.

Appeal to the Supreme Court

SEBI and the stock exchanges appealed to the Supreme Court, which held that the High Court had focused primarily on interim relief rather than addressing the Petitioners’ broader challenge to the legality of SEBI’s circulars and actions. The Supreme Court directed the High Court to reconsider the writ petition comprehensively.

OUR THOUGHTS

This case underscores the need for regulatory bodies to act within the bounds of their statutory authority and adhere to the principles of natural justice. The freezing of the Petitioners’ demat accounts, particularly shares in unrelated companies, violated their constitutional rights under Articles 14, 19, and 21. The case also highlights the complexities of determining promoter status. While SEBI’s reliance on historical records was procedurally correct, it failed to account for the Petitioners’ lack of involvement in Shernuj’s management for over two decades. Arbitrary enforcement of penalties, such as freezing unrelated securities, undermines investor confidence and creates precedents for regulatory overreach.

The High Court’s initial judgment serves as a reminder that actions by statutory authorities are subject to judicial scrutiny. The outcome of the fresh hearing will likely shape the balance between regulatory enforcement and investor protection in the Indian securities market.

MIH EDTECH INVESTMENTS, B.V. & ORS V. THINK & LEARN PRIVATE LIMITED

INTRODUCTION

In February 2024, a Petition was filed before the NCLT, Bengaluru against Think & Learn Private Limited (“Byjus”) alleging oppression and mismanagement. The Petition was made on various corporate governance violations including the rights issue undertaken by Byjus. We have dealt with the brief facts of the case in relation to the proposed rights issue, order passed and reliefs granted by NCLT and our views thereon.

BRIEF FACTS

MIH Edtech Investments and other shareholders (collectively “Petitioners”) filed Petitions under CA, 2013 against Byjus and its directors (“Respondents”), alleging oppression and mismanagement. The Petitioners sought a stay on the rights issue proposed by Byjus, citing:

- Lack of prior information to existing shareholders about the proposed rights issue;

- Rights issue exceeding Byjus’ authorized share capital, violating CA, 2013; and

- A significant negative impact on the Petitioners’ shareholding.

The first Petition was filed vis-à-vis the first rights issue and the second Petition was filed vis-à-vis the second rights issue, (undertaken by Byju’s during the pendency of the first Petition).

FINDINGS OF NCLT

- 27 February 2024: (i) NCLT directed the Respondents not to allot shares without increasing the authorized share capital as per CA 2013; (ii) It ordered that the funds from the rights issue should be held in a separate account and shall remain unused until the matter is resolved; and (iii) It extended the rights issue closure date to ensure that shareholders’ rights to apply for the said rights issue were protected. Lastly, the NCLT has reserved its decision on various reliefs sought by the Petitioners including whether the first rights issue constitutes oppression and mismanagement.

- 12 June 2024: (i) Respondents were restrained from proceeding with a second rights issue initiated on 11 May 2024; (ii) NCLT Directed funds from the second rights issue to be held in a separate account until the first rights issue matter is resolved; and (iii) NCLT ordered the maintenance of the existing shareholding pattern

OUR THOUGHTS

The Hon’ble Supreme Court of India, in Needle Industries India v. Needle Industries Newey (India) Holding Limited (“Needle Industries Case”) pronounced a landmark decision on oppression and mismanagement and interpreted as to what amounts to oppression and propounded that an ‘oppressive’ act would: (i) lack in probity, (ii) be unfair to the members, and (iii) cause prejudice to the members in exercise of their legal and proprietary right as a shareholder.

In light of Needle Industries Case, the NCLT must determine if the first rights issue constitutes oppression, as in the present Byju’s case, wherein the Petitioners were faced to make a forced choice i.e., either by not subscribing to the rights issue (thereby resulting in their shareholding dropping from 24.5% to 2.5%) or by subscribing and incurring financial losses due as a result of lower valuation of the shares. Such actions seem unfair and prejudicial, potentially aiming to sideline the Petitioners.

Moreover, the Respondents appear to have violated Section 62(1)(a)(iii) of CA, 2013 by disadvantaging the Petitioners through the rights issue. The NCLT should also address whether the rights issue was in Byju’s best interest or an attempt to dilute the Petitioners’ stake.

EASTERN INDIA MOTION PICTURES ASSOCIATION AND ORS V. MILAN BHOWMIK & ANR.

INTRODUCTION

In December 2024, the Hon’ble Calcutta High Court allowed two members of Eastern India Motion Pictures Association (“Eastern India”) to bypass the restrictions under CA, 2013 permitting a minority shareholders’ dispute to be heard by the civil court instead of the NCLT/ NCLAT (collectively “Tribunal”). This decision diverged from the conventional approach mandated by the CA, 2013.

