Expansion of Scope of Fast Track Merger

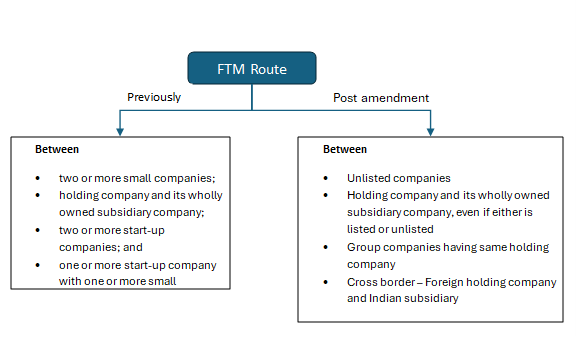

Section 233 of the Companies Act 2013 (“Act”) allows certain companies to merge or amalgamate through Central Government (“CG”) approval, which is thereby delegated to Regional Director1. The 2025-2026 Budget Speech proposed expanding the scope of such mergers, shortly after which a draft notification proposing an amendment to the Companies (Compromises, Arrangements, and Amalgamations) Rules, 2016 (“Merger Rules”), along with an explanatory note, was published.

The merger process under Sections 230 to 232 of the Companies Act, which involves approval through the National Company Law Tribunal, differs significantly from the fast-track merger route under Section 233 of the Act. These differences arise on several grounds, including the following:

| Basis | Merger through Tribunal (“Regular Merger Route”) | Fast Track Merger (“FTM Route”) |

| Applicable provisions | Section 230 to Section 232 of the Act r.w. applicable rules of the Merger Rules | Section 233 r.w Rule 25 of the Merger Rules |

| Eligible Entities | Any companies subject to Merger Rules and subject to court / tribunal jurisdiction. | (Pre-amendment) (a) two or more small companies; (b) holding company and its wholly-owned subsidiary company; (c) two or more start-up companies; (d) and one or more start-up company with one or more small company. |

| Initiation | Application to Tribunal by company/creditor/member/liquidator. | Scheme directly prepared by companies and notified to RoC, OL, and affected persons. |

| Time period | Longer (NCLT process + regulator representations). | Shorter (RoC/OL objections within 30 days; CG decision within 60 days). |

| Approving authority | NCLT sanction required. | If no objection then RD, on behalf of the CG, confirms. If there are objections2, then the application is referred to NCLT (Sec. 232) under Regular Merger Route. So, FTM Route not available if there is any objection(s). |

| Approval by Member | Requires approval by majority in number representing 3/4th in value. | Requires approval by members holding 90% of total shares. |

| Approval by Creditors | 3/4th in value of creditors/class of creditors. | 90% in value of creditors/class of creditors. |

On 4th September, 2025, the Ministry of Corporate Affairs notified the Companies (Compromises, Arrangements and Amalgamations) Amendment Rules, 2025(“Amendment Rules”) which inter alia extends the FTM Route to additional category of companies as follows:

- Unlisted Companies (not being Section 8 companies): One or more unlisted company with one or more unlisted company.

Conditions: Aggregate outstanding loans, debentures, or deposits not exceeding ₹200 crore; and no default in repayment of any loans, debentures, or deposits.

- Holding Company and Subsidiary Company: Holding (listed or unlisted) with its subsidiary (listed or unlisted).

Restriction: Not applicable where the transferor company is listed.

- Subsidiaries of the Same Holding Company: One or more subsidiary company of a holding company with one or more other subsidiary company of the same holding company.

Restriction: Not applicable where the transferor company is listed.

- Cross-Border Holding–Subsidiary Mergers: Foreign company (holding company) with the transferee Indian company (being the wholly owned subsidiary)

Another key amendment is the insertion of Sub-Rule 9 in Rule 25 of the Merger Rules, which addresses the gap in Clause 233(12)3. While Clause 233(12) extended the FTM Route to schemes of division or transfer under Section 232(1)(b)4, it did not clarify the Central Government’s powers in such cases. The amendment now empowers the Regional Director, on behalf of the Government, to include Tribunal-like provisions, such as transfer of property, continuation of legal proceedings, dissolution without winding up, and transfer of employees, in the FTM Route orders. Consequently, a Regional Director’s order attains the same legal effect as an NCLT order for division or transfer schemes.

