Proportionate Reduction as ‘Transfer’: Principal Commissioner of Income Tax v. Jupiter Capital

Brief Facts:

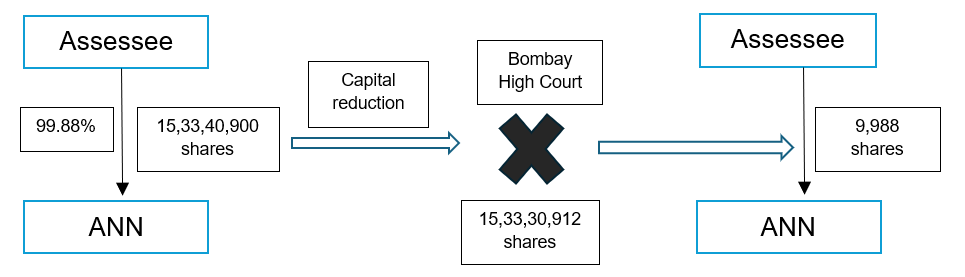

The Assessee is a company engaged in the business of investing in shares, financing and money lending. It held 15,33,40,900 shares at a face value of Rs. 10 each which constituted 99.88% of the total number of shares in Asianet News Network Private Limited (“ANN”). ANN incurred heavy losses resulting in the loss of networth. ANN filed a petition in the Bombay High Court (“High Court”) for reduction of its share capital to set off its losses against the paid-up equity share capital. The High Court sanctioned ANN’s share capital reduction from 15,35,05,750 to 10,000 shares, proportionately cutting the Assessee’s holding from 15,33,40,900 to 9,988 shares (face value unchanged at Rs. 10), with Rs. 3,17,83,474 paid as consideration.

The Assessee claimed long-term capital loss accrued to the reduction in share capital from the sale of shares in ANN. The Assessing Officer (“AO”) rejected the capital loss claim, ruling no “transfer” under Section 2(47) of Income Tax Act, 1961 occurred despite reduced share numbers, as face value and holding percentage (99.88%) stayed unchanged. Commissioner of Income Tax (Appeals) upheld this, distinguishing the judgement of Kartikeya V. Sarabhai1 (“Kartikeya”) by requiring sale/relinquishment to a third party. The Income Tax Appellate Tribunal (“ITAT”) reversed the judgement of CIT and applied the Kartikeya judgement squarely to recognize rights extinguishment in cancelled shares. The High Court of Karnataka dismissed Revenue’s appeal and affirmed the decision of ITAT.

Issue for consideration:

The Department of Revenue sought leave to appeal before the Supreme Court of India (“Supreme Court”). The issue for consideration before the Supreme Court was whether the ITAT was correct in allowing the assessee’s claim of long-term capital loss of Rs. 164.48 crore, finding an extinguishment of rights in 15,33,40,900 shares under Section 2(47), even without any reduction in the shares’ face value?

Judgement:

The Supreme Court, in its order dated 2 January 2025, dismissed the Revenue’s SLP, holding that the proportionate reduction in Jupiter Capital’s shareholding constituted a “transfer” under Section 2(47) of the Income Tax Act, 1961. Relying on Kartikeya V. Sarabhai v. CIT, the Court clarified that Section 2(47)’s inclusive definition encompasses relinquishment or extinguishment of rights in capital assets, beyond mere sale. Here, the Assessee extinguished rights in 15,33,40,900 shares of ANN, receiving 9,988 shares plus Rs. 3.18 crore consideration thereby triggering long-term capital loss computation under Section 45, irrespective of unchanged face value (Rs. 10) or shareholding percentage (99.88%).

The bench emphasized that capital reduction under Section 66 of the Companies Act erodes shareholder rights to dividends and liquidation proceeds proportionally, qualifying as transfer. Precedents like Anarkali Sarabhai v. CIT2 reinforced that redemption or reduction equates to the company buying back shares, with no need for third-party involvement or percentage dilution. No error of law arose in the High Court/ITAT affirming the loss, distinguishing from cases lacking consideration or rights extinguishment.

Our thoughts:

This Supreme Court ruling provides welcome relief for taxpayers seeking to claim capital losses from a company’s share capital reduction, resolving years of conflicting judicial stances that bred uncertainty. The Mumbai ITAT Special Bench in Bennett Coleman & Co. Ltd v. ACIT3 ruled that share substitution via reduction without consideration does not constitute a ‘transfer,’ disallowing resultant capital losses. This was later overridden by the Mumbai ITAT in Tata Sons Limited v. CIT4, permitting such losses even absent consideration. The Supreme Court drew on the Gujarat High Court’s CIT v. Jaykrishna Harivallabhdas5, affirming that consideration is not essential for computing capital gains on rights extinguishment, potentially extending guidance to no-payout scenarios. Given the grey areas involved in such a capital reduction transaction not involving transfer or conversion, it would be worthwhile to have an amendment in the Income Tax Act to facilitate such loss upon capital reduction as capital loss.

The information contained in this document is not legal advice or legal opinion. The contents recorded in the said document are for informational purposes only and should not be used for commercial purposes. Acuity Law LLP disclaims all liability to any person for any loss or damage caused by errors or omissions, whether arising from negligence, accident, or any other cause.