BRIEF FACTS

Two members (“Members”) of Eastern India, a company limited by guarantee, challenged the election of Eastern India’s executive committee, alleging violations of its Articles of Association and its election rules.

The matter, falling under Section 241 of the CA 2013 (dealing with oppression and mismanagement), required adjudication by the Tribunal. However, the Members approached the civil court, circumventing Section 430 of the CA 2013, which bars civil court jurisdiction over matters falling under the Tribunal’s purview. Eastern India argued this was impermissible.

The Members countered Eastern India’s contention, citing Section 244 of the CA 2013, which mandates a minimum of 1/5th of members (in companies with no share capital) to approach the Tribunal. Since only two members raised the dispute, they argued the Tribunal lacked jurisdiction.

JUDGMENT

- Single Judge Bench: Found merit in the Members arguments, ruling they rightly approached the High Court of Calcutta due to their insufficient strength under Section 244. The court dismissed Eastern India’s application and rejected the possibility of a waiver under the proviso of Section 244 of the CA 2013, deeming the civil court to be a more efficacious remedy.

- Division Bench: Upheld the decision of the Single Judge Bench, adding that Tribunal proceedings on eligibility would be uncertain and time-consuming, justifying the Member’s direct approach to the civil court.

OUR THOUGHTS

This ruling deviates from the CA 2013’s legislative intent, undermining the Tribunal’s authority and the minimum eligibility criteria for claims of oppression and mismanagement. It risks enabling minority shareholders to misuse a civil courts forum, delaying resolutions and disrupting a company operations. While the order does offer an alternative perspective, it raises concerns about potential conflicts in authority between civil courts and the Tribunal. Clarity in governance is needed to prevent such ambiguities and avoid the misuse of this interpretation taken by the Hon’ble High Court of Calcutta. No appeal has been filed in the Supreme Court as of date.

PHILIPS INDIA LTD. V. SUDHIR HARIBHAI PATEL & ANR.

INTRODUCTION

The NCLT, Kolkata ruling in the case of Philips India Limited (“Philips India”) on 19 September 2024, has sparked significant debate by narrowing the interpretation of share capital reduction under Section 66 of CA, 2013. The NCLT dismissed Philips India’s application, holding that such reduction is permissible only for situations explicitly mentioned in the provision. This judgment seemingly overlooks the broader scope of Section 66, which permits reduction “in any manner” and is not confined to specified scenarios.

By conflating capital reduction with buyback provisions under Section 68, the NCLT arguably misinterpreted the distinct mechanisms and objectives of these two provisions. The judgment has been challenged before the National Company Law Appellate Tribunal (“NCLAT”). We have dealt with the brief facts of the case, the tribunal’s findings, and the contentious legal and practical implications that have arisen.

BRIEF FACTS

- The Petition: Philips India filed a petition under Section 66 of CA, 2013, seeking to cancel and extinguish 3.87% of its total issued, subscribed, and paid-up share capital held by minority shareholders.

- Reasoning for Reduction: The shares of Philips India were delisted in 2004, leaving minority shareholders without liquidity for their investments. To address this issue and reduce administrative costs associated with these shareholders, Philips India proposed paying them the “fair value” of INR 740 per share (as valued by KPMG Valuation Services LLP), with a premium of INR 175 over the fair value.

- Approval by Majority: The scheme was approved by 99.58% of the shareholders through a special resolution.

- Opposition by Minority Shareholders: Despite Philips India’s claim that the capital reduction scheme was designed to benefit minority shareholders by providing them with liquidity and an exit opportunity, the minority shareholders contested the move on several grounds including undervaluation of their shares by KPMG, transparency of the valuation process, the lack of detailed disclosures on critical parameters like cash flow projections and discount rates. Perceiving the scheme as an attempt by the majority shareholders to consolidate control at an unfairly low price, the minority shareholders viewed the proposal as oppressive and violative of Foreign Exchange Management Act, 1999 (“FEMA”) and the regulations thereunder. This opposition underscores the complexities in balancing corporate actions with minority shareholder protections.

FINDINGS OF THE NCLT

- Scope of Section 66:

- NCLT examined whether Section 66 could be invoked to provide liquidity to minority shareholders. It concluded that capital reduction is permissible only for:

- extinguishing or reducing unpaid share capital liability; or

- cancelling paid-up capital that is lost, unrepresented by assets, or in excess of the company’s needs.

- Philips India’s primary objectives of providing liquidity and reducing administrative costs were deemed insufficient to invoke Section 66, as they do not align with these specified purposes.