PROCEDURAL TIGHTENING

- CAA forms revised: Forms CAA-9, CAA-10, CAA-11, and CAA-12 have been replaced with updated versions that seek greater disclosure and better alignment with practice.

- New Form CAA-10A: Introduced to capture auditor certification for unlisted companies proceeding for the fast track merger under 25(1A)(iii).

- GNL-1 Integration: Form CAA-10 (Declaration of Solvency) must now be filed as an attachment to Form GNL-1. This seemingly small change has significant consequences: filings are centralised through a generic e-form, improving the MCA’s ability to track and monitor submissions. However, it also adds a compliance layer companies must ensure correct tagging and attachment to avoid technical rejections.

PRACTICAL ASPECTS

- Limited Expansion for Listed Companies

The Amendment Rules permits a limited expansion for the listed companies under the FTM Route whereby, a listed transferee company can absorb an unlisted transferor company. However, the listed nature of the transferee company would involve an intervention of the stock exchanges, pursuant to Regulation 37 of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 provisions, as mentioned herein:

“…..the listed entity desirous of undertaking a scheme of arrangement or involved in a scheme of arrangement, shall file the draft scheme of arrangement, proposed to be filed before any Court or Tribunal under sections 391 – 394 and 101 of the Companies Act, 1956 or under Sections 230 – 234 and Section 66 of Companies Act, 2013, whichever applicable, along with a non – refundable fee as specified in Schedule XI, with the stock exchange(s) for obtaining the No objection letter, before filing such scheme with any Court or Tribunal, in terms of requirements specified by the Board or stock exchange(s) from time to time.”

This would require an additional step in the process of FTM Route, as it specifically provides that the scheme needs to be filed with the stock exchange, in order to obtain a no objection letter thereof, before it is filed with the CG, registrar and the official liquidator as per section 233(2) of the Act.

We understand that an attempt to address this issue has been made through an amendment to Rule 25 of the Merger Rules, specifically by inserting a sub-rule under Rule 25(1). This amendment stipulates that, in case of companies regulated by a sectoral authority, the notice inviting objections or suggestions under Section 233(1)(a) must be issued to the relevant regulator, namely, the respective stock exchanges in the case of listed companies. However, the amendment does not explicitly override the requirements under Regulation 37 of these regulations. Therefore, it can be reasonably inferred that both provisions must be complied with independently, resulting in dual compliance obligations.

- Requirement of High Approval threshold

Other major limitation under the FTM Route is the requirement of approval from 90% of (a) number of shareholders; and (b) value of creditors. While this may be workable for closely held or private companies, where shareholding is limited and value of creditors may not be significant, it is extremely difficult for listed transferee companies (where ownership and creditor base are dispersed) or unlisted transferor/ transferee companies having wider shareholding and significant creditor base. This high threshold significantly reduces the practical use of the FTM Route for larger corporates, even after the expansion introduced by the Amendment Rules.

- No Deemed Exemption from Triggering the Open Offer Obligation

The Securities and Exchange Board of India (Substantial Acquisition of Shares and Takeovers) Regulations, 2011 (“SEBI Takeover Code”) exempts share acquisitions under a merger or demerger only when the scheme is sanctioned by a court or tribunal (Regulation 10(1)(d)(ii)5). Since section 233 schemes are approved by a Regional Director and not the Tribunal, this exemption may not apply. As a result, if a FTM Route leads to an increase in promoter or acquirer shareholding in a listed transferee company, it may technically trigger an open offer obligation, thereby making the fast-track route relatively risky for listed transferee company.

