JIO-Blackrock Joint Venture: Reshaping Investment Landscape

INTRODUCTION

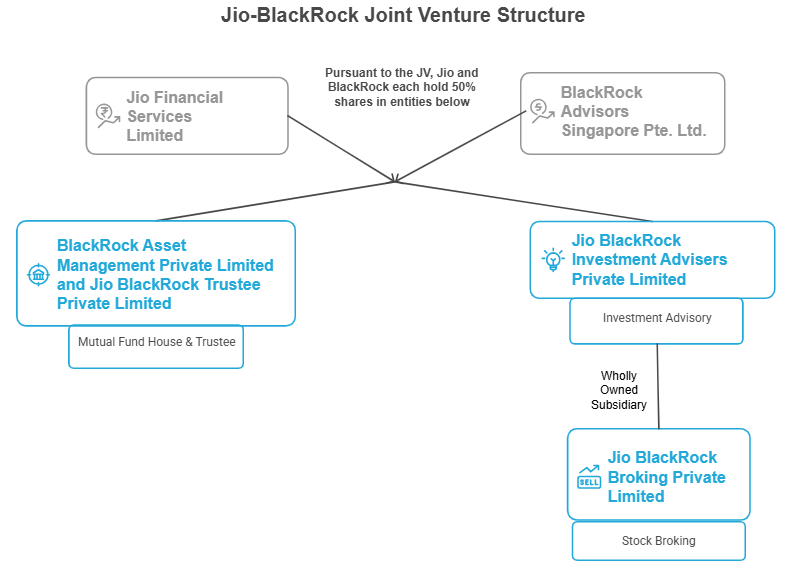

The alliance between Jio Financial Services Limited (“Jio”) and BlackRock Group marks a significant development in India’s financial services market. On 26 July 2023, the two entities announced a 50:50 joint venture i.e., a JV, with the objective of entering and reshaping India’s asset management industry.1 The transaction brings together Jio’s extensive domestic footprint, digital infrastructure and execution capabilities with BlackRock’s expertise in investment management, product excellence and access to technology.

BACKGROUND OF PARTIES

- Jio Financial Services Limited

Jio operates as a financial services platform with a strategic focus on delivering credit, investment, and other retail financial products directly to consumers and merchants.

- BlackRock Advisors Singapore Pte. Ltd

BlackRock Advisors Singapore Pte. Ltd. (“BlackRock”) is part of the BlackRock Group, a leading global asset manager known for its expertise in investment management, risk analytics, and technology-enabled investment solutions.

STRUCTURE OF THE TRANSACTION

- Mutual Fund

The formation of a mutual fund is governed by the provisions of Security Exchange Board of India (Mutual Funds) Regulations, 1996 (“Mutual Fund Regulations”). The Mutual Fund Regulations provide that a mutual fund shall be constituted in the form of a trust and further, one of the criteria for grant of certificate of registration by the SEBI is the appointment of an asset management company to manage the mutual fund and operate the scheme of such funds.

After receiving an in-principle approval from SEBI on 3 October 2024, Jio and BlackRock incorporated Jio BlackRock Asset Management Private Limited (“AMC”) and Jio BlackRock Trustee Private Limited (“Trustee Company”) on 28 October 2024.2 Jio and BlackRock, both held equal shareholding (50:50) in the AMC and the Trustee Company.

Jio and BlackRock each made a further capital infusion into the AMC in the following manner:

| Sl. No. | Date | No of Equity Shares (Jio and BlackRock each) | Total Amount infused (in USD millions) |

| 1. | 21 January 2025 | 58.5 mn | 13.53 |

| 2. | 3 April 2025 | 63.0 mn | 7.80 |

| 3. | 10 December 2025 (rights issue) | 136.0 mn | 15.15 |

SEBI granted its final approval to AMC through the issuance of the certificate of registration and approval to act as the asset management company for ‘Jio BlackRock Mutual Fund’ on 26 May 2025.3

- Investment Advisory

The Securities and Exchange Board of India (Investment Advisers) Regulations, 2013, mandate that any person seeking to act as an investment adviser must obtain SEBI’s approval and meet the prescribed eligibility norms relating to qualifications and net – worth thresholds. Upon compliance with these conditions, SEBI issues the certificate of registration.

On 6 September 2024, Jio and BlackRock incorporated another joint venture entity, Jio BlackRock Investment Advisers Private Limited, in which Jio and BlackRock held equal shareholding (50:50).4

Jio and BlackRock each made a further capital infusion into Jio BlackRock Investment Advisers Private Limited in the following manner:

| Sl. No. | Date | No of Equity Shares (Jio and BlackRock each) | Amount infused by Jio and BlackRock each (in USD millions) |

| 1 | 3 April 2025 | 66.5 mn | 7.80 |

| 2 | 10 December 2025 (rights issue) | 93.5 mn | 10.41 |

SEBI, subsequently, on 10 June 2025, granted Jio BlackRock Investment Advisers Private Limited its certificate of registration to operate as an investment adviser.

- Stock Brokering

The Securities and Exchange Board of India (Stock Brokers) Regulations, 1992 require any person intending to act as a stockbroker to obtain SEBI’s approval. SEBI evaluates factors such as infrastructure, operational capability, past experience etc. Upon satisfaction of these conditions, SEBI issues the certificate of registration.