- NCLT examined whether Section 66 could be invoked to provide liquidity to minority shareholders. It concluded that capital reduction is permissible only for:

- Valuation Disputes:

- NCLT noted significant discrepancies in valuations: INR 740 per share by KPMG (petitioner’s valuer) versus INR 4,605 to INR 6,119 per share by Haresh B. Shah and Gaurav Jain (respondents’ valuers).

- Despite agreeing that the discounted cash flow (“DCF”) method was appropriate, NCLT criticized the lack of transparency in the valuation parameters used by KPMG.

- Conflict with Buyback provisions under Section 68 and Dismissal of Petition: NCLT concluded that the proposed reduction effectively amounted to a buyback (under the guise of a capital reduction), as it involved purchasing shares from a specific class of shareholders and since Section 66(6) explicitly excludes buyback transactions, the petition was dismissed.

OUR THOUGHTS

A view could be taken that NCLT’s ruling in this case reflects a narrow interpretation of Section 66, which allows for share capital reduction “in any manner” and provides companies with significant flexibility. By restricting the provision to specific scenarios and conflating it with Section 68, which governs proportionate buybacks, NCLT overlooked the distinct purposes and mechanisms of these provisions. Section 66 permits selective capital reduction with tribunal oversight, while Section 68 involves shareholder and board approvals for proportionate buybacks, reading them together has made it unjustified. Furthermore, NCLT misinterpreted the exclusion of buybacks from Section 66, which is intended to avoid procedural overlap, not to impose limitations on reductions with incidental similarities to buybacks.

The order also failed to address significant valuation discrepancies, raising concerns about transparency and procedural fairness. While the tribunal acknowledged gaps in KPMG’s valuation, it did not reconcile these differences or ensure clarity in the valuation methodology. By imposing unwarranted restrictions on Section 66, the ruling risks deterring companies from pursuing legitimate avenues for selective capital reduction, particularly in cases involving delisted shares. With the appeal pending before the NCLAT, the decision could provide much-needed clarity on the scope of Section 66 and its implications for corporate restructuring.

KEY DEVELOPMENTS IN THE CORPORATE LEGAL LANDSCAPE IN 2024

1. Indian Companies now permitted to directly list equity shares on International Exchanges (January 2024)

To permit the Indian Companies to list their equity shares on international exchanges, the Companies (Listing of Equity Shares in Permissible Jurisdictions) Rules, 2024 have been introduced which details out the conditions and procedural aspects. Presently, the International Financial Services Centre in India (IFSC) – India International Exchange and NSE International have been notified as the permitted international stock exchanges on which a permitted Indian public company can list their equity shares. Further, only non-resident Indians and citizens which shares land border with India can sell, purchase or become the beneficial owner of such equity shares (with prior approval of the Indian government)(To get more insights on this key development, please read our Article published here).

2. SEBI Guidelines for AIFs on Holding Investments in Dematerialized form (January 2024)

The SEBI introduced an amendment to the SEBI (Alternative Investment Funds) Regulations, 2024, mandating AIFs to hold investments in dematerialized form, and appointment of custodians for safekeeping of their securities. Pursuant to the amendment, the guidelines issued by SEBI mandate all investments made by AIFs on or after 01 October 2024, to be held in demat form, with few exceptions for prior investments.

Additionally, the guidelines now mandate that all AIFs to appoint custodians irrespective of their corpus size. The guidelines also state that standards for reporting of AIFs’ investment data shall be formulated by the pilot Standard Setting Forum for AIFs (SFA), in consultation with SEBI. (To get more insights on this key development, please read our Article published here)

3. Foreign Exchange Management (Foreign Currency Accounts by A Person Resident in India) (Amendment) Regulations (April 2024)

The RBI has, by way of a notification dated 19 April 2024, amended the Foreign Exchange Management (Foreign Currency Accounts by a person resident in India) Regulations, 2015. Previously, subject to certain compliances with respect to raising of external commercial borrowings or raising of resources through American or Global Depository Receipts, the funds that were raised, pending their utilization or repatriation to India, could be held in deposits in foreign currency accounts with a bank outside India. However, pursuant to the amendment, the funds that are raised through direct listing of equity shares of companies incorporated in India on International Exchanges, pending their utilisation or repatriation to India, can also be held in foreign currency accounts with a bank outside India. (To access the amendment, please click here)

4. Relaxed norms for Overseas Portfolio Investments (June 2024)

The Foreign Exchange Management (Overseas Investment) Directions, 2022 permit listed Indian companies and resident individuals to make Overseas Portfolio Investment (“OPI”) in overseas funds. Earlier, an OPI could only be made in the ‘units’ of overseas funds that are duly regulated by the financial services regulator of the host country. However, now the RBI has broadened the scope of OPI whereby in addition to ‘units’, OPI can now be made in ‘any other instrument (by whatever name called)’ issued by an overseas fund. Further, the duly regulated fund could also include a fund that is regulated through a fund manager. (To get more insights on this key development, please read our Article here)

