Reshaping Gujarat’s Gas Ecosystem: A Comprehensive Analysis of the GSPC–GSPL–GGL Restructuring

INTRODUCTION

In a landmark restructuring of India’s energy sector, Gujarat consolidated its gas enterprises under Gujarat Gas Ltd (“GGL”), dissolving Gujarat State Petroleum Corporation (“GSPC”), India’s second-largest natural gas trading company and public sector undertaking, after nearly five decades.

BACKGROUND OF PARTIES 1

- Gujarat State Petroleum Corporation (“GSPC”) is an unlisted company, engaged in natural gas trading, with interests in 11 operating exploration and production blocks, and wind power. It has shown strong revenues and profitability, highlighting its scale and rationale for the amalgamation.

- Gujarat State Petronet Limited (“GSPL”) is a listed entity primarily engaged in transmitting natural gas through pipelines on an open-access basis.

- GSPC Energy Limited (“GEL”) is a wholly owned subsidiary of GSPC engaged in trading natural gas.

- Gujarat Gas Ltd (“GGL”) is a subsidiary company of GSPL, and a city gas distribution (“CGD”) company engaged in natural gas distribution. In Q2 FY26, GGL’s profit fell 9.4% year-on-year to USD 33.1 million on flat revenue, underscoring consolidation needs.

- GSPL Transmission Ltd (“GTL”) is a wholly owned subsidiary of engaged in the business of transmitting natural gas through pipelines on an open-access basis.

RATIONALE FOR THE DEAL

From a combined reading of the Scheme of Amalgamation (“Scheme”) and transcript for the Investor & Analyst Conference Call held on 31st August 20242 the following can be noted:

- Central Role of GGL: The scheme places GGL at the core of the group’s integrated gas businesses, allowing each entity sharper growth focus.

- Consolidation Benefits: By merging assets and operations, GGL becomes one of India’s largest integrated players in gas trading and city gas distribution. It can deploy cash flows more efficiently, improve profitability, and utilize USD 857.9 million in tax losses for stronger returns.

- Strategic Impact: The structure enhances GGL’s market presence, pricing power, and shareholder valuation, while the demerger of transmission into GTL ensures clear focus in each segment.3

STRUCTURE OF THE DEAL

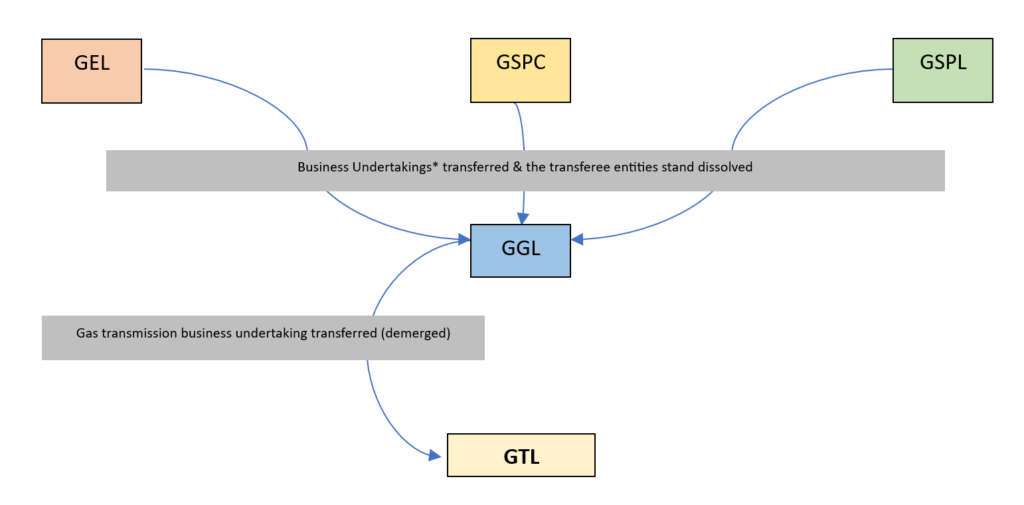

The Scheme merged GSPC, GSPL, and GEL into GGL, then demerged transmission into GTL. The amalgamation removed related-party transactions, boosting GGL’s profitability and strengthening key return metrics such as Return on Capital Employed, Return on Equity and Earnings Before Interest Taxes Depreciation and Amortization margins.4

Under the Scheme, GSPL’s joint ventures -India Gasnet and India Transco, were first transferred to GGL as part of its ‘Undertaking.’ Subsequently, the transmission business of GSPL (i.e., GSPL India Gasnet and GSPL India Transco) would be transferred to GTL, as part of the gas transmission business undertaking being demerged from GGL.

