India-Mauritius Tax treaty upheld in Tiger Global-Flipkart transaction

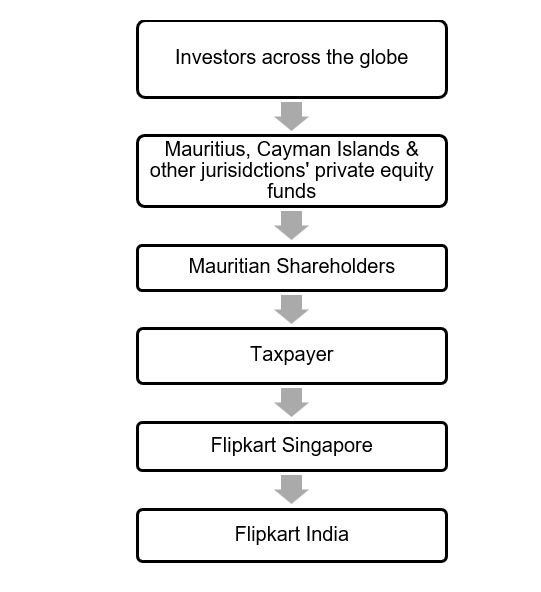

In May 2018, Walmart Inc. announced that it would acquire 77% stake in Flipkart, a leading e-commerce marketplace in India. In this marque deal of 2018, when entities of the private equity house Tiger Global sold their stake in Flipkart to Walmart, the issue relating to chargeability of the capital gains pertaining to this transaction came up for consideration. One of the core reasons for the scrutiny of this transaction by the Indian Income-tax Department (IITD) was that it was routed through Mauritius, an apparent tax haven jurisdiction. In the recent past, various transactions routed through Mauritius or Singapore have been questioned on the ground that the entity claiming the benefit under the relevant double taxation avoidance agreement (DTAA) is a conduit entity and the transaction leads to avoidance of tax. Even the tax residency certificate (TRC) has been questioned, which has been furnished by them to claim the tax benefit.

Recently, the Hon’ble Delhi High Court (High Court) in the case of Tiger Global International III Holdings v. AAR[i], dealt with the issue of suspicion with respect to transactions undertaken by the entities located in the tax haven jurisdictions and the conflict between the provisions of Income-tax Act, 1961 (IT Act) and the DTAA.

Facts

In May 2018, a share purchase agreement (SPA) was executed between Walmart International Holdings, Inc. (Purchaser) and the shareholders of Flipkart Singapore, which included the taxpayer as well. The taxpayer had acquired the shareholding of Flipkart Singapore between October 2011 and April 2015 i.e., prior to 1 April 2017. Under this SPA, the taxpayer along with other petitioners agreed to sell 74% of their stake in Flipkart Singapore to an entity of the Purchaser. Thereafter, the taxpayer approached the IITD for seeking a ‘nil’ withholding tax certificate under Section 197 of the IT Act on the ground that : (a) these shares were acquired before 1 April 2017 and hence not liable to tax in India in accordance with the provisions of article 13 of the DTAA between India and Mauritius; and (b) TRC of it being a Mauritian resident is held by the taxpayer.

The application under section 197 was rejected by the IITD on the grounds that the taxpayer is not entitled to the benefit under the relevant DTAA, as it is not independent in its decision making with regard to the capital assets held by the taxpayer. Aggrieved by the rejection, the taxpayer approached the Authority for Advance Ruling (AAR). AAR considered the application and concurred with the view taken by the IITD that the taxpayers are not entitled to the benefits under the relevant DTAA. Aggrieved by the ruling of the AAR, the taxpayer filed the writ petition before this High Court.

Submissions of the Taxpayer

The taxpayer claiming the benefit under the DTAA between India and Mauritius, submitted the following arguments before the High Court:

- TRC constitutes sufficient evidence for accepting the status of residence as well as the issue of beneficial ownership for the purposes of claiming treaty benefits.