5. Amendment of Securities Contracts (Regulation) Rules, 1957 simplifying listing requirements (August 2024)

To ease the process of listing on international exchanges, the Securities Contracts (Regulation) Rules, 1957 now stand amended. The amendments simplify the listing requirements for Indian public companies on international exchanges within the International Financial Services Centres (IFSCs) by removing the provision which determined the public offer threshold based on the size of the post issue capital of the company and reduced the minimum threshold of public offer from 25% to 10%. The amendment also eliminates the requirement to increase public shareholding within certain timelines and the requirement of maintaining minimum 10% public shareholding in case of the announcement of a resolution plan under the Insolvency and Bankruptcy Code, 2016. (To get more insights on this key development, please read our Article here)

6. Establishment of Centre for Processing Accelerated Corporate Exit for striking-off of a Limited Liability Partnerships (August 2024)

To expedite the strike – off procedures for Limited Liability Partnerships (LLP’s), the Ministry of Corporate Affairs has introduced an amendment to the LLP Rules, 2009, via the Limited Liability Partnership (Amendment) Rules, 2024. Previously, striking off the name of an LLP was solely processed by the Registrar of Companies, now, the Centre for Processing Accelerated Corporate Exit (C-PACE), an authority which has been established by the Central Government under the CA, 2013, has been designated as the authority responsible for the exit process of the LLPs. (To access the amendment, please click here)

7. E-Adjudication of Penalty Proceedings (August 2024)

The amendment to the Companies (Adjudication of Penalties) Rules, 2014, effective from 16 September 2024, introduces e-adjudication for penalty proceedings. The amendment mandates that all adjudication proceedings including issue of notices, document filings, hearings and payment of penalties, shall be conducted electronically via a new e-adjudication platform developed by the Central Government. Further, in case any person to whom a summon or notice is to be issued, and the e-mail address of such person is unavailable, the adjudicating officer is required to send the notice by post to the address of the person and preserve a copy in the e-adjudication platform. The amendment is a significant step towards simplifying the adjudication process, thereby improving both efficiency and record management. (To access the amendment, please click here)

8. New Merger Control Regime – Introduction of Deal Value Threshold etc. (September 2024)

In a significant development, the Ministry of Corporate Affairs has notified the Competition (Amendment) Act, 2023 introducing a major overhaul to the merger control regime notifying certain additional rules and regulations. The concept of ‘Deal Value Threshold’ has now been introduced whereby the CCI will have to be notified where the ‘value of the transaction’ exceeds INR 20 billion. Additionally, certain provisions in relation to categories of combinations that will be exempt from notifying the CCI, system of fast-track approvals (green channel route), open offer relaxations, and de minimis exemptions have now also been inter alia provided. (To get more insights on this key development, please read our Article here)

9. Reverse Flipping (September 2024)

With the aim to simplify the process for inbound mergers, the Ministry of Corporate Affairs issued a Notification on 09 September 2024, introducing certain amendments whereby inbound mergers between a foreign holding company and its Indian wholly owned subsidiary would now be covered under the fast-track merger mechanism within the scheme of Section 233 of CA, 2013, thus eliminating the requirement of obtaining an approval from the National Company Law Tribunal However, this is subject to complying with certain conditions such as obtaining an RBI approval. (To get more insights on this key development, please read our Article here)

10. Share swaps under the Foreign Non-Debt Instrument Rules, 2019 (September 2024)

To simplify cross-border share swaps, the Ministry of Finance vide a notification, introduced amendments to the Foreign Exchange Management (Non-Debt Instruments) Rules, 2019. The amended rules now permit cross border share swap transactions via the transfer of equity instruments of an Indian company. Other key changes include extension of the exclusion of non-repatriable investments under indirect foreign investment to overseas citizens of India, increasing the threshold limits for Foreign Portfolio Investors (FPIs), amending the definition of ‘control’ to align with the CA, 2013, etc. (To get more insights on this key development, please read our Article here).

11. Amendment to Compounding Rules under FEMA, 1999 (September 2024)

To streamline the process of compounding applications, the Ministry of Finance has notified Foreign Exchange (Compounding Proceeding) Rules, 2024, that override the existing Foreign Exchange (Compounding Proceeding) Rules, 2000. The amendment revises the monetary limits for the compounding authorities of RBI to compound a contravention under the Foreign Exchange Management Act, 1999. The fee for submission of compounding application has also been increased, which can now be remitted through online modes of payment. Further, compounding is now permitted for contraventions against which an appeal has been filed. (To get more insights on this key development, please read our Article here)

12. Definition of ‘Connected Person’ under SEBI (PIT) Regulations (December 2024)