Allocation of shares took place in the following manner:

| Transaction | Exchange Ratio | Result |

| GSPC → GGL | 10 GGL (FV INR 2) for 305 GSPC (FV INR 1)5 | GSPC shareholders become GGL shareholders |

| GSPL → GGL | 10 GGL (FV INR 2) for 13 GSPL (FV INR 10)6 | GSPL shareholders become GGL shareholders |

| GGL → GTL (Demerger) | 1 GTL (FV INR 10) for 3 GGL (FV INR 2)7 | GGL shareholders get proportionate GTL shares |

Furthermore, GGL will assume all of GSPC’s long-term contracts.8

All employees of GSPC, GSPL, and GEL, under the Scheme, are absorbed into GGL with continuity of service.9The existing management of GGL continues to lead the merged business, and the current GSPL transmission management transitions to GTL, ensuring uninterrupted operational continuity. 10

Under the Scheme, all cheque-related and payment-instrument proceedings involving GSPC, GSPL, or GEL are transferred to GGL upon amalgamation, while all legal, tax, regulatory, and arbitration proceedings relating to the gas transmission business vest in GTL as the successor entity post-demerger.11

All outstanding loans, liabilities, and credit facilities of the transferor companies stand transferred to GGL upon the Scheme’s effectiveness, with GGL assuming full responsibility for these obligations as the surviving entity.12

KEY LEGAL ASPECTS

A notable procedural feature of this restructuring is that the approval pathway did not follow the conventional route of seeking sanction from the National Company Law Tribunal (“NCLT”) under Sections 230-232 of the Companies Act, 2013 (“Companies Act”) instead, approval has to be sought from the Central Government pursuant to notification dated 13 June 2017 issued under Section 462 of the Companies Act.13

The restructuring by-passed the conventional NCLT approval under Sections 230–232 of the Companies Act. Instead, under a notification dated 13 June 2017 issued by the Ministry of Corporate Affairs (“MCA”) granting exemptions to government companies, approval was sought directly from the Central Government. Accordingly, the MCA issued an order on 10 September 2025 to convene shareholder meetings and allow the Scheme to proceed.

- Petroleum and Natural Gas Regulatory Board Act, 2006 (“PNGRB Act”)

The merger and demerger comply with the PNGRB Act. GGL retains its CGD and trading authorisations, while GSPL’s transmission licences shift to GTL with PNGRB approval. No new licences are needed, though both must continue ongoing compliance.

- Competition Aspects

Under Section 5 of the Competition Act, a ‘group’ exists where one enterprise holds at least 26% voting rights in another. With GSPC holding 37% in GSPL, GSPL 54% in GGL, and GEL wholly owned by GSPC, these entities together formed the “GSPC Group”.

Item 10 of the Schedule appended to the Competition (Criteria for Exemption of Combinations) Rules, 2024 (“Competition Exemption of Combination Rules”) waives CCI approval for intra-group mergers without change in control. Before the deal, the Gujarat Government held 95% voting rights in GSPC; after, it retained 55.07% in GGL and the right to appoint a board majority. Since “control” remained unchanged, the transaction was exempt from CCI approval.

- Taxation Aspects

As per the provisions of Income Tax Act, any transfer: (i) in a scheme of amalgamation14, of a capital asset15 by the amalgamating company to the amalgamated company if the amalgamated company is an Indian company; and (ii) in a demerger16, of a capital asset by the demerged company to the resulting company, if the resulting company is an Indian company, is exempted from the provisions of Capital Gains Tax.

Hence, the transfer of assets from GSPC, GSPL and GEL to GGL and the demerger of the transmission business into GTL qualifies as a tax-neutral treatment.17

In addition, GSPC’s accumulated tax losses of approximately USD 857.9 million are eligible to be carried forward to GGL under Section 72A, subject to the prescribed continuity and asset-holding conditions. As confirmed by management, these losses may be set off against the merged entity’s profits for the next two to three years, with the benefit available for up to eight assessment years.18 Overall, the scheme is designed to preserve tax attributes, avoid immediate tax leakage, and enhance fiscal efficiency for the reorganised gas businesses.19

- Approval from Stock Exchanges

GSPC, as a listed entity, was involved in the transaction therefore, the scheme was required to comply with the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (“SEBI LODR”). Accordingly, the draft scheme of arrangement was filed with the stock exchanges, and the requisite no-objection letters were obtained before filing the scheme with the MCA, as required under the provisions of Companies Act. 20