- The taxpayer placed reliance on the ruling of the Hon’ble Supreme Court in the case of Union of India v. Azadi Bachao Andolan[ii] to argue that TRC remains the primary and constant requirement for the purposes of claiming treaty benefits and that the perceived motives underlying the incorporation or establishment of an entity in Mauritius would be wholly irrelevant.

- It was also argued that the clarificatory circular issued by the government and judicial precedents establish that TRC is conclusive and sufficient proof of residency to avail the benefits of a DTAA, however, the AAR questioned the validity of the TRC obtained by the taxpayer.

- Unilateral amendments which came to be introduced in section 9 of the IT Act, by virtue of the Finance Act, 2012, and which incorporated principles of taxation of indirect transfers, cannot be interpreted or enforced, so as to have the effect of overriding existing tax treaties. The legislature never intended that these amendments deprive an assessee from the benefits which could be claimed under the relevant DTAA.

- If the DTAA requires domestic tax authorities to have the power to tax an indirect transfer of shares as contemplated under section 9 of the IT Act, then the tax treaties will have to specifically incorporate provisions enabling the domestic tax authorities to levy capital gains tax arising from indirect transfer of assets, such as provisions which have been incorporated in DTAAs between India and Columbia, Fiji and Indonesia. However, there is no such provision under the DTAA between India and Mauritius.

- Expenditure incurred by the taxpayer for a period of twelve months immediately preceding the date when the gains were accrued, qualifies the criteria specified under Limitation of Benefits (LOB) clause (article 27A (4)) of the DTAA between India and Mauritius, thus, it cannot be regarded as a shell or a conduit company. Once the DTAA itself came to incorporate LOB conditions it would be wholly impermissible for the IITD to conjure up additional grounds of disqualification and which may then be used for the purposes of denial of treaty benefits.

- In order to determine the eligibility to claim the benefits under DTAA, the criterion such as motive for incorporation of the entity, the situs of control and management of the entity and aspects relating to beneficial ownership are irrelevant. Even if these criteria are taken into consideration, the taxpayer has clearly established that it is managed and controlled by independent board of directors situated in Mauritius and is liable to be taxed as a resident in Mauritius.

- The principles of beneficial ownership imputed by the AAR was erroneous, because the said concept is not incorporated under Article 13 of the DTAA between India and Mauritius. Once a Mauritian resident produces a TRC, the test of beneficial ownership stands fully satisfied.

Submission of Respondents

The IITD argued that the taxpayer is not entitled to the benefit of the DTAA between India and Mauritius by submitting the following:

- Based on the holding pattern and organizational structure of the taxpayer, the respondents contended that TGM LLC was the parent and holding company. It was also submitted that the taxpayers were mere facades of the “US based parent” and the investee companies constitute the head and brains of the funds held by the taxpayers.

- In addition to this, it was also contended that only when the taxpayers realized the future business potential of Flipkart Online (a start-up incorporated in 2008 and was stated to have sold its assets to Flipkart India in 2011) that the taxpayer entities were incorporated and interposed. Thus, the subsequent creation of the taxpayer was not backed by any commercial rationale.

- The taxpayer failed to show any administrative expenses borne in the course of activities undertaken in Mauritius and does not appear to have engaged any employees. Thus, it was submitted that interposing of Mauritius entities was done solely to avoid the incidence of tax which would have arisen on capital gains arising in India at the time of their eventual exit.

- It was also submitted that in most of the board resolutions, the board is stated to have merely “noted” or “ratified” decisions. This would be irrefutable evidence that the decision-making power is being vested in and exercised by entities other than the directors of the taxpayer.

- Relying on the judgement of Supreme Court in Azadi Bachao Andolan (supra), it was argued that though treaty shopping may be viewed as a permissible tax avoidance measure, however, if the taxpayer abuses an organization form/ legal form without reasonable business purpose and seeks to avoid tax, then the IITD may disregard the form of the arrangement or the impugned action undertaken by the taxpayer to evade tax. In such situations, TRC is not conclusive and sufficient evidence, and IITD is not restrained from undertaking any further enquiries where any tax fraud is suspected.

