Bajaj Consolidates Full Control: Allianz Exits Joint Venture

INTRODUCTION

In one of the most significant restructurings in the Indian insurance landscape, the Bajaj Group initiated a sweeping realignment of its long-standing partnership with Allianz SE (“Allianz”), marking the end of one of the country’s successful joint ventures. After two decades of the joint venture, the German insurer Allianz exited its joint venture with the Bajaj Group as part of a global portfolio realignment, despite reaffirming that India remains a strategic priority. The exit was amicable and planned, with both parties coordinating the transition.

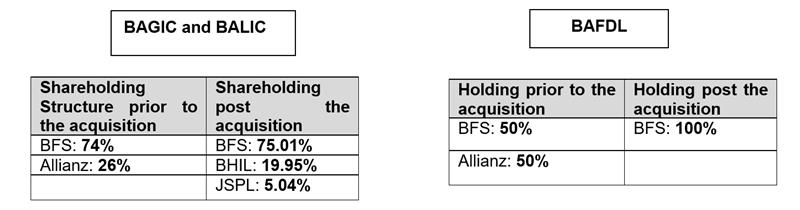

Allianz’s stake in Bajaj Allianz Life Insurance Company (“BALIC”) and Bajaj Allianz General Insurance Company (“BAGIC”) were both acquired by the Bajaj Group. Further, 50% of the shareholding of Allianz in Bajaj Allianz Financial Distributors Limited (“BAFDL”), the authorised corporate agent of BAGIC and BALIC was acquired by Bajaj Finserv (“BFS”).

As part of the acquisition, BFS, Bajaj Holdings & Investment Ltd. (“BHIL”), and Jamnalal Sons Private Limited (“JSPL”) collectively acquired:

- 26% paid-up equity share capital in BAGIC for a consideration of USD 1.586 billion; and

- 26% paid-up equity share capital in BALIC for a consideration of USD 1.196 billion.

Further, BFS acquired 50% of the paid-up equity share capital i.e. 12,00,000 equity shares in BAFDL for a consideration not exceeding USD 1.44 billion.

STRUCTURE OF THE DEAL

The restructuring was anchored in a way where Allianz fully exited all three joint venture entities i.e. BAGIC, BALIC and BAFDL with the Bajaj Group assuming complete ownership. The acquisition was done through three share purchase agreements that were entered into by the entities for acquisition of paid-up equity share capital. The shareholding prior to and subsequent to the acquisition is as follows:1

As of 8 January 2026,2 Allianz confirmed the completion of the sale of 23% in BALIC and BAGIC to the Bajaj Promoter Group. It expects to complete the exit from the insurance JVs and transfer the remaining 3% stake by Q2 2026. Allianz also reiterated that the Indian market continues to remain a core growth market for the group leading to a proposed partnership with Jio Financial Services, resulting in a binding 50:50 domestic reinsurance joint venture, and additional non-binding proposals for equally owned life and general insurance JVs.

KEY LEGAL ASPECTS

Companies Act

The transaction is governed by the share-transfer framework under the Companies Act, pursuant to which shares are transferable in accordance with Section 56 of the Companies Act and the articles of association of the respective entities. The board of directors of the relevant Bajaj group entities, at their board meetings held on 17 March 2025, considered Allianz’s proposal to exit the insurance joint ventures and approved the termination of the joint ventures, subject to the receipt of necessary regulatory approvals from CCI and IRDAI.3 Three share purchase agreements dated 17 March 2025 were entered into for acquisition of shareholding in BALIC, BAGIC and BAFDL respectively. Further, an agreement was entered into terminate the joint venture agreements.

Insurance Regulatory and Development Authority of India

The Insurance Act is the governing act for the transfer of shares in an insurance company. Sub-section 4 of Section 6A of the Insurance Act4 provides that any public limited company dealing with general and life insurance business shall not register any transfer of its shares unless:

- It is in accordance with Section 56 of the Companies Act;

- After the approval of IRDAI, when the total paid-up holding of the transferee is likely to exceed five percent of the paid-up capital post the transfer; and

- After the approval of IRDAI, where the nominal value of the shares intended to be transferred by any individual, firm, group, constituents of a group, or body corporate under the same management, jointly or severally exceeds one percent of the paid-up equity capital post the transfer.