OUR THOUGHTS

At its core, this restructuring reflects a decisive strategic shift by the State of Gujarat, moving away from a fragmented, multi-entity framework towards a streamlined, integrated gas portfolio. By consolidating GSPC, GSPL and GEL into Gujarat Gas and carving out a dedicated transmission utility in GTL, the state has effectively rationalised overlapping functions and addressed structural inefficiencies that have persisted for years. The elimination of related-party leakages, the utilisation of approximately USD 857.9 million in accumulated tax losses, and the creation of a unified entity with expanded sourcing, trading and distribution capabilities place GGL in a significantly stronger competitive position. GTL, meanwhile, benefits from the clarity and stability inherent in operating as a pure-play regulated transmission business. The transaction is underpinned by strong economic logic and sectoral alignment, if executed with focus and regulatory precision, this restructuring has the potential to serve as a benchmark for how state-owned energy clusters can modernise and position themselves for India’s rapidly evolving gas market.

The information contained in this document is not legal advice or legal opinion. The contents recorded in the said document are for informational purposes only and should not be used for commercial purposes. Acuity Law LLP disclaims all liability to any person for any loss or damage caused by errors or omissions, whether arising from negligence, accident, or any other cause.

- Composite Scheme of Amalgamation and Arrangement (can be accessed at draft-scheme-of-amalgamation-and-arrangement-13-09-2024.pdf) ↩︎

- Gujarat Gas Limited and Gujarat State Petronet Limited Investor & Analyst Presentation Call, August 31, 2024 (can be accessed at transcript-ggl-conference-call–the-scheme-of-arrangement-31-08-2024.pdf) ↩︎

- Composite Scheme of Amalgamation and Arrangement (can be accessed at draft-scheme-of-amalgamation-and-arrangement-13-09-2024.pdf) ↩︎

- Composite Scheme of Amalgamation and Arrangement (can be accessed at draft-scheme-of-amalgamation-and-arrangement-13-09-2024.pdf ↩︎

- Composite Scheme of Amalgamation and Arrangement at Page 38 (can be accessed at draft-scheme-of-amalgamation-and-arrangement-13-09-2024.pdf) ↩︎

- Composite Scheme of Amalgamation and Arrangement at Page 63 (can be accessed at draft-scheme-of-amalgamation-and-arrangement-13-09-2024.pdf) ↩︎

- Composite Scheme of Amalgamation and Arrangement at Page 108 (can be accessed at draft-scheme-of-amalgamation-and-arrangement-13-09-2024.pdf) ↩︎

- Composite Scheme of Amalgamation and Arrangement at Page 7 (can be accessed at draft-scheme-of-amalgamation-and-arrangement-13-09-2024.pdf) ↩︎

- Composite Scheme of Amalgamation and Arrangement at Page 2 (can be accessed at draft-scheme-of-amalgamation-and-arrangement-13-09-2024.pdf) ↩︎

- [1] Composite Scheme of Amalgamation and Arrangement at Page 15 (can be accessed at draft-scheme-of-amalgamation-and-arrangement-13-09-2024.pdf) ↩︎

- Gujarat Gas Limited and Gujarat State Petronet Limited Investor & Analyst Presentation Call, August 31, 2024 at Page 2 (can be accessed at transcript-ggl-conference-call–the-scheme-of-arrangement-31-08-2024.pdf ↩︎

- Gujarat Gas Limited and Gujarat State Petronet Limited Investor & Analyst Presentation Call, August 31, 2024 (can be accessed at transcript-ggl-conference-call–the-scheme-of-arrangement-31-08-2024.pdf) ↩︎

- Ministry of Corporate Affairs notification dated 13 June 2017 (can be accessed at https://www.mca.gov.in/bin/ebook/dms/getdocument?doc=NzY0OA==&docCategory=Notifications&type=open) ↩︎

- Section 2(1B) of the Income Tax Act 1961 ↩︎

- Section 2(14) of the Income Tax Act 1961 ↩︎

- Sections 2(19AA) of the Income Tax Act 1961 ↩︎

- Composite Scheme of Amalgamation and Arrangement at Page 6 (can be accessed at draft-scheme-of-amalgamation-and-arrangement-13-09-2024.pdf) ↩︎

- Composite Scheme of Amalgamation and Arrangement at Page 8 (can be accessed at draft-scheme-of-amalgamation-and-arrangement-13-09-2024.pdf) ↩︎

- No immediate tax liability arises on the transfer of assets or on the issuance of shares to shareholders of the transferor companies, and the tax cost of assets continues with the transferee entities by virtue of Section 43(6) and Section 49(1)(iii)(e). ↩︎

- Disclosure to Stock Exchange dated 05 February 2025 (can be accessed at https://nsearchives.nseindia.com/corporate/GUJGASLTD_05022025192710_1411RevisedObservationLetter05022025.pdf) ↩︎