However, as per independent window available Regulation 11(1)6 and 11(3)7 of the SEBI Takeover Code, the acquirer may file an application with the Securities and Exchange Board of India, supported by a duly affidavit, giving details of the proposed acquisition and the grounds on which the exemption from open offer has been sought from the compliance of givng an open offer.

- No Change Warranted for the Payment of Stamp Duty

Certain states such as Maharashtra, Gujarat, and Rajasthan specifically refer to a “confirming order” under Section 233, thereby expressly covering orders of the Regional Director. In other states, where the Indian Stamp Act applies, such orders are treated as “conveyance” through the statutory definition, and the corresponding provisions relating to stamp duty on conveyance become applicable. Accordingly, the implementation of stamp duty on orders passed under Section 233 will continue, as such orders fall within the definition of an “instrument.” Consequently, stamp duty applicable to a conveyance would be levied.

CONCLUSION

Pursuant to the Amendment Rules, a scheme of arrangements, mergers or amalgamations may be entered into between the following categories of company (subject to the conditions and restrictions provided in section 233 of the Act r.w. Rule 25 of the Merger Rules):

- two or more small companies;

- holding company and its wholly-owned subsidiary company;

- two or more start-up companies;

- one or more start-up company with one or more small company;

- one or more unlisted company with one or more unlisted company;

- a holding company (listed or unlisted) and a subsidiary company (listed or unlisted);

- one or more subsidiary company of a holding company with one or more other subsidiary company of the same holding company; and

- Foreign company (holding company) with the transferee Indian company (being the wholly owned subsidiary)

The FTM Route regime has evolved from being a niche tool for small/start-up entities into a mainstream restructuring pathway with real potential to change how Indian corporates consolidate and grow however it would still require certain changes in the existing pieces of legislation to make it run smoother in practicality, especially in terms of a listed entity.

The information contained in this document is not legal advice or legal opinion. The contents recorded in the said document are for informational purposes only and should not be used for commercial purposes. Acuity Law LLP disclaims all liability to any person for any loss or damage caused by errors or omissions, whether arising from negligence, accident, or any other cause.

- In accordance with Section 458 of the Act. ↩︎

- or for any reason CG is of the opinion that such a scheme is not in public interest or in the interest of the creditors. ↩︎

- “The provisions of this section shall mutatis mutandis apply to a company or companies specified in sub-section (1) in respect of a scheme of compromise or arrangement referred to in section 230 or division or transfer of a company referred to clause (b) of sub-section (1) of section 232.” ↩︎

- “(1) Where an application is made to the Tribunal under section 230 for the sanctioning of a compromise or an arrangement proposed between a company and any such persons as are mentioned in that section, and it is shown to the Tribunal—…..(b) that under the scheme, the whole or any part of the undertaking, property or liabilities of any company (hereinafter referred to as the transferor company) is required to be transferred to another company (hereinafter referred to as the transferee company), or is proposed to be divided among and transferred to two or more companies,…” ↩︎

- “The following acquisitions shall be exempt from the obligation to make an open offer under regulation 3 and regulation 4 subject to fulfillment of the conditions stipulated therefor,—…. (d) acquisition pursuant to a scheme,— …(ii)of arrangement involving the target company as a transferor company or as a transferee company, or reconstruction of the target company, including amalgamation, merger or demerger, pursuant to an order of a court [or a tribunal]38[***]39under any law or regulation, Indian or foreign; or” ↩︎

- “The Board may for reasons recorded in writing, grant exemption from the obligation to make an open offer for acquiring shares under these regulations subject to such conditions as the Board deems fit to impose in the interests of investors in securities and the securities market.” ↩︎

- “The acquirer or the target company, as the case may be, shall along with the application referred to under sub-regulation (3) pay a non-refundable fee of rupees five lakh, by way of direct credit into the bank account through NEFT/RTGS/IMPS or online payment using the SEBI Payment Gateway or any other mode as may be specified by the Board from time to time.” ↩︎