TReDS Registration: New Turnover Criteria for MSMEs

On 07 November 2024, the Ministry of Micro, Small and Medium Enterprises issued a notification[1] replacing two earlier notifications introducing a new threshold for onboarding on the Trade Receivables Discounting System (TReDS) platforms.

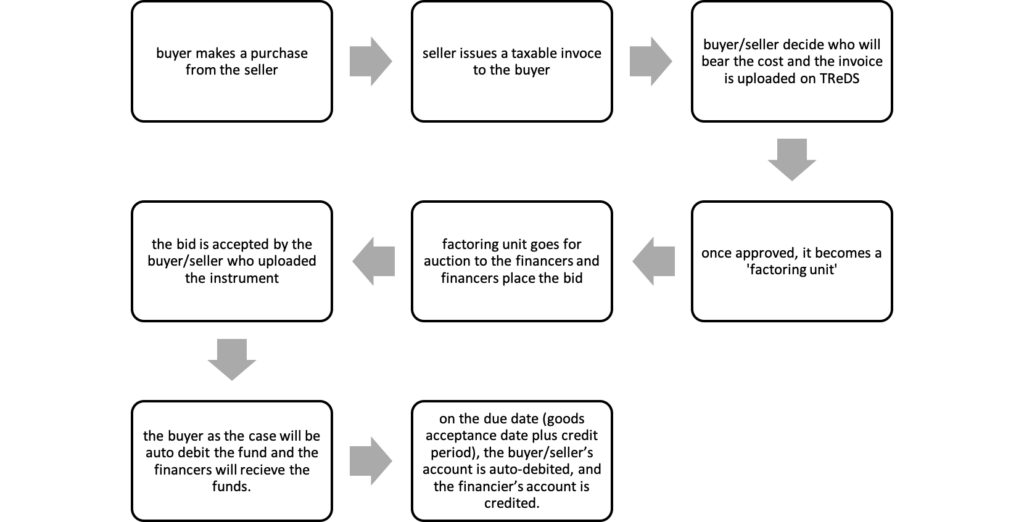

The TReDS platform is an electronic platform for facilitating the financing and discounting of trade receivables of Micro, Small and Medium Enterprises (MSMEs) through multiple financiers. These receivables can be due from corporates and other buyers including government departments and public sector enterprises. The platform is helping bridge the gap of payment cycle by helping MSMEs get paid faster. In this update, we have discussed the TReDS Mechanism for MSME invoice settlement and key change introduced by the notification:

How does TReDS function:

Currently, there are 3 (three) government-approved TReDS platforms operating in India namely, Invoicemart, Receivables Exchange of India, and Mynd Solutions wherein the MSMEs upload their invoices or bills of exchange on the platform within the statutory limit of 45 (forty-five) days from the date of acceptance or deemed acceptance of goods or services, where buyers accepts the transaction. Multiple financial institutions, such as Banks, NBFCs, and other financial institutions as permitted by the Reserve Bank of India, then competitively bid to purchase these receivables, providing businesses with instant access to funds. This approach eliminates the traditional wait for payment and reduces dependency on high-interest loans.

Below is the flowchart depicting the functionality of TReDs:

The key change introduced in the notification dated 07 November 2024 is that all companies registered under the Companies Act, 2013, with a turnover exceeding INR 250 crores, (which was previously INR 500 crores) as well as all Central Public Sector Enterprises, must mandatorily onboard on the TReDS platform by 31 March 2025.

This notification represents one of the several initiatives undertaken by the government to enhance India’s financial infrastructure, enabling more MSMEs to access working capital quickly and improve their overall financial health and liquidity.

The information contained in this document is not legal advice or legal opinion. The contents recorded in the said document are for informational purposes only and should not be used for commercial purposes. Acuity Law LLP disclaims all liability to any person for any loss or damage caused by errors or omissions, whether arising from negligence, accident, or any other cause.

[1] Notification No. S.O. 4845(E) dated 7 November 2024