- Rule 10U of the Income-tax Rules, 1962 (the Rules), provides that Chapter X-A does not apply to any income accruing or arising from transfer of investments before 1 April 2017. However, sub-rule (2) constitutes a “without prejudice” clause which would override this provision. Thus, it was contended that even though an arrangement may have been entered into prior to 1 April 2017, any benefit obtained from that arrangement on or after 1 April 2017 would be subject to the provisions contained in Chapter X-A.

Ruling of the High Court

Organizational structure

The High Court discussed the organizational structure of the taxpayer and the factually incorrect aspect taken on record by the AAR on the role played by the TGM LLC. In this regard, the High Court accepted the factual position submitted by the taxpayer, that TGM LLC is the Investment Manager and has no equity participation whatsoever. Accordingly, the High Court held that “The entire case as set up against the petitioner thus appears to suffer from a wholly erroneous and factually unsustainable premise of TGM LLC being the holding and the parent company. Neither the AAR nor the respondents before us have been able to dislodge or cast a doubt on the role and position of TGM LLC as advocated and asserted by the writ petitioners. This fundamental mistake has clearly tainted the impugned orders beyond repair. The orders impugned thus suffer from a manifest and patent error quite apart from being fundamentally flawed”.

Tax Avoidance and Treaty Abuse

Treaty abuse is generally understood to mean the use of tax treaties by persons who were not intended to benefit or derive advantages from the treaty contrary to the intended and avowed objectives of the contracting states. It is settled that mere establishment of an intermediary or subsidiary in the absence of negative factors cannot and should not be readily presumed to be lacking in bona fides or being an attempt to create an artifice lacking substance. In this context, the principles of substance over form and economic substance have been evolved.

In order to prevent treaty abuse, Article 6 of the BEPS Action Plan recommends that treaty provisions should incorporate specific anti-abuse rules and which in turn resulted in the formulation of LOB and Principal Purpose Test (PPT). Under the PPT, a treaty benefit shall not be granted if it is reasonable to conclude that obtaining the benefit was one of the principal purposes of any transaction or arrangement.

Thus, the principal focus of authorities across the globe is to ensure that persons not entitled to directly derive benefits from the treaty provisions are not able to obtain such benefits indirectly. Both OECD as well as UN Model suggested adopting concepts of qualified persons and deal with various other situations in which treaty benefits may be denied.

Along with this, the transaction should also be tested based on the precept of active business conduct. The fact that the company was established in a member state for the purpose of benefiting from more favorable legislation does not in itself suffice to constitute abuse of that freedom, if the company is established based on sound and justifiable economic considerations. Thus, mere establishment of a subsidiary in a tax-favoring nation cannot lead to a presumption of tax evasion.

Favorable Tax Jurisdiction

The Hon’ble Supreme Court of India, in the Vodafone International Holdings B.V. v. Union of India & Anr.[iii], clarified that investments routed through Mauritius should not be presumed to be illegal or disreputable. The Supreme Court emphasized that the law does not inherently view such investments negatively.

In Azadi Bachao Andolan case (supra), it was noted that nearly 50% of the FDI into India in 2012 originated from Mauritius. Basis this data, the High Court observed that “the data and the facts noticed above lead us to the irresistible conclusion that it would be wholly incorrect to presume investments originating from that nation as being inherently dubious or disreputable. Thus, the mere fiscal residence of an entity in Mauritius would not give rise to a presumption of infamy or constrain courts to approach such investments through what are metaphorically referred to as tinted lenses”. The High Court also noted that the Supreme Court acknowledged that treaty shopping, while often viewed negatively, is a necessary practice for developing economies to attract foreign investment. The Supreme Court described treaty shopping as a “necessary evil” and noted that nations adopt checks and balances to prevent significant revenue loss or treaty abuse.

Also, in the Vodafone International case (supra), it was observed that the rise of multinational corporations has led to an increase in the establishment of entities in jurisdictions like Mauritius. These entities are often created for legitimate tax planning and commercial reasons. The Supreme Court held that if the contracting states intended to deny benefits to certain entities, they would have included specific provisions in the DTAA.