On 20 January 2025, Jio BlackRock Investment Advisers Private Limited incorporated a wholly owned subsidiary, Jio BlackRock Broking Private Limited, to undertake stock broking activities. SEBI subsequently granted this entity its certificate of registration to operate as a stockbroker/clearing member on 25 June 2025.5

Ecosystem Capabilities

The Jio–BlackRock joint venture and its associated businesses, comprising a mutual fund house, an investment advisory arm, and a stock broking platform are designed with strong backend integration capabilities that enable seamless interaction across all three verticals. For example, subject to compliance with SEBI’s conflict of interest provisions, the mutual fund house can leverage the Jio–BlackRock stock broking platform both to advertise its products and to execute trades. Simultaneously, the investment advisory arm can provide the mutual fund house with expert inhouse insights on investment opportunities. These cross platform integration capabilities provide a unique touch to the joint venture, enhancing operational efficiency and ultimately driving long term shareholder value.

KEY LEGAL ASPECTS

FDI Aspects

BlackRock’s investment in the JV would need to comply with FEMA NDI Rules, as it falls in the sector of ‘other financial services’. Foreign direct investment in this sector is permitted up to 100% though the automatic approval route, subject to compliance with conditionalities imposed by SEBI, including minimum capitalization norms.

AI Aspects

Jio BlackRock Mutual Fund is positioning Artificial Intelligence (“AI”) as a core part of both its investment process and its risk management through BlackRock’s Aladdin platform and Systematic Active Equity (“SAE”). Aladin aggregates market data, runs risk analytics, stress tests, and compliance checks while unifying portfolio management, trading, operations, and reporting in one system. While SAE, approach builds predictive stock signals through machine learning on big data, then optimizes active portfolios with human oversight to generate more returns.

SEBI’s regulations on Artificial Intelligence (“AI”) and Machine Learning (“ML”) are still in their nascent stages. Through its circular on ‘Reporting for AI and ML applications and systems offered and used by mutual funds’ dated 09 May 2019, SEBI is creating an inventory of the AI and ML landscape in India.6 The circular prescribes that mutual funds should report AI and ML applications in their operations, within 15 days of each quarter to the Association of Mutual Fund in India. Further, SEBI has also released a consultation paper on “Guidelines for Responsible Usage of AI/ML in Indian Securities Markets” dated 28 June 2025.7 Currently, these are not binding, and comments are solicited from the stakeholders. However, they signal SEBI’s regulatory intent to develop a framework that mitigates the risks associated with AI and ML deployment in the financial markets.

OUR THOUGHTS

Jio BlackRock’s entry signals an important shift in the evolution of India’s investment ecosystem. By anchoring its platform in technology enabled and AI supported investment processes, the joint venture positions itself to expand the reach of formal asset management beyond traditional investor segments. If executed responsibly, this model can meaningfully lower distribution frictions, personalise advisory pathways at scale, and bring first-time investors into the fold of regulated financial products.

That promise, however, must be matched with prudence. Retail investors in India are still developing an understanding of algorithmic tools, and the marketing of AI and ML carries the risk of misperception. In the absence of a dedicated SEBI framework governing the use of AI and ML in financial markets, the onus lies on Jio BlackRock to prioritise transparency, risk disclosures, and investor literacy. A proactive approach to education and communication will be essential, not only to safeguard investor interests but also, to preserve the long-term credibility of a platform that intends to operate at scale in a trust sensitive market.

The information contained in this document is not legal advice or legal opinion. The contents recorded in the said document are for informational purposes only and should not be used for commercial purposes. Acuity Law LLP disclaims all liability to any person for any loss or damage caused by errors or omissions, whether arising from negligence, accident, or any other cause.

- Press release by Blackrock dated July 26,2023 (can be accessed at: https://www.blackrock.com/corporate/newsroom/press-releases/article/corporate-one/press-releases/blackrock-and-jio-financial-services-agree-to-form ) ↩︎

- Disclosure by Jio Financial Services Ltd under Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements),2015 dated 4 October 2024 (can be accessed at :https://bsmedia.business-standard.com/_media/bs/data/announcements/bse/04102024/57730fa6-8bd7-4aeb-97bf-ebe7942efa87.pdf ) ↩︎

- Disclosure by Jio Financial Services Ltd. under Regulation 30 of SEBI (Listing Obligations and Disclosure Requirement) 2015, dated 27 May 2025 (can be accessed at: https://nsearchives.nseindia.com/corporate/JIOFINANCIAL_27052025130900_JFSL.pdf ) ↩︎

- Disclosure by Jio Financial Services Ltd. under Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements),2015 dated 8 September 2024 (can be accessed at https://jep-asset.akamaized.net/cms/assets/jfs/investor-relations/corporate-announcements/incorporation-of-a-joint-venture-company.pdf) ↩︎

- Disclosure by Jio Financial Services Ltd. under Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements),2015 dated 27 June 2025 (can be accessed at : https://nsearchives.nseindia.com/corporate/JIOFINANCIAL_27062025103641_JBBPL.pdf) ↩︎

- Circular by Securities Exchange Board of India on Reporting for AI and ML applications and systems offered and used by mutual funds dated 9 May 2019(can be accessed at: https://www.sebi.gov.in/legal/circulars/may-2019/reporting-for-artificial-intelligence-ai-and-machine-learning-ml-applications-and-systems-offered-and-used-by-mutual-funds_42932.html) ↩︎

- Consultation Paper by Securities Exchange Board of India on Guidelines for Responsible Usage of AI/ML in Indian Securities Market dated 20 June 2025 (can be accessed at: https://www.sebi.gov.in/reports-and-statistics/reports/jun-2025/consultation-paper-on-guidelines-for-responsible-usage-of-ai-ml-in-indian-securities-markets_94687.html) ↩︎