Substance Over Form While Determining Permanent Establishment: Hyatt International Southwest Asia Ltd. v. Additional Director of Income Tax

Brief Facts:

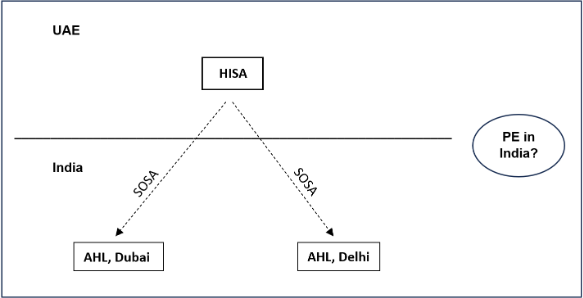

Hyatt International Southwest Asia Ltd (“Appellant”) is a company incorporated in the United Arab Emirates (“UAE”) and is a tax resident UAE under Article 4 of the Agreement between the Government of India and the UAE for the avoidance of Double Taxation (“India-UAE DTAA”). In 2008, two Strategic Oversight Services Agreements (“SOSA”) were entered into by the Appellant with Asian Hotels Limited, India (“AHL”), one for Asian Hotels Limited, Delhi and the other for Asian Hotels Limited, Mumbai. The SOSA was entered into for provision of strategic planning services and know-how by the Appellant to ensure the operation and development of Asian Hotels Limited into an efficient and high-quality international full-service hotel.

For the Assessment Year 2009-10, the Appellant filed its return of income declaring ‘Nil’ income. Upon the issuance of notice by an Assessing Officer under Section 142(1) and 143(3) of the Income Tax Act, 1961, the Appellant submitted a reply stating that its income is not taxable as:

- There is no specific article under the India-UAE DTAA referring to Fees for Technical Services.

- The Appellant did not have any fixed place of business, office, or branch in India.

- Presence of its employees in India did not exceed nine months as specified under Article 5(2) of the India-UAE DTAA.

The Assessing Officer held that the activities of the Appellant constitute a permanent establishment (“PE”) under Article 5 of the India-UAE DTAA. The Appellant filed objections before the Dispute Resolution Panel which rejected the same. The Appellant filed appeals before the Income Tax Appellate Tribunal (“ITAT”). The ITAT, relying of the decision of the court in Formula One World Championship Limited v. Commissioner of Income Tax, International Taxation-3, Delhi & Anr.1 (“Formula One judgement”), held that the Appellant has a fixed place of business in India qualifying as a PE under Article 5 of the India-UAE DTAA.

The Appellant filed an appeal before the High Court. The High Court dealt with the essential question of “Whether the Appellant has PE in India within the meaning of the Double Taxation Avoidance Agreement?” The High Court held that despite being a company incorporated in Dubai and a tax resident of the UAE, the Appellant had a PE in India. The said judgement of the High Court was appealed to the Supreme Court of India.

Arguments before the Supreme Court of India:

The Appellant contended before the Apex Court that the SOSA explicitly stipulates that the Appellant shall render its services from Dubai and is not obligated to send or station any employee in India. Further, the income of the Appellant is not taxable as there is no specific article in India-UAE DTAA enabling taxation of Fees for Technical Services. The Appellant further stated that it doesn’t maintain a fixed place of business, office or branch in India nor was there any specifically reserved place at the disposal of the Appellant.

The Revenue Authority contended that the SOSA which was entered into for a period of 20 years and under the same, the premises of AHL were under the full and unconditional disposal of the Appellant. The Respondents referred to various clauses of the SOSA and submitted that the role of the Appellant was training staff, monitoring operations, exercising financial oversight, and influencing procurement and operational decisions.

Decision of the Supreme Court:

The Supreme Court formulated the principal issue for consideration as whether the Appellant has a PE in India under Article 5(1) of the India-UAE DTAA and consequently, whether its income derives under SOSA is taxable in India.

Prior to delving further into the reasoning, the Apex Court analyzed the relevant clauses of DTAA and the SOSA. Article of 5 of the India-UAE DTAA defines PE as “a fixed place of business through which the business of an enterprise is wholly or partly carried on”. Article 7 of the India-UAE DTAA deals with taxation of business profits which are attributable to a PE. Article 7(1) states that profit of an enterprise shall be taxable only in the State of its residence unless the enterprises carry on business in the other contracting state through a PE.

The relevant provisions of the SOSA examined by the Supreme Court of India include:

| Relevant Article of SOSA | Provision |

| Section 4 of Article I | ‘Title of the hotel’ – If AHL desires to obtain financial assistance for the construction of the hotel or if the hotel is to be used as collateral for any borrowing unrelated to hotel business, the owner of AHL is required to obtain a non-disturbance and attornment agreement from the lender, which must also be acceptable to the Appellant. |

| Article II | The term is for twenty years with a possibility of extension by ten years through mutual agreement. |

| Section 1 of Article III | AHL shall be operated with standards comparable to international hotels operated by the Appellant. |

| Section 2 of Article III | The Appellant had complete control and discretion in formulating and establishing the strategic plan for all aspects of AHL including branding, marketing, product development, and daily operations. |

| Section 3 of Article III | The Appellant assigned employees to India without prior approval from hotel owner or management. |

| Section 4 of Article III | The Appellant had the powers to formulate policies governing the bank accounts of AHL. |

| Section 1(a) and 1(b) of Article V | “Strategic Fees” for the Appellant had been set out as a calculation of percentage of room revenue and other revenues and income. |

Subsequent to analyzing the above-mentioned provisions of the SOSA, the role of the Appellant was held to not be confined to mere policy formation. The degree of control and supervision vested in the Appellant for a Fixed Place PE under Article 5(1) of the India-UAE DTAA. The Supreme Court relied on the Formula One judgement to state that the two essential tests include

- The place must be “at the disposal” of the enterprise

- The business of the enterprise must be carried on through that place

Further, the three core attributes of a PE must be stability, productivity, and degree of independence. The “disposal test” was held to be important as a test. The Appellant held control over the hotel’s strategic, operational, and financial dimensions. The functions performed by the Appellant are to be performed over a period of twenty years and include revenue sharing. Thus, the Supreme Court held economic substance over legal form in determining PE status.

Our thoughts:

The Supreme Court’s July 24, 2025 judgment in Hyatt International Southwest Asia Ltd. v. CIT significantly expands the “fixed place PE” threshold under Article 5(1) of the India-UAE DTAA, ruling that a UAE-based Hyatt entity created a PE in India through substantive operational control including policy enforcement, HR oversight, staff deployment, and profit-linked fees from an Indian hotel despite lacking ownership or exclusive possession of premises, thereby prioritising economic substance over contractual form. This lowers the bar to be considered as a PE for foreign entities in hospitality, consulting, and tech sectors providing managerial services, potentially taxing business profits under Article 7 even without physical offices or extended stays, while exposing intra-group oversight models to Indian tax attribution and prompting structural reassessments like relocations or enhanced withholding.

The information contained in this document is not legal advice or legal opinion. The contents recorded in the said document are for informational purposes only and should not be used for commercial purposes. Acuity Law LLP disclaims all liability to any person for any loss or damage caused by errors or omissions, whether arising from negligence, accident, or any other cause.

- (2017) 15 SCC 622 ↩︎