The Supreme Court emphasized that once an entity qualifies for benefits under the DTAA, it should not be denied those benefits based on perceived unethicality of treaty shopping. The Supreme Court held that national courts should not lift the corporate veil if the DTAA is intended to override domestic laws.

The Vodafone International (supra) judgment further noted that the Revenue could apply the principle of substance over form if a transaction is found to be a sham transaction or is aimed at tax evasion. However, with absence of LOB clause coupled with presence of Circular No. 789 of 2000 and TRC, a Mauritian entity could not be denied benefits merely because the investment originated from Mauritius.

Basis the above, the High Court observed that “more importantly we find that the position of the Union Government does not appear to have been opposed to what the Supreme Court ultimately held in Azadi Bachao Andolan and Vodafone. The Union as well as the Revenue appear to have accepted the legal position as enunciated in those two decisions and which had acknowledged the invocation of the substance over form principles to the confined and extremely narrow contingencies where the Revenue may be recognised as being justified in questioning the motives of an investment transaction”.

Tax Residency Certificate

According to Circular No. 789 of 2000 issued by the government, TRC issued by Mauritian authorities would constitute sufficient evidence for determining fiscal residence and beneficial ownership of an entity. This circular further clarified that such a certificate would suffice even in respect of capital gains on sale of shares. Once it is found that TRC is duly issued by the Mauritian authorities, to question the same would be destructive of the faith reposed by the contracting states in the authorities of the respective states.

The High Court further observed that “The TRC represents the first level of certification of the holder being a bona fide business entity domiciled in the Contracting State. The issuance of a TRC constitutes a mechanism adopted by the Contracting States themselves so as to dispel any speculation with respect to the fiscal residence of an entity. It therefore can neither be cursorily ignored nor would the Revenue be justified in doubting the presumption of validity which stands attached to that certificate bearing in mind the position taken by the Union itself of it constituting ―sufficient evidence‖ of lawful and bona fide residence.”

However, the significance and the salutary purpose underlying the issuance of a TRC cannot be overemphasized. As observed in Vodafone International (supra) in the context of piercing of the corporate veil, the extent to which the Revenue could enquire and investigate despite a TRC being obtained is confined to cases of tax fraud, sham transactions where the entity has no economic substance, or the transaction is suspected to be aimed at camouflaging illegality.

Limitation of Benefits provisions in DTAA

The LOB clause embodies appropriate provisions designed to deprive an entity of the treaty benefits. Once LOB provisions come to be incorporated in a convention, it would be those provisions which would govern and be determinative of an allegation of treaty abuse or a treaty benefit being illegitimately claimed.

Further, LOB clauses also include provisions laying down verifiable and certifiable standards to dislodge any presumption of treaty abuse. These provisions ensure that contracting states do not deploy their own standards and test of probity, to question the validity of a transaction on such parameters which are wholly alien to the treaty and contrary to the negotiated terms. Thus, the TRC and LOB provisions adequately address the concerns of treaty abuse and it would be impermissible for Revenue to construct additional barriers or qualifications.

The LOB clause inserted in the DTAA between India and Mauritius clearly enumerated the circumstances in which an entity may be denied benefits of Article 13(3B) or where it would be deemed to be a mere shell/conduit company and specified contingencies in which a negative legal fiction would operate and dispel any assumption of an entity being a shell/ conduit company. Thus, it was held that the Revenue cannot create additional barriers or invent novel grounds for disentitlement of the DTAA benefits to the taxpayers.

The Economic Substance Test

TGM LLC was the investment manager/management company, a crucial fact which has been lost sight of by the Revenue and it had proceeded on the incorrect premise that it was the holding or the parent company of the taxpayer. Further, the taxpayer has also incurred expenditure, which fulfills the threshold criteria under Article 27A, and the financial statements of the taxpayer show a net increase in shareholders’ equity resulting from the operations of the taxpayer company. Thus, it was held by the High Court that the taxpayer does not lack economic substance and were not incorporated in Mauritius solely for the purpose of treaty abuse.