The requirements under Section 6A of the Insurance Act must be read in conjunction with the provisions of Chapter IV of IRDAI (Registration, capital structure, transfer of shares and amalgamation of insurers) Regulations, 2024 (“IRDAI Regulations”). Any application seeking prior approval from the IRDAI under Section 6A, along with the requisite documents and details pertaining to the transferor and transferee of shares, must be submitted in the format prescribed under Regulation 22(1) of the IRDAI Regulations.5 Furthermore, in accordance with Regulation 23, IRDAI will conduct due diligence prior to granting approval for the proposed transfer of shares under Section 6A of the Insurance Act.

BAGIC and BALIC are public limited companies involved in the business of general insurance and life insurance respectively. In line with the procedural framework, IRDAI constituted a Panel of Whole-Time Members to evaluate the applications filed by BALIC and BAGIC for the proposed transfer of 26% shareholding to BFS, BHIL, and JSPL. The Panel of Whole- Time Members approved the applications in its meeting dated 15 July 2025 thereby providing a green signal to the acquisition.6

Competition Aspects

The acquisition was notified to CCI under Section 6(2) of the Competition Act read with the Competition Combination Regulations.

The Commission noted that BFS already held 74% equity control over BALIC and BAGIC and further the proposed acquisition would result in a change from joint control to sosle control of the Bajaj Group in all three entities. After assessing the transaction under the factors set out in Section 20(4) of the Competition Act, the CCI concluded that the consolidation of ownership within the Bajaj Group would not alter market dynamics in the life insurance, general insurance, or insurance distribution segments, and accordingly approved the combination under Section 31(1) of the Competition Act, finding that it was unlikely to cause any appreciable adverse effect on competition in India.78

FDI Aspects

Since Allianz is a European Company incorporated and registered in Germany, with its registered office in Munich, it will be considered a non-resident person for foreign exchange control regulations. As the transaction involved the transfer of shares from a non-resident to resident Indian acquirers, it was subject to the compliance requirements under the FEMA NDI Rules. The parties were required to comply with Form FC-TRS reporting for the transfer of shares from a non-resident to resident Indian acquirers and adhere to the pricing and valuation requirements prescribed under Rule 21 of FEMA NDI Rules, which mandates that shares transferred from a non-resident to a resident must not be sold at a price lower than the fair market value, as determined in accordance with internationally accepted valuation methodologies certified by a chartered accountant or a SEBI-registered merchant banker.

OUR THOUGHTS

The Bajaj-Allianz JV buyout is widely seen as a strategic win for the Bajaj Group resulting in a consolidation of ownership and control of BALIC, BAGIC and BAFDL within the Bajaj Group, transitioning the insurers from a long-standing joint-venture structure to sole control by a single corporate group. While the transaction does not materially alter competition or market concentration in the life or general insurance markets, this acquisition is expected to streamline governance and align with the long -term goals of Bajaj Group. This transaction reflects a maturing phase of the Indian insurance market, where established domestic financial groups are consolidating promoter control over scaled insurance platforms, even as global insurers enter Indian insurance markets with renewed interest.

The information contained in this document is not legal advice or legal opinion. The contents recorded in the said document are for informational purposes only and should not be used for commercial purposes. Acuity Law LLP disclaims all liability to any person for any loss or damage caused by errors or omissions, whether arising from negligence, accident, or any other cause.

- Intimation under Regulation 30(9) of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2017 (can be accessed at: Intimation under Regulation 30(9) read with Schedule III, Para D of Part A of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (17 March 2025) ↩︎

- Media release by Allianz dated 8 January 2026 (can be accessed at: https://www.allianz.com/en/mediacenter/news/media-releases/260108-allianz-divestment-joint-ventures-bajaj.html) ↩︎

- Intimation under Regulation 30(9) of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2017 (can be accessed at: Intimation under Regulation 30(9) read with Schedule III, Para D of Part A of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (17 March 2025) ↩︎

- Section 6A of the Insurance Act, 1938 ↩︎

- Regulation 22(1) of IRDAI (Registration, capital structure, transfer of shares and amalgamation of insurers) Regulations, 2024 ↩︎

- IRDAI press release dated 16 July 2025 (can be accessed at: Press Note- Transfer of equity shares related to M/s Bajaj Allianz Life Insurance Company and M/s Bajaj General Insurance Company (16 July 2025) ↩︎

- Press Information Bureau press release dated 20 May 2025 (can be accessed at CCI approves the proposed combination, Press release (20 May 2025) ↩︎

- CCI order on notice under Section 6 (2) of the Competition Act, 2002 dated 20 May 2025 (can be accessed at CCI Order (20 May 2025) ↩︎