Chapter X-A and GAAR

Tax evasion is illegal, tax avoidance occupies a grey area, often teetering on the edge of legality. This ambiguity led to the introduction of the General Anti-Avoidance Rule (GAAR) to target tax avoidance through concrete legislation. GAAR provisions are designed to prevent tax benefits being derived in circumstances where there is no business purpose other than obtaining a tax benefit, resulting in codification of the “substance over form” principle in tax law. GAAR is intended to apply only to abusive, contrived, and artificial arrangements.

Relying upon the jurisprudence on GAAR provisions, the High Court held that GAAR can be invoked in situations not covered by tax treaties, but it should not override treaty provisions like LOB clauses. The High Court also referred to the circular No. 7 of 2017, which prescribes conditions for applying the GAAR provisions and observed that GAAR shall not be invoked merely on the ground that the entity is located in a tax haven jurisdiction. If the jurisdiction of the entity is finalized based on non-tax commercial considerations and the main purpose of the arrangement is not to obtain tax benefit, GAAR will not be applicable.

The High Court posed a question before itself was “We are in the facts of the present case, essentially concerned with whether Chapter X-A could have any application in light of the grandfathering clause comprised in the treaty read alongside the provisions of the Act”. The High Court also clarified its scope of review by stating that “Our observations are thus not intended to constitute a broad enunciation on the scope of applicability of Chapter X-A and the extent to which statutory GAAR would override treaty provisions”.

On the above question, the High Court held that the intention of the contracting states was clear and evident to leave out capital gains that may arise or accrue with respect to shares acquired prior to 1 April 2017. The amendments in the DTAA were introduced after the IT Act had adopted the principles of taxing indirect transfers, where shares may derive substantial value from assets situated in India. Also, Article 13(3B) prescribes two separate tax rates for the period beginning 1 April 2017 up to 31 March 2019 and thereafter, although for obvious reasons no such tax rates are prescribed for period before 1 April 2017.

Further, it was held that provisions of domestic legislations should not be interpreted in a manner that it would seek to override the provisions contained in DTAA because it would result in subordinate legislation being elevated to a status over and above a treaty entered into by two nations in exercise of their power. Thus, the High Court held that the argument of the respondent based on Rule 10U is wholly unmerited.

Beneficial Ownership

In order to charge tax on the basis of beneficial ownership, aspects of ownership and control over the income, a right of disposal or a contractual obligation to pass on the same to another, should be taken into account. The concept of beneficial ownership would be imputed to cases where the recipient of income or the holder of the asset is merely the ostensible depository, and which may hold the income either as an administrator or trustee. It would have to be established that the recipient has no right or control over the income and merely holds the same to be deployed on the instruction of another.

Based on the aforesaid precepts, it was held that taxpayers were beneficial owners of the shares transferred. It was also held by the High Court that “Since the respondents do not rest or found this allegation on any material or evidence which may be read as even remotely suggestive of the petitioners being under a contractual or legal obligation to transmit the revenues to TGM LLC”.

Conclusion

On the basis of the above analysis, the High Court concluded as follows:

- Mauritius and entities domiciled in that nation are neither liable to be viewed on a negative plane nor are they obliged to satisfy a separate standard of legitimacy.

- The mere establishment of a subsidiary in a tax favoring jurisdiction like Mauritius cannot lead to a presumption of tax evasion by the concerned entity.

- It is acknowledged that multinational corporations seek to invest across the globe and the establishment of offshore companies is motivated by bonafide commercial purposes

- TGM LLC was acting only as an investment manager and was not the parent or holding company of the taxpayer. The taxpayer was involved in substantial economic activities and intended to operate as a pooling vehicle for investments. Thus, it cannot be said that the taxpayer was lacking in economic substance.

- The fact that few members on the board of the taxpayer are connected with the Tiger Global group does not imply that taxpayer are mere puppets. It is very common for holding companies to have certain rights to exercise oversight and broad supervision over the affairs of the subsidiaries which inter alia includes seat on board of directors. Thus, it cannot be assumed that the taxpayer is a puppet of the holding company merely because the holding company has shareholder influence over the taxpayer.

- TRC held by an entity should be considered conclusive and sufficient evidence of residence and beneficial ownership of an entity. Although, in case of TRC holding entities, the Revenue can pierce the corporate veil in certain limited circumstances such as tax fraud, sham transactions camouflaging of illegal activities and lack of economic substance.

- Tax treaties are entered into in the exercise of sovereign powers; thus, such arrangements cannot be subjected to aspersions cast on their validity. Consequently, a consistent view has been taken by the Supreme Court and international organizations that the treaty benefits will override the provisions of domestic legislations. These treaty benefits can be denied only when there is a tax fraud, sham transaction or the entity is a mere conduit and arrangement is contrary to the scheme of the treaty itself.

- LOB provisions are incorporated in the treaty which provides for ascertainable standards to defy the presumptions of treaty abuse.

- LOB provisions and the TRC comprehensively and adequately address the concerns in relation to potential treaty abuse and it would be impermissible for the Revenue to manufacture additional roadblocks or standards that parties would be required to meet in order to avail the DTAA benefits, subject to caveats of illegality, fraud and the transaction being in contravention of the underlying object and purpose of the treaty.

- The provision of Article 13(3A) embodies the intent of the contracting states to ring-fence all such transactions which had been consummated prior to 1 April 2017. Article 13(3B) restricted its scope to prescribing separate tax rates for the period between 1 April 2017 and 31 March 2019, but no such tax rate was prescribed for capital gains arising from sale of shares acquired prior to 1 April 2017 which categorically demonstrates the intent of the parties to the India-Mauritius DTAA to exclude capital gains emanating from shares acquired prior to 1 April 2017 from the ambit of taxation. Therefore, the grandfathering clause in Article 13(3A) would exclude the transaction undertaken by the taxpayers from the ambit of capital gains tax.

- Domestic tax legislation cannot be interpreted in a manner which brings it in direct conflict with a treaty provision or with an overriding effect over the provisions contained in a DTAA, since the same would in effect amount to accepting the right of the legislature of one of the contracting states to unilaterally amend or override the provisions of a treaty and would result in the elevation of a domestic subordinate legislation over that of the provisions embodied in a treaty entered into between sovereign nations. Thus, there is no merit in the argument that the transaction would not be grandfathered under Rule 10U of the IT Rules.

On the basis of these aforementioned observations, the High Court held that the taxpayer is entitled to the benefits under Article 13 of the said DTAA and quashed the impugned order passed by the AAR denying such benefits.

Our Thoughts

Taxation of indirect transfers, validity of TRC and treaty abuse have been subject to judicial discussions not only in the recent past, but for the last two decades. Time and again it has been held that validity of the TRC cannot be questioned, unless fraud can be proved. This issue is currently before the Hon’ble Supreme Court.

The High Court has passed a favorable order, not only addressing the issue on validity of TRC, but also a much-debated issue of eligibility of DTAA benefit in relation to indirect transfers. Generally, indirect transfers may seek the benefit of the residuary clause, if beneficial, as the taxation arises in the contracting state of the alienator with respect to capital gains arising on transfer of any asset. With this ruling, the Mauritian seller undertaking indirect transfers may also seek the benefit of Article 13(3A) of the DTAA between India and Mauritius, if the shares are acquired prior to 1 April 2017, in addition to the residuary clause.

The ruling has also emphasized the importance of LOB provisions and how GAAR cannot be invoked in such cases.

The view taken by the High Court will re-assure foreign investors who benefited from tax treaties before 2017 and strengthens the position of Mauritius as a financial hub. This ruling certainly reiterates the position that, unless there is evidence of a sham transaction, merely because the transaction is from tax friendly jurisdiction, it cannot be questioned.

All in all, a very welcome ruling.

The information contained in this document is not legal advice or legal opinion. The contents recorded in the said document are for informational purposes only and should not be used for commercial purposes. Acuity Law LLP disclaims all liability to any person for any loss or damage caused by errors or omissions, whether arising from negligence, accident, or any other cause.

[i] TS-624-HC-2024DEL

[ii] [(2004) 10 SCC 1]

[iii] [(2012) 6 